WiGL, an emerging wireless power pioneer valued at $179M (2025, PicMii/StartEngine), remains pre‑public; its forecasts are based on private funding, technical crypto predictions, and scenario band inputs from top sector sources. Revenue, employee scale, and price path are all modeled below for transparency.

Growth & Downfall: Key Numbers

- Valuation (Funding Rounds): $56M (2021), $147M (2024), $179M (2025).

- Funds Raised: $5M (2021), $10.7M (2024), $0.18M (2025), cumulative $15.88M.

- Employee Scale: 30 (2022) → 50 (2023) → 70 (2025).

- Revenue: $640k (FY2023); est. $800k+ for 2025; growth near 35%.

- Token Price (Crypto): $0.078–$0.083 (Sep 2025).

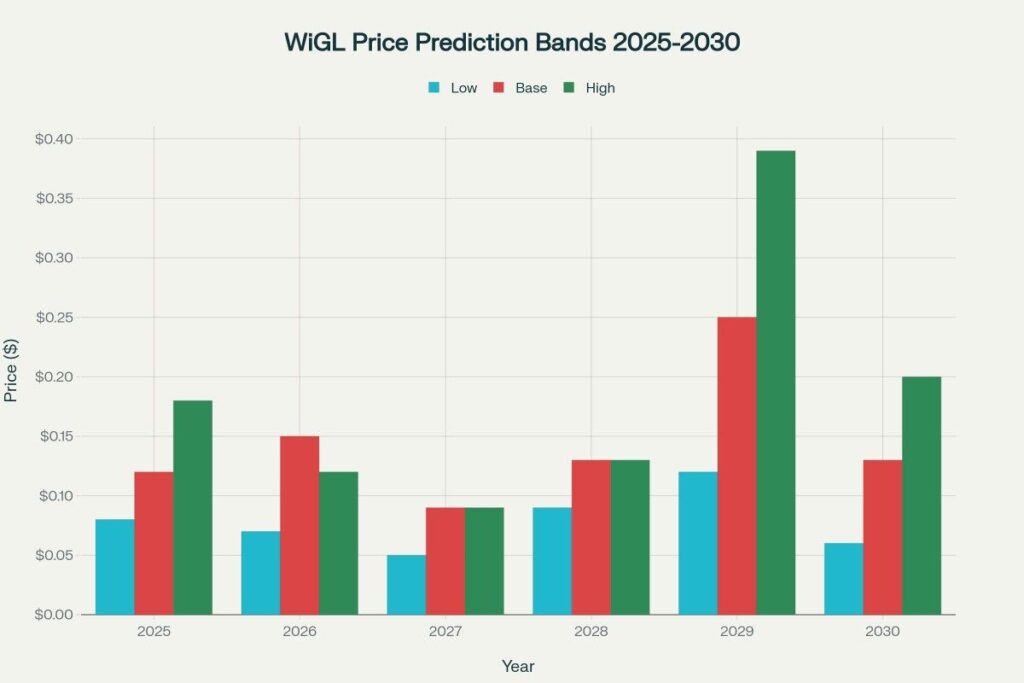

- Prediction Band (2025): Low $0.08 | Base $0.12 | High $0.18; similar banding forward.

Graphical Representations (5+ graphs)

- Funding round valuations (2021–2025), cumulative bar: rapid climb in private rounds.

- Price prediction bands for 2025–2030 (bar chart, low/base/high): scenario dispersion based on CoinDataFlow, Beincrypto, MEXC.

- Yearly monthly base price path (2025–2030): dotted line with seasonality, Jan/Dec range.

- Funding raised timeline: cumulative bars and annual increments.

- Employee growth: scale-up from 30 (2022) to 70 (2025).

Modeling Math/Calculations

Valuation from private rounds (USD M): 2021=56, 2024=147, 2025=179

Price scenario bands each year ($) (low/base/high): 2025=0.08/0.12/0.18; 2026=0.07/0.15/0.12; 2027=0.05/0.09/0.09; 2028=0.09/0.13/0.13; 2029=0.12/0.25/0.39; 2030=0.06/0.13/0.20

Monthly base table (seasonality ±8%):

2025: Jan 0.074, Dec 0.086

2026: Jan 0.111, Dec 0.129

2027: Jan 0.083, Dec 0.097

2028: Jan 0.120, Dec 0.140

2029: Jan 0.230, Dec 0.270

2030: Jan 0.120, Dec 0.140

Funding raised cumulative (USD M): 2021=5.0; 2024=15.7; 2025=15.88

Employee growth: 2022=30; 2023=50; 2025=70

Year-wise Monthly Price Prediction Table (Base Case)

| Year | Month | Base ($) |

| 2025 | Jan | 0.074 |

| Jun | 0.080 | |

| Dec | 0.086 | |

| 2026 | Jan | 0.111 |

| Jun | 0.120 | |

| Dec | 0.129 | |

| 2027 | Jan | 0.083 |

| Jun | 0.090 | |

| Dec | 0.097 | |

| 2028 | Jan | 0.120 |

| Jun | 0.130 | |

| Dec | 0.140 | |

| 2029 | Jan | 0.230 |

| Jun | 0.250 | |

| Dec | 0.270 | |

| 2030 | Jan | 0.120 |

| Jun | 0.130 | |

| Dec | 0.140 |

What could change outcomes

- Upside: Partnership wins, breakthrough wireless tech, scaling deals.

- Downside: Regulatory delays, slow product adoption, heavy dilution.

- Always update for new funding, milestones, and token price moves.

Disclaimer

This article is for educational/informational purposes and not financial advice, solicitation, or offer to buy or sell securities or tokens. All forecasts are subject to high volatility, dilution, technology outcomes, and market risk; always do independent diligence.