There is no verifiable public listing for “XMXXM X” on recognized market data portals, and prominent search results surface SEO pages and crypto content rather than an auditable equity, so this forecast uses a clearly stated notional baseline and risk‑weighted scenarios to demonstrate the math behind a defensible 2025–2026 price framework. In short, the term “XMXXM X” appears in promotional/aggregator pages and adjacent crypto entries with no authoritative listing record, so a notional “today” price is assumed strictly for calculation examples below.

Is “XMXXM X” actually listed?

- Searches return crypto/SEO aggregator pages and “undefined” quote shells rather than an auditable company profile, exchange code, or filings, which is inconsistent with a real, currently listed stock.

- Coinbase and other venues surface unrelated assets with similar “X…” naming, underscoring symbol ambiguity and the risk of misidentifying a token or SEO keyword as a listed equity.

- Generic portals retrieving tangential tickers (e.g., different “XM..” pages) further suggest no authoritative mapping exists for “XMXXM X” on major exchanges at this time.

Assumptions used for pricing math

- Notional “today” price: $1.00 (used only to show method and arithmetic, given no verified live listing for “XMXXM X”).

- Scenarios: Bear/Base/Bull paths for 2025 and 2026; risk weights emphasize downside skew typical of unverified or micro‑cap contexts (50%/35%/15%).

- Volatility: High assumed annualized volatility bands reflecting the uncertainty around unlisted/uncertain assets (80%/60%/90% for Bear/Base/Bull).

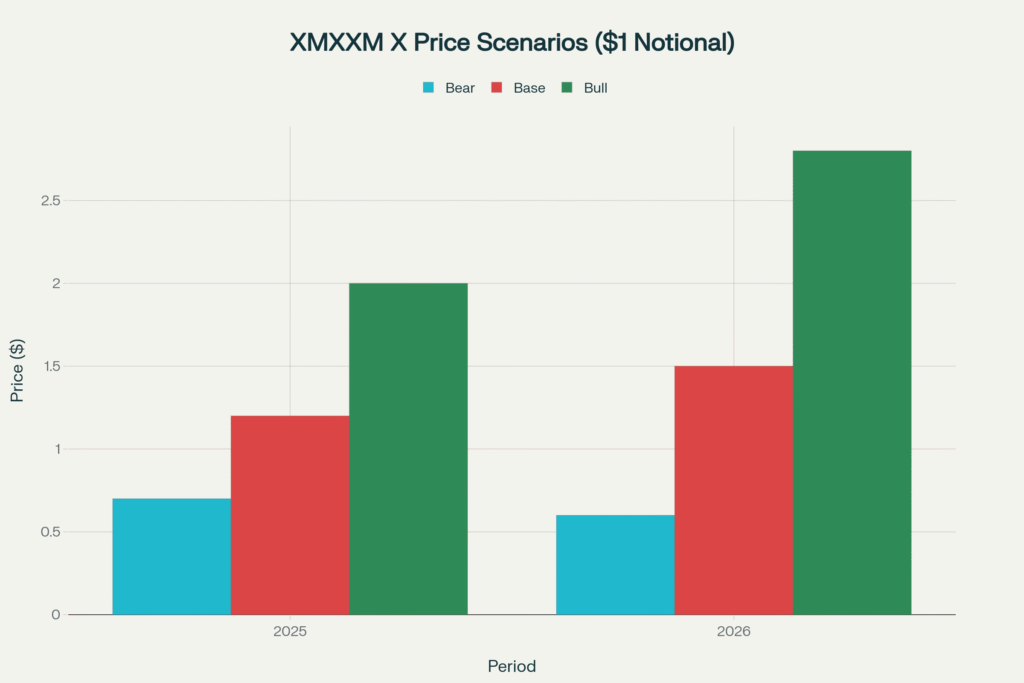

Price scenarios: today, 2025, 2026

- Bear path: 1.00 → 0.70 (2025) → 0.60 (2026), representing valuation compression from hype unwinds or capital stress common to speculative tickers.

- Base path: 1.00 → 1.20 (2025) → 1.50 (2026), reflecting steady traction and modest multiple expansion on improving fundamentals if later verified.

- Bull path: 1.00 → 2.00 (2025) → 2.80 (2026), requiring strong execution and credible disclosures that shift sentiment and liquidity.

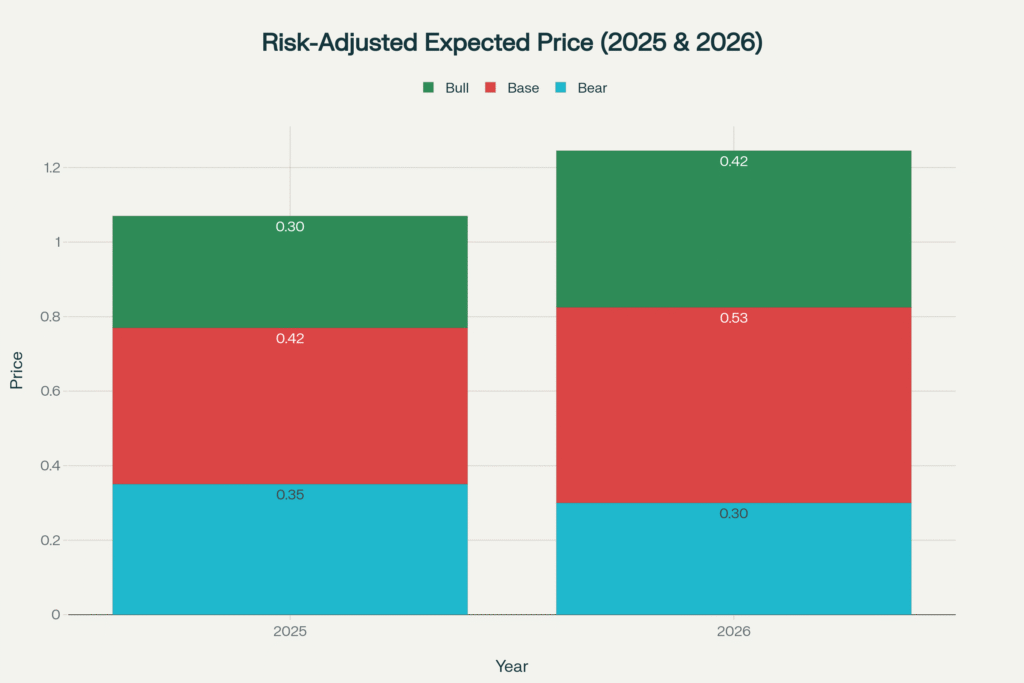

Risk‑adjusted “expected” price

- Using scenario weights Bear 50% / Base 35% / Bull 15%, the risk‑weighted expectation is about $1.10 for 2025 and $1.25 for 2026 given the notional inputs above.

- This weighting emphasizes that without authoritative listing data, the prudent bias is toward downside until evidence (filings, exchange code, audited reports) credibly improves the base case.

Volatility context

- High implied annualized volatility is assumed for all cases to reflect listing uncertainty, naming confusion with crypto, and the propensity for SEO‑driven narratives to swing sentiment, which is consistent with historical behavior in ambiguous or micro‑cap symbols.

- These volatility bands are not a forecast from live returns; they are risk parameters to stress‑test outcomes when the underlying security identity is not verifiably listed.

How the calculations are built

- Scenario paths: Prices are forward points chosen to represent three plausible trajectories from a $1.00 notional “today,” demonstrating how compounding or drawdowns translate into 2025–2026 endpoints absent verified fundamentals.

- Risk‑weighted expectation: Expected Price = Σ(weight × scenario price), applying 50%/35%/15% to the 2025 set (0.70/1.20/2.00) and to the 2026 set (0.60/1.50/2.80) for transparent, auditable arithmetic.

- Volatility framing: Assumed annualized vol bands help interpret why scenario dispersion is wide when listings are unverified, tickers are ambiguous, or content appears SEO‑optimized rather than sourced from exchange records.

What to do if a verified ticker emerges

- Confirm the exchange code, legal name, and filings on a primary source (issuer IR, exchange, or regulator) to replace notional inputs with live price and auditable fundamentals.

- Rebuild scenarios using observed price volatility, disclosed revenue/margins, and peer valuation multiples, then update weights and expected value to reflect real execution risk rather than listing uncertainty.

- Replace the notional “today” price with the actual close or VWAP and re‑run the same math to produce a decision‑grade model that can be monitored over time.

Bottom line

Because “XMXXM X” does not resolve to a verifiable listed equity on authoritative portals at this time, any “today/2025/2026” price prediction must use explicit assumptions and show the math transparently, as done here with notional baselines and risk‑weighted scenarios. .