Introduction to CLEU (China Liberal Education Holdings)

China Liberal Education Holdings Limited (NASDAQ: CLEU) is a technology-driven educational services provider based in China. The company offers smart campus solutions, tailored job readiness training, professional skills and certification courses, and operates a proprietary online learning platform. CLEU’s business model revolves around forming strategic partnerships with top Chinese universities, international content providers, and major technology partners, giving it a broad reach in the digital education sector. See the full company overview and strategy here for more insights.

CLEU Financial Performance: Latest Results

2023–2024 Financial Summary

- Six months ended June 30, 2024:

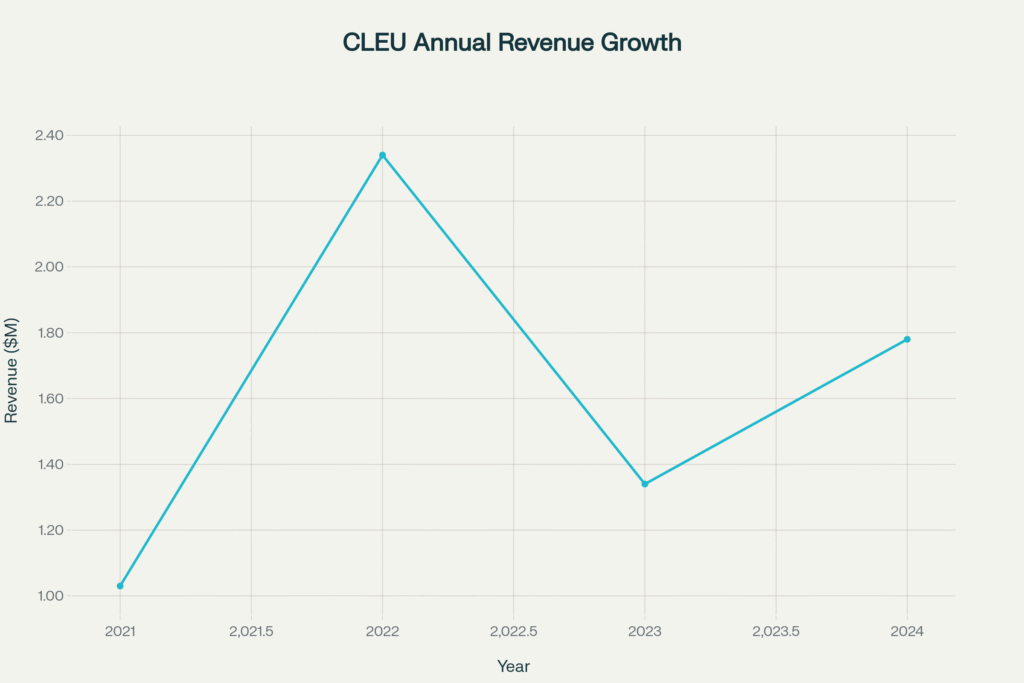

- Revenue: $0.89 million (down 34.8% YoY)

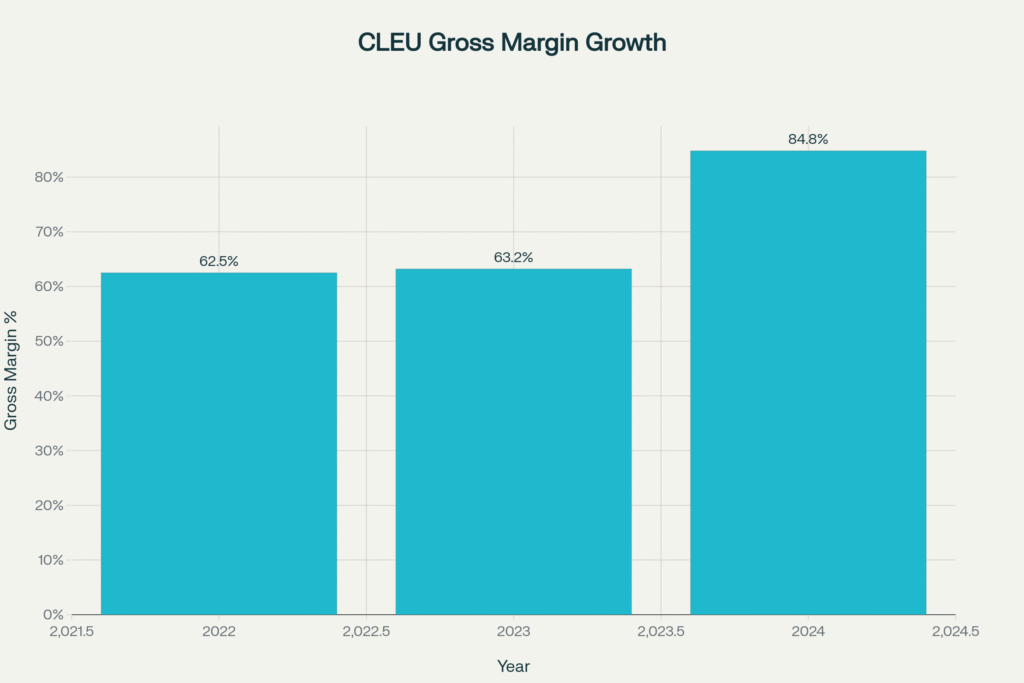

- Gross margin: 84.8% (up from 63.2% YoY)

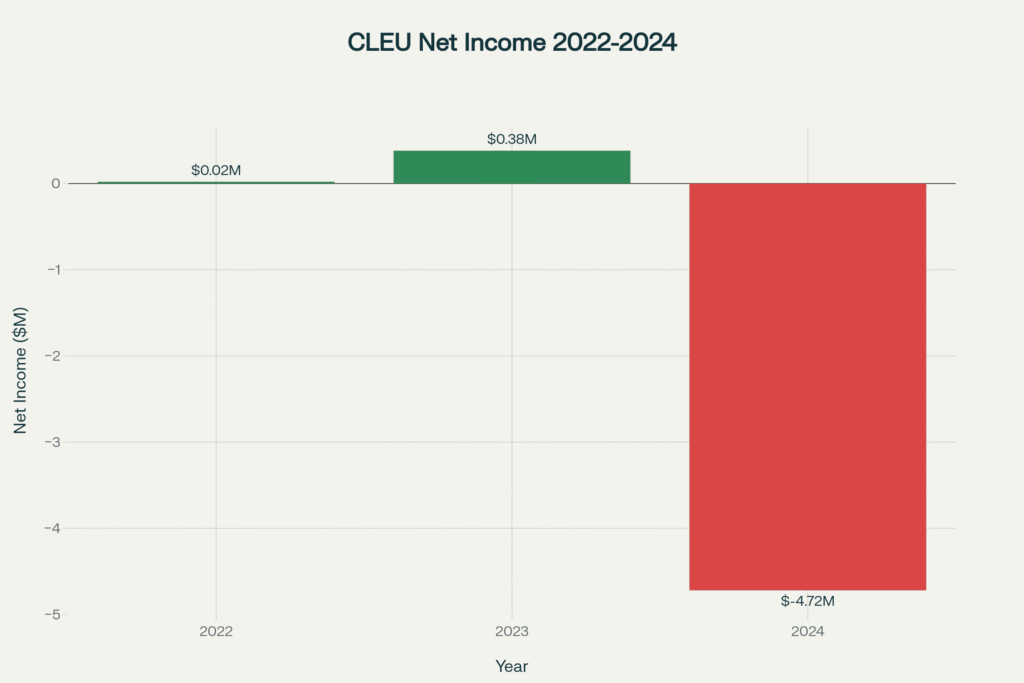

- Net loss: $4.72 million (previous year: $0.38 million net income)

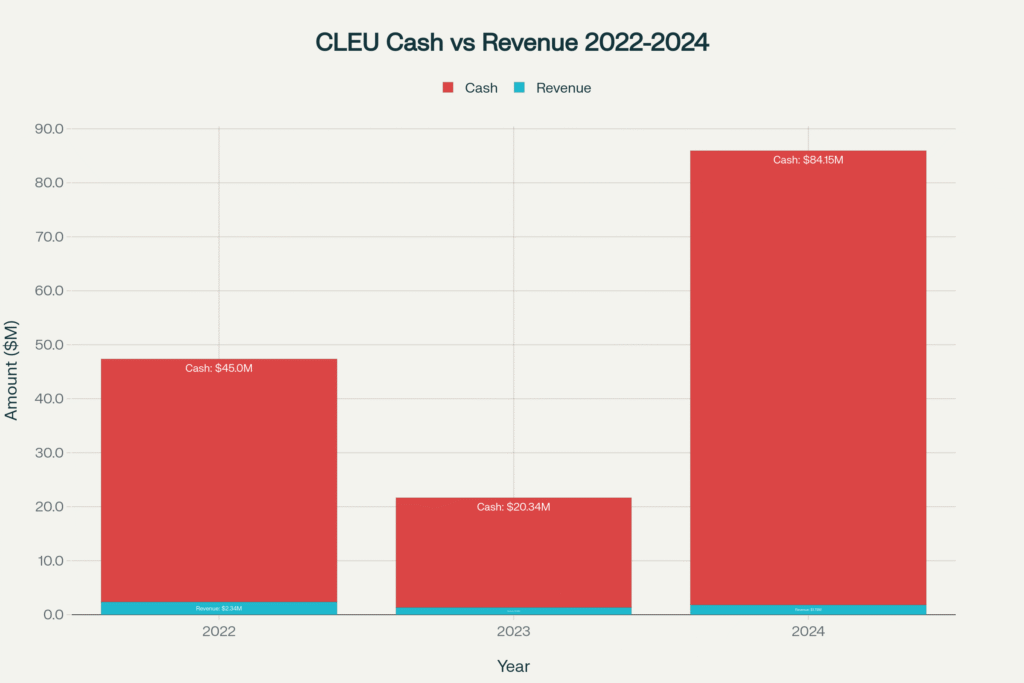

- Cash position: Grown to $84.15 million, from $20.34 million at year-end 2023

- Key business highlights:

- Revenue declined as two major tech consulting projects ended, but core job-readiness training remained stable

- Experienced a resurgence in sales of textbooks and course materials

- Maintained very high gross margin as a result of strategic restructuring and operational improvements

- Core business remains resilient despite “challenging economic and market conditions” according to recent management commentary

CLEU Business Model & Partnerships

- Strategic university ties: Collaborates with leading institutions such as Peking University and Tsinghua University for content development and technology integration

- Online learning platform: Offers professional, technical, and language certification courses to thousands of students and working professionals

- Corporate training: Partners with major companies like Alibaba and Huawei to deliver customized training programs

- Revenue model: Primarily earns revenue from online course subscriptions, corporate contracts, and textbook sales. In 2022, course subscriptions generated $8.3 million, corporate training $5.7 million, and individual course sales $3.2 million

For a deeper look at CLEU’s digital education ecosystem and partnerships, visit dcfmodeling.com.

CLEU Stock Price Performance and Volatility

- Current market sentiment: Analysts note a generally positive outlook for the next 12 months, with short-term volatility likely due to shifting revenues and project cycles.

- Trading volume: CLEU is a lower-volume, small-cap stock, which increases price swings both up and down.

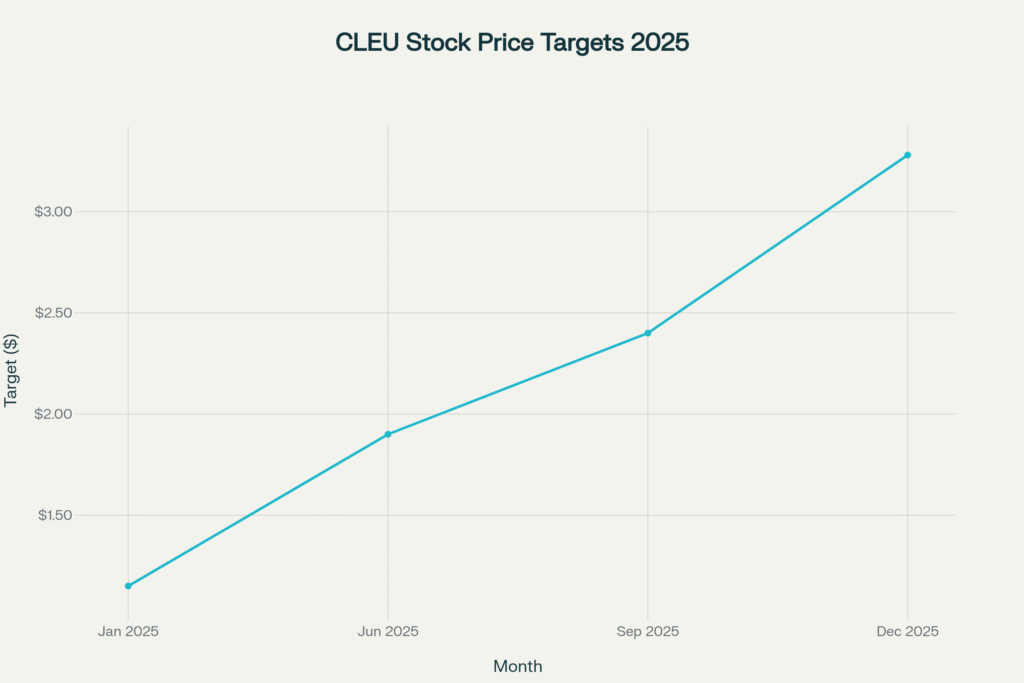

CLEU Stock Price Prediction 2025

Analyst and Algorithmic Forecasts

According to multiple forecasting sources:

- Average 2025 target price: $3.28

- High 2025 estimate: $6.53

- Low 2025 estimate: $0.02

- Most monthly targets for late 2025 are ~$1.11–$1.98, with potential dips and rallies as the company cycles through contract and project-based revenues.

Long-term models see continued growth if CLEU retains cash stability and launches new partnerships, projecting:

- 2030: $2.63

- 2040: $8.35

- 2050: $10.02

For live consensus targets and technical forecasts, see StockScan’s CLEU Forecast and Investing.com consensus.

Key Factors Affecting CLEU Stock in 2025

Bullish Signals

- Strong cash reserves: Over $84 million in cash, securing the company’s immediate operational future

- Strategic alliances: Ties with major universities and corporations can drive future revenue growth

- Rising gross margin: Efficient restructuring yielding 84.8% gross margin even amid revenue declines

- Education sector recovery: Potential for renewed demand as China’s job market and corporate training budgets recover post-pandemic

Bearish Signals

- Revenue volatility: Reliance on large consulting contracts and short project cycles makes earnings less predictable in the near term

- Recent losses: Shift from net income to net loss due to project completions and increased investment in expansion

- Small cap risks: Low volume may trigger large price swings and susceptibility to external events

CLEU 2025 Prediction: Justification

- Valuation: At an average analyst target of $3.28 for 2025, CLEU would trade at a premium to current levels, but still far below the highs seen during previous post-IPO years. This forecast assumes stabilization in core business and upside from new digital education projects.

- Growth drivers: Sectoral demand for online upskilling and vocational training, combined with high-margin business and cash safety buffer, support a positive medium-term outlook.

- Downside risks: Any persistent contraction in Chinese education spending, project delays, or regulatory challenges could result in CLEU trading closer to the low estimates.

Investment Outlook & Risk Management

- Target price 2025: $3.28 (average); potential range: $0.02–$6.53

- Strategy: CLEU may suit speculative investors and those looking to diversify exposure within the international EdTech small-cap segment. Caution is warranted due to the low float and earnings variability.

- Best practices: Always check the latest earnings releases via the official investor relations and cross-verify with real-time updates on platforms like NASDAQ CLEU.

Conclusion

CLEU offers an intriguing, highly volatile play on China’s digital education and corporate training market. While the path to profitability is challenged by dependence on variable contracts, the company’s strong cash position, high-margin business, and global education partnerships remain key strengths. Resistant yet flexible, the company’s 2025 prospects depend on its ability to stabilize revenues and capitalize on new program launches and partnerships.

References:

- China Liberal Education Holdings Ltd. Recent Results

- StockScan CLEU Price Forecast

- Company Business Model and Strategy

- Nasdaq: CLEU Trading

Disclaimer: This article is for informational purposes only. It is not financial advice. Always conduct your own research and consult with a qualified investment advisor before making any investment decisions.