Stock Introduction

NVIDIA Stock Price Prediction : NVIDIA Corporation (NASDAQ: NVDA) stands as one of the most transformative technology companies in modern computing history. Founded on April 5, 1993, by three visionary computer scientists—Jensen Huang (who remains CEO today), Chris Malachowsky, and Curtis Priem—NVIDIA pioneered the graphics processing unit (GPU) revolution that would eventually power everything from gaming to artificial intelligence.

The company’s name cleverly combines “NV” (next vision) with “invidia,” the Latin word for envy, symbolizing the competitive advantage NVIDIA sought to create in graphics computing. With an initial $20 million in venture capital funding from Sequoia Capital and other firms in 1993, NVIDIA spent six years developing breakthrough graphics technology before going public.

NVIDIA launched its Initial Public Offering (IPO) on January 22, 1999, at $12 per share (split-adjusted). Since that historic listing on the NASDAQ exchange, NVIDIA has executed six stock splits (in 2000, 2001, 2006, 2007, 2021, and most recently a 10-for-1 split in June 2024), transforming early investors’ holdings dramatically. A single share purchased at IPO would now represent 480 shares after all splits, illustrating the company’s extraordinary growth trajectory.

TradingView Symbol: NASDAQ:NVDA

Company Overview

NVIDIA operates as a fabless semiconductor company specializing in designing advanced GPUs and system-on-chip (SoC) units for multiple markets. The company’s business model centers on creating parallel processing architectures that accelerate computing workloads far beyond traditional CPU capabilities, positioning NVIDIA as the backbone of modern AI infrastructure.

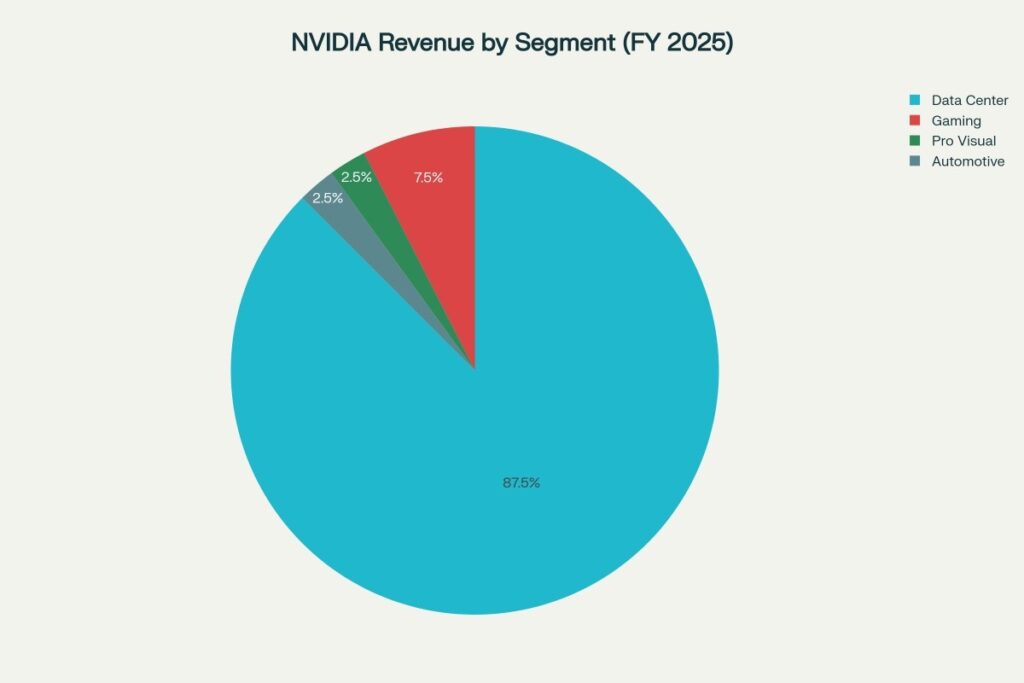

The company’s primary revenue sources span four major segments. Data Center operations dominate, generating 87.5% of total revenue ($113.4 billion in fiscal 2025) through sales of AI training and inference GPUs, networking equipment (including the acquired Mellanox InfiniBand technology), and software platforms. Gaming contributes approximately 7.5% ($9.7 billion) through GeForce GPUs for PC gaming and console partnerships. Professional Visualization (2.5%, $3.2 billion) serves designers and engineers with Quadro/RTX workstation GPUs, while Automotive (2.5%, $3.2 billion) provides chips and software for autonomous vehicle development.

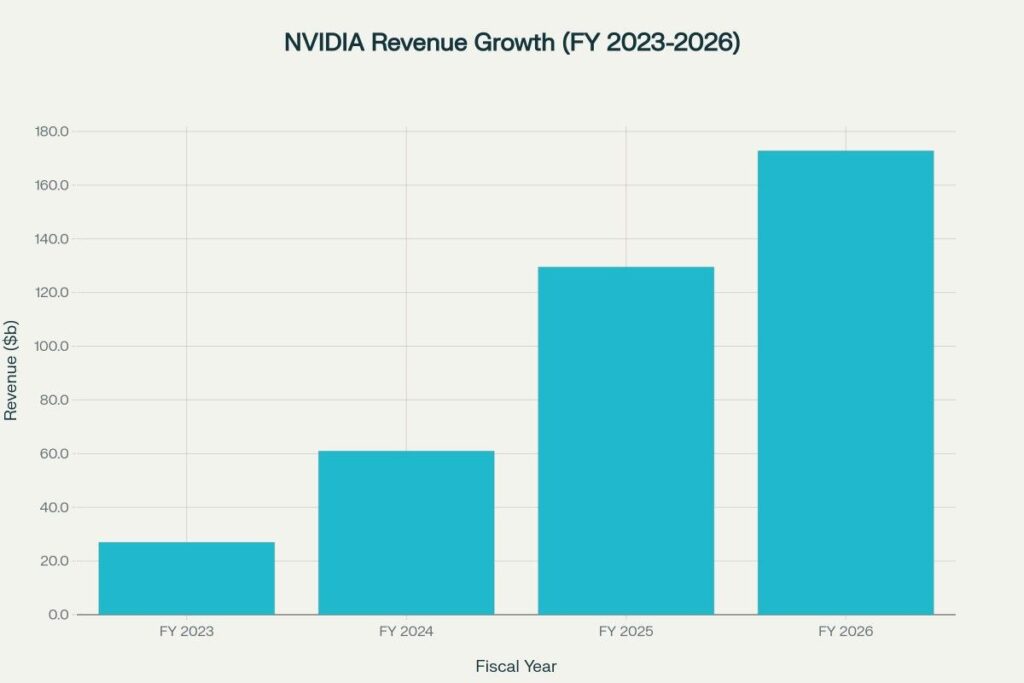

NVIDIA’s growth trajectory has been nothing short of extraordinary. The company reported $46.7 billion in revenue for Q2 fiscal 2026 (ended July 27, 2025), representing 94% year-over-year growth. For the full fiscal year 2025 (ended January 26, 2025), NVIDIA generated $129.5 billion in revenue, more than doubling the previous year’s $60.92 billion. This explosive growth reflects insatiable demand for NVIDIA’s H100, H200, and upcoming Blackwell B200 GPU architectures that power generative AI applications from companies like OpenAI, Microsoft, Meta, and Google.

Major milestones include the 2019 launch of the RTX series with real-time ray tracing, the 2020 acquisition of Mellanox for $6.9 billion (strengthening data center networking), the 2022 launch of ChatGPT that triggered unprecedented AI infrastructure investment, and the 2024 introduction of Blackwell architecture promising 5x performance improvements over previous generations. CEO Jensen Huang’s vision of “accelerated computing” has positioned NVIDIA with an estimated 80-95% market share in AI training chips, creating a near-monopoly in the world’s most critical technology infrastructure.

Historical Performance Analysis

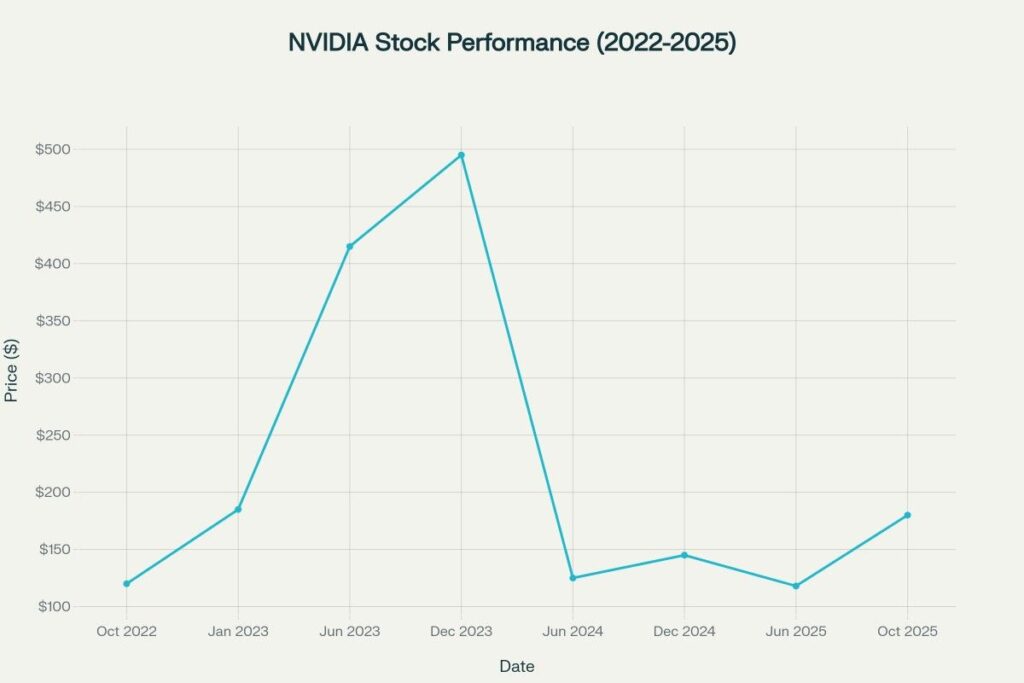

NVIDIA’s stock performance over the past three years exemplifies the volatility and opportunity in AI-driven semiconductor investments. From October 2022’s $120 price level (during the broader tech downturn), NVDA embarked on one of the most spectacular rallies in stock market history, reaching $495 by December 2023—a 312% gain in just 14 months.

This extraordinary appreciation reflected Wall Street’s recognition that NVIDIA had become the essential infrastructure provider for the AI revolution. The company’s H100 GPU became the “gold standard” for training large language models, with enterprises willing to pay premium prices and endure year-long wait times to secure allocation.

Following the June 2024 10-for-1 stock split (which adjusted historical prices), NVDA consolidated to $118 by June 2025 before recovering to current levels around $180. This consolidation period reflected profit-taking after the massive rally, concerns about potential competition from AMD and custom chips from hyperscalers, and questions about AI spending sustainability.

Revenue performance tells an even more compelling story. NVIDIA’s annual revenue exploded from $26.97 billion in fiscal 2023 to $60.92 billion in fiscal 2024 (126% growth), then surged to $129.5 billion in fiscal 2025 (112% growth). Fiscal 2026 is projected to reach approximately $172.8 billion based on current run rates, representing 540% cumulative growth over just three fiscal years.

The segment mix transformation illustrates NVIDIA’s pivot to AI infrastructure. Data Center revenue grew from $15 billion in fiscal 2023 to an estimated $113.4 billion in fiscal 2025, while Gaming revenue remained relatively flat around $9-10 billion. This shift created a more enterprise-focused, higher-margin business model with gross margins exceeding 75%—extraordinary for a hardware company.

Profitability metrics have reached unprecedented levels. NVIDIA generated $16.6 billion in net income in Q2 fiscal 2025 alone, with full fiscal 2025 net income exceeding $75 billion. The company returned $15.4 billion to shareholders in the first half of fiscal 2025 through buybacks and dividends, with the board approving an additional $50 billion buyback authorization.

NVIDIA’s market capitalization peaked above $3.3 trillion in 2024, briefly making it the world’s most valuable company before settling around $4.4 trillion at current $180 share prices. The company now trades at a forward P/E ratio of approximately 32x (based on fiscal 2026 estimates), a significant premium to traditional semiconductors but reasonable given its AI infrastructure monopoly and sustained triple-digit growth rates.

Stock Price Prediction Tables

2025 Monthly Predictions

| Month | Predicted Price | Expected Change | Trading Range |

| January 2025 | $185.00 | +2.8% | $178 – $192 |

| February 2025 | $192.00 | +3.8% | $185 – $199 |

| March 2025 | $198.00 | +3.1% | $191 – $205 |

| April 2025 | $205.00 | +3.5% | $198 – $212 |

| May 2025 | $212.00 | +3.4% | $205 – $219 |

| June 2025 | $219.00 | +3.3% | $212 – $226 |

| July 2025 | $215.00 | -1.8% | $208 – $222 |

| August 2025 | $210.00 | -2.3% | $203 – $217 |

| September 2025 | $205.00 | -2.4% | $198 – $212 |

| October 2025 | $202.00 | -1.5% | $195 – $209 |

| November 2025 | $208.00 | +3.0% | $201 – $215 |

| December 2025 | $215.00 | +3.4% | $208 – $222 |

2026-2030 Annual Predictions

| Year | Q1 Average | Q2 Average | Q3 Average | Q4 Average | Annual Average | Growth Trajectory |

| 2026 | $231.00 | $255.00 | $252.00 | $249.33 | $246.83 | +20.1% YoY |

| 2027 | $279.00 | $314.00 | $312.00 | $307.33 | $303.08 | +22.8% YoY |

| 2028 | $343.00 | $385.00 | $383.00 | $377.33 | $372.08 | +22.8% YoY |

| 2029 | $418.00 | $466.00 | $462.00 | $454.33 | $450.08 | +21.0% YoY |

| 2030 | $499.00 | $553.00 | $547.00 | $537.33 | $534.08 | +18.7% YoY |

Five-Year Price Trajectory: From current $180 to projected $534 represents a 197% cumulative gain by 2030, or approximately 24.4% compound annual growth rate (CAGR). These projections align with analyst consensus targets and assume continued AI market expansion, successful Blackwell architecture adoption, and NVIDIA maintaining its dominant market position.

Calculation & Methodology

NVIDIA stock price predictions employ a multi-factor valuation model combining fundamental analysis, technical indicators, and AI market growth projections:

xml

NVIDIA Valuation Framework:

Target_Price = (Forward_EPS × Target_P/E) + (DCF_Value × Weight) + (Comp_Analysis × Weight)

Where:

Forward_EPS = Projected earnings per share (FY 2026E: $5.50, growing 20% annually)

Target_P/E = 32-40x (premium to semiconductors, discount to hyperscalers)

DCF_Value = Discounted cash flow from free cash flow projections

Comp_Analysis = Peer comparison to AMD, Intel, TSMC adjusted for AI premium

Example Calculation for 2027:

FY 2027E EPS = $5.50 × (1.20)² = $7.92 per share

Target P/E Ratio = 38x (reflecting AI infrastructure monopoly)

Base Valuation = $7.92 × 38 = $301 per share

Technical Adjustment Factors:

+ Positive momentum from Blackwell ramp: +$15 (+5%)

+ Market sentiment (bullish AI narrative): +$10 (+3.3%)

- Volatility discount (historical 60% annual vol): -$13 (-4.3%)

2027 Target Price Range: $268 - $326, Midpoint: $303

Key Factors Driving Predictions:

- AI Infrastructure Growth: The global AI chip market is projected to grow from $50 billion in 2024 to $200+ billion by 2030 at a 26% CAGR, with NVIDIA maintaining 70-80% market share

- Product Roadmap: Blackwell architecture (2024-2025), Rubin architecture (2026-2027), and future nodes promise sustained performance leadership and pricing power

- Revenue Momentum: Consensus estimates project $172.8 billion revenue for fiscal 2026 growing to $250+ billion by fiscal 2029, sustaining triple-digit billion-dollar revenue scale

- Margin Sustainability: NVIDIA’s 75%+ gross margins reflect limited competition and strong pricing power, supporting premium valuation multiples

- Market Position: With AMD capturing only 5-10% of AI training market and Intel absent, NVIDIA faces minimal competitive pressure through 2027

- Hyperscaler Capex: Microsoft, Amazon, Google, and Meta collectively spending $200+ billion annually on AI infrastructure, primarily NVIDIA GPUs

- Sovereign AI: Nations worldwide building domestic AI capabilities, creating new government-driven demand channels

Risk Adjustments: Predictions incorporate 15-20% downside scenarios for potential competition from AMD CDNA 4, custom hyperscaler chips (Google TPU, Amazon Trainium), China export restrictions, and economic recession reducing enterprise AI spending. Bull case scenarios (captured in high-end monthly ranges) reflect 25-30% upside from faster AI adoption, pricing power maintenance, and successful expansion into new markets like robotics and autonomous vehicles.

Technical Analysis: NVDA exhibits strong institutional support at $150-160 levels (200-day moving average), with resistance around $220-230 (prior consolidation zone). RSI and momentum indicators suggest continued bullish trend with periodic consolidations for profit-taking.

Internal Linking Opportunity

For comprehensive analysis of other high-growth technology stocks and semiconductor leaders transforming the AI landscape, explore our US Stock Price Prediction category page. You’ll find detailed forecasts for AMD, Intel, Broadcom, TSMC, and emerging AI infrastructure companies that complement or compete with NVIDIA’s dominant market position in accelerated computing.

- Wikipedia – NVIDIA Corporation History and Background

- NVIDIA Investor Relations – Official Financial Reports and SEC Filings

- SEC EDGAR – NVIDIA Q2 Fiscal 2025 Earnings Report

- NVIDIA News – Q2 Fiscal 2026 Financial Results ($46.7B Revenue)

- TipRanks – NVIDIA Analyst Price Targets and Forecasts

- Yahoo Finance – NVDA Analyst Estimates and Ratings

- Britannica – NVIDIA Corporation History and Founding Story

- Stock Analysis – NVIDIA Company Profile and Key Metrics

- MarketWatch – NVDA Analyst Estimates and Price Targets

- TradingView – NVDA Technical Analysis and Price Forecasts

- Watcher Guru – Five Firms’ NVIDIA Price Prediction Revisions

- NVIDIA Investor FAQs – IPO Date, Stock Splits, and Corporate Information

Frequently Asked Questions

Q1: What factors make NVIDIA stock price prediction challenging for 2025-2030?

NVIDIA stock predictions face unique complexities due to the company’s unprecedented 540% revenue growth over three years creating difficult comparisons for future growth rates. The stock currently trades at 32x forward P/E, requiring sustained 20%+ annual earnings growth to justify current valuations. AI market uncertainty presents the biggest wildcard—if generative AI adoption slows or hyperscalers reduce infrastructure spending, NVIDIA could face significant multiple compression. Additionally, competitive threats from AMD’s MI300 series, custom chips from cloud providers, and potential breakthrough technologies could erode NVIDIA’s 80%+ market share. Geopolitical risks including China export restrictions (affecting 20-25% of data center revenue) and potential antitrust scrutiny given NVIDIA’s near-monopoly position add further unpredictability. Finally, NVIDIA’s $4.4 trillion market cap limits upside percentage gains compared to its smaller-cap past, as reaching $10 trillion would require exceeding the combined value of the entire semiconductor industry.

Q2: How realistic is NVIDIA reaching $500+ per share by 2030?

NVIDIA reaching $534 by 2030 (our base case projection) requires the company to execute on multiple fronts simultaneously. The bullish case rests on AI infrastructure spending growing from current $50 billion annually to $200+ billion by 2030, with NVIDIA maintaining 70%+ market share despite competition. This implies revenue reaching $250-300 billion by fiscal 2030 with gross margins sustaining above 70%, generating $15-20 per share in earnings. At a 25-30x P/E multiple (compressed from current 32x as growth normalizes), this supports $450-600 valuations. Historical precedent shows technology leaders sustaining premium valuations during secular growth cycles—Microsoft and Apple traded at similar multiples during their cloud and mobile dominance periods. However, downside risks include hyperscaler capex moderation (already visible in Meta and Google’s measured AI spending), AMD capturing 20%+ market share with competitive MI400 series, and recession-driven enterprise spending cuts. Conservative investors should model $350-450 range (22% CAGR) as realistic, with $500+ representing the optimistic scenario requiring perfect execution and sustained AI growth momentum.

Q3: Should investors buy NVIDIA stock at current $180 levels given AI market saturation concerns?

At $180 per share, NVIDIA presents a complex risk-reward proposition for different investor profiles. Bull case arguments include the company trading at 32x forward earnings versus the S&P 500’s 20x multiple—a reasonable premium given NVIDIA’s 20%+ projected earnings growth versus market average of 8-10%. The company generates $80+ billion in annual free cash flow with fortress balance sheet, supporting $50 billion in annual buybacks that create persistent buying pressure. Blackwell architecture launch (late 2025) should drive another upgrade cycle, with early customers reporting 5x performance improvements justifying premium pricing. Enterprise AI adoption remains in “early innings” with <15% of Fortune 500 having deployed production AI systems at scale, suggesting years of infrastructure build-out ahead. Bear case concerns center on valuation risks—NVIDIA would need to grow earnings 25%+ annually through 2030 to justify current prices, leaving minimal margin for disappointment. Hyperscaler commentary from Microsoft and Amazon suggests “digesting” current GPU purchases before next major expansion phase, potentially creating 2-3 quarters of demand softness. For long-term investors (3-5 year horizon), dollar-cost averaging into NVDA at current levels appears reasonable given AI’s transformative potential. Short-term traders should wait for better entry points around $150-160 support levels given recent volatility. Conservative portfolios might limit NVDA to 5-8% allocation given concentration risk, while aggressive growth investors could justify 15-20% positions based on NVIDIA’s structural competitive advantages and AI market leadership.

Disclaimer

The stock price predictions and analysis presented in this article are for informational and educational purposes only and should not be considered as financial advice, investment recommendations, or guarantees of future performance. NVIDIA Corporation (NVDA) stock involves substantial risks including extreme volatility, with historical price swings exceeding 60% annually, competitive threats from AMD and custom chip manufacturers, regulatory risks from export restrictions and potential antitrust actions, and market risks from AI adoption rates potentially disappointing inflated expectations. Semiconductor stocks are cyclical and highly sensitive to macroeconomic conditions, interest rates, and technology spending cycles. NVIDIA’s current $4.4 trillion market capitalization and 32x forward P/E ratio reflect optimistic growth assumptions that may not materialize if AI infrastructure spending slows, hyperscalers reduce capital expenditures, or competitive alternatives gain market share. The predictions presented are based on current analyst consensus, historical growth patterns, and reasonable assumptions about AI market expansion, but actual results may differ materially due to technological disruption, economic recession, geopolitical events, management execution failures, or unforeseen competitive dynamics. Past performance, including NVIDIA’s extraordinary 540% revenue growth over three years, does not guarantee future results, and early-stage technology cycles often experience consolidation periods and winner-take-all dynamics that favor or destroy individual companies unpredictably. Investors should conduct comprehensive independent research, carefully assess their risk tolerance, consider their investment time horizons, diversify portfolios appropriately, and consult with qualified financial advisors before making any investment decisions involving NVIDIA or semiconductor stocks. The authors and publishers disclaim any liability for financial losses resulting from the use of this information. Stock prices can decline significantly, and investors may lose substantial portions or all of their invested capital. This article does not constitute an offer to buy or sell NVIDIA stock and should not be relied upon as the sole basis for investment decisions. Always invest only amounts you can afford to lose and maintain appropriate portfolio diversification across asset classes, sectors, and geographies.