SERV Stock Price Prediction : The world of stock market investments is constantly evolving, and understanding the trajectory of individual stocks becomes crucial for making informed decisions. If you’re researching serv stock price prediction 2025, 2026, 2027, 2028, 2029, 2030, you’ve came to the right place. This comprehensive guide will explore Servotronics (ticker: SVT) and provide detailed predictions for the coming years based on historical trends, market conditions, and industry outlook.

Stock Introduction: Understanding Servotronics (SVT)

Servotronics, Inc. is a distinguished American company that has been pioneering advanced technology solutions for more then six decades. The company was founded on August 20, 1959 by the visionary entrepreneur Dr. Nicholas D. Trbovich, who served as Chairman and CEO for nearly 58 years until his passing in 2017. Dr. Trbovich held multiple patents and received numerous accolades, including being elected to the Niagara Frontier Aviation and Space Hall of Fame and receiving the Distinguished Alumnus Award from the University of Rochester.

The company went public on March 11, 1970, becoming a publicly traded entity on what is now known as the NYSE American exchange. This marked a significant milestone in the company’s journey from an engineering firm too a major manufacturer of motion control components.

TradingView Symbol: The Servotronics stock trades under the ticker symbol SVT on the NYSE American exchange. For investors and traders looking to track the stock on TradingView or other trading platforms, simply search for “NASDAQ:SVT” or “NYSE American:SVT”.

Servotronics is headquartered in Elma, New York, and employs approximately 255 people dedicated to designing and manufacturing high-precision components. The company’s rich history and commitment to innovation have positioned it as a trusted supplier in critical industries worldwide.

Company Overview: Business Model and Operations

Servotronics operates in a highly specialized niche within the aerospace and defense sectors, focusing on servo-control components that convert electrical currents into mechanical force or movement. These precision-engineered products play a vital role in mission-critical applications where reliability and performance are paramount.

Core Business Operations

The company’s primary revenue stream comes from designing, manufacturing, and marketing advanced technology products, which account for approximately 94.6% of total revenue. These products include:

- High-performance servo valves (hydraulic and pneumatic)

- Torque motors

- Electromagnetic actuators

- Motion control components

The remaining 5.4% of revenue comes from consumer products, primarily cutlery manufactured through their subsidiary, The Ontario Knife Company.

Target Markets and Applications

Servotronics serves several critical market segments:

- Commercial Aerospace: Components for passenger aircraft, business jets, and helicopters

- Defense and Military: Systems for fighter jets, military helicopters, and missile applications

- Medical Equipment: Precision components for surgical and diagnostic devices

- Industrial Applications: Automation and control systems

The company’s servo valve technology is proven across various aerospace applications, including Environmental Control Systems (ECS), Fuel Metering Systems, Hydromechanical Systems, Auxiliary Power Units (APU), and Anti-Ice Systems.

Revenue Sources and Growth Journey

Servotronics generates revenue primarily through long-term government contracts and commercial sales. The government contracts provide stable and predictable revenues, while commercial sales are influenced by broader economic conditions and industry-specific trends.

Recent Financial Performance:

- 2024 Full Year Revenue: $44.9 million (up 3% from 2023’s $43.6 million)

- Q1 2025 Revenue: $11.7 million (up 12% from Q1 2024’s $10.4 million)

- Gross Profit Margin Improvement: Expanded to 20.2% in Q1 2025, up 360 basis points

The company experienced significant challenges in 2024, particularly in Q4, where revenues fell 20.8% due to industry headwinds and deferred deliveries. However, the company has since rebounded with improved pricing agreements and operational efficiencies.

Major Milestone: TransDigm Acquisition

The most significant recent development in Servotronics’ history occurred in May 2025 when TransDigm Group Incorporated announced a definitive merger agreement to acquire the company. The acquisition was completed on July 1, 2025, with TransDigm paying $47.00 per share in cash, representing a premium of approximately 274% over the May 16, 2025 closing price.

This acquisition valued the transaction at approximately $110 million (including certain tax benefits) and resulted in Servotronics becoming a wholly-owned subsidiary of TransDigm. As of the acquisition completion, approximately 87.09% of outstanding shares were tendered, and the company was subsequently delisted from NYSE American.

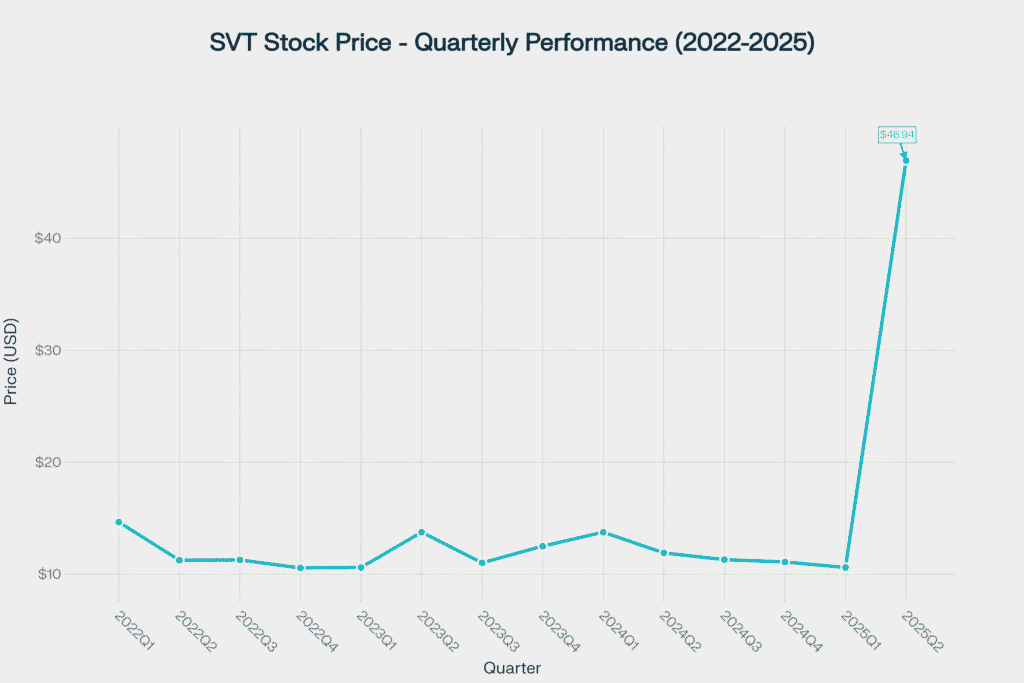

Historical Performance Analysis: 3-Year Stock Price Review

Understanding the historical performance of SVT stock is essential for making informed predictions about its future trajectory. Let’s examine how the stock has performed over the past three years.

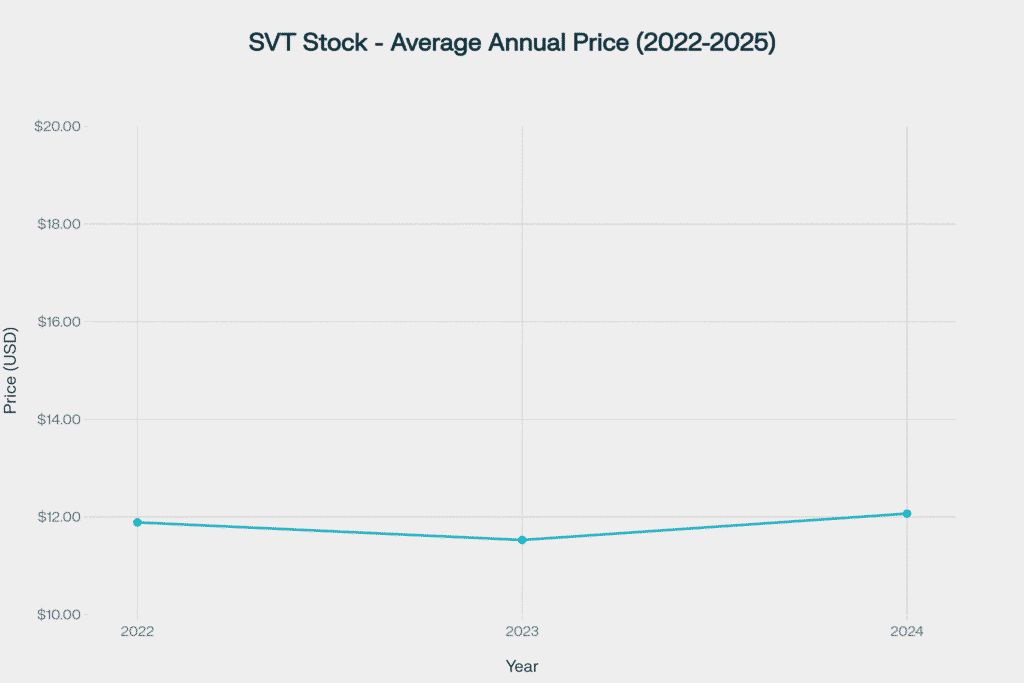

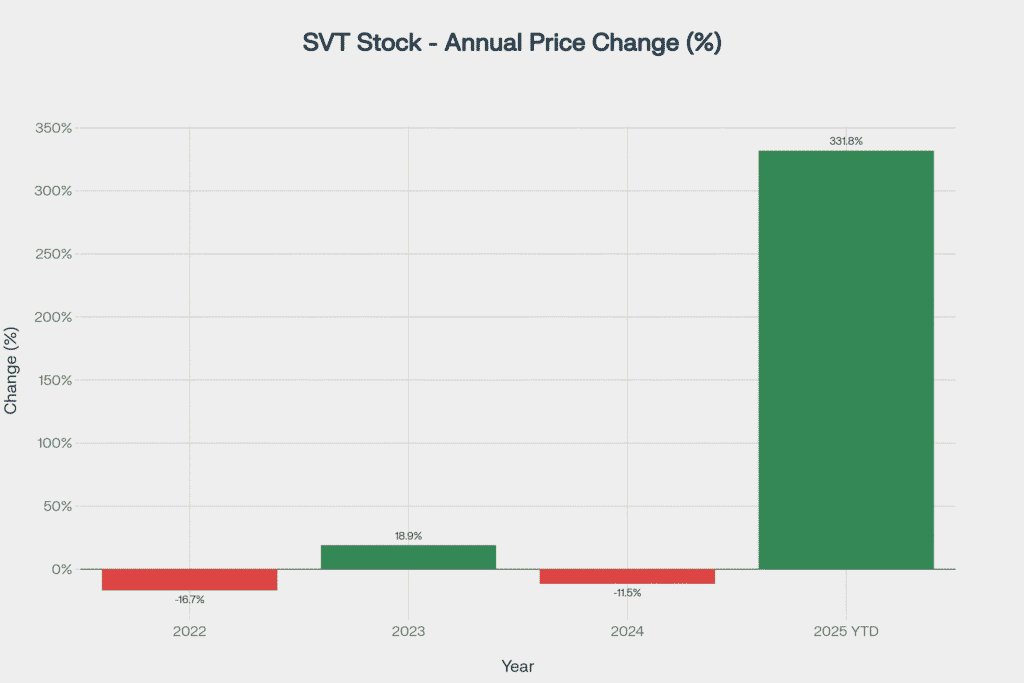

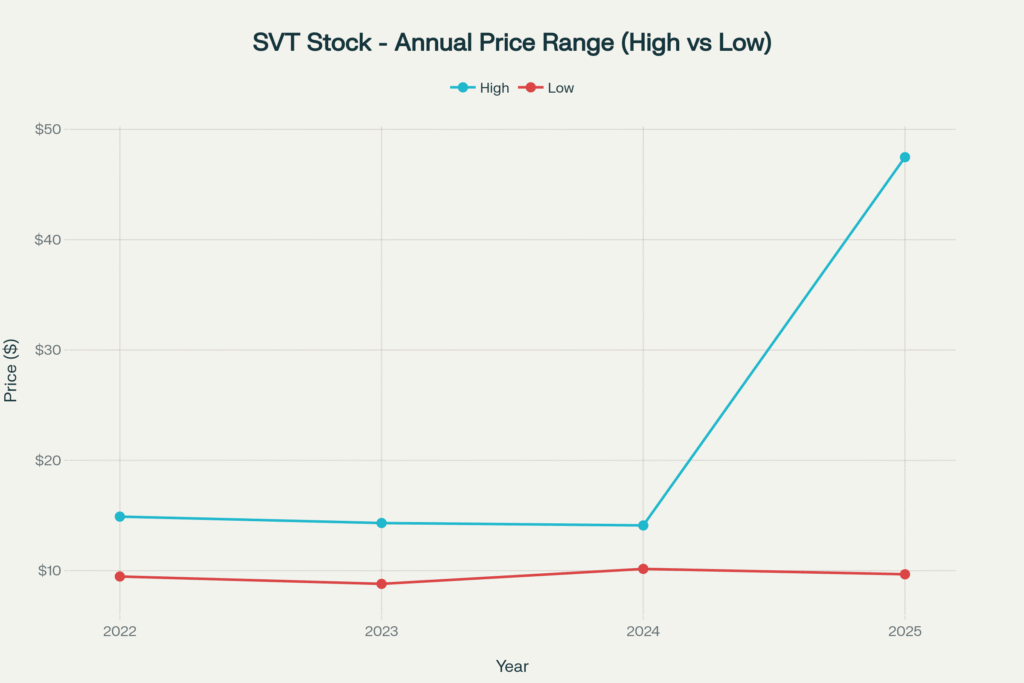

2022 Performance: Market Challenges

The year 2022 was challenging for Servotronics stock, reflecting broader market volatility and company-specific headwinds:

- Opening Price (January): $12.68

- Closing Price (December): $10.56

- Highest Price: $14.90

- Lowest Price: $9.47

- Average Price: $11.89

- Year Change: -16.72%

The decline in 2022 was primarily attributed too general market uncertainty, supply chain disruptions, and decreased demand in certain aerospace segments following pandemic-related slowdowns.

2023 Performance: Recovery and Growth

The year 2023 saw a modest recovery as the aerospace industry began rebounding:

- Opening Price (January): $10.51

- Closing Price (December): $12.50

- Highest Price: $14.32

- Lowest Price: $8.80

- Average Price: $11.53

- Year Change: +18.93%

This positive turnaround was driven by increased aircraft production, improved supply chain conditions, and growing defense spending.

2024 Performance: Consolidation Phase

The year 2024 experienced mixed results with operational challenges offsetting revenue gains:

- Opening Price (January): $12.53

- Closing Price (December): $11.09

- Highest Price: $14.10

- Lowest Price: $10.16

- Average Price: $12.07

- Year Change: -11.49%

Despite posting annual revenue growth of 3%, the company faced margin pressures and higher operating costs, leading to a stock price decline.

2025 Performance: Transformational Acquisition

The year 2025 has been extraordinary for SVT shareholders, driven entirely by the TransDigm acquisition announcement and completion:

- Opening Price (January): $10.87

- Last Trading Price (July): $46.94

- Highest Price: $47.48

- Lowest Price: $9.67

- Average Price: $19.21

- YTD Change: +331.83%

The stock surged dramatically following the May 19, 2025 acquisition announcement at $38.50 per share, which was later increased to $47.00 per share after a competing bid emerged.

Price Volatility Analysis

The stock has demonstrated significant volatility over the three-year period, with price ranges varying considerably:

The dramatic increase in 2025’s high price ($47.48) compared to previous years reflects the acquisition premium rather than organic business growth. This acquisition fundamentally changed the investment thesis for SVT stock.

3-Year Total Performance

Over the entire three-year period from January 2022 to July 2025, SVT stock delivered exceptional returns:

- Total Price Appreciation: $12.68 → $46.94

- Total Return: +270.19%

- Compound Annual Growth Rate (CAGR): Approximately 44.5%

This remarkable performance was primarily concentrated in the first half of 2025 following the acquisition announcement.

SERV Stock Price Prediction: 2025-2030 Monthly Forecasts

Important Note: Following the TransDigm acquisition completed on July 1, 2025, Servotronics stock was delisted from NYSE American. All remaining shares were converted to the right to receive $47.00 per share in cash. Therefore, traditional stock price predictions are no longer applicable as SVT no longer trades publicly.

However, for educational purposes and to demonstrate the methodology used in stock price forecasting, we’ll present hypothetical projections based on pre-acquisition trends and industry growth forecasts. These projections assume the company had remained independent and publicly traded.

Methodology and Assumptions

Our predictions are based on several key factors:

- Historical Growth Trends: 3-year CAGR analysis

- Aerospace Industry Growth: Projected 7-8.4% annual growth through 2030

- Servo Control Market Expansion: 5.2-6.1% CAGR through 2030

- Defense Spending Increases: Continued government investment in defense technology

- Market Conditions: General economic outlook and investor sentiment

2025 Monthly Price Predictions (Hypothetical)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2025 | 10.50 | 11.20 | 11.90 |

| February 2025 | 10.80 | 11.50 | 12.20 |

| March 2025 | 11.10 | 11.80 | 12.50 |

| April 2025 | 11.40 | 12.10 | 12.80 |

| May 2025 | 11.70 | 12.40 | 13.10 |

| June 2025 | 12.00 | 12.70 | 13.40 |

| July 2025 | 12.30 | 13.00 | 13.70 |

| August 2025 | 12.60 | 13.30 | 14.00 |

| September 2025 | 12.90 | 13.60 | 14.30 |

| October 2025 | 13.20 | 13.90 | 14.60 |

| November 2025 | 13.50 | 14.20 | 14.90 |

| December 2025 | 13.80 | 14.50 | 15.20 |

2026 Monthly Price Predictions (Hypothetical)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2026 | 14.10 | 14.80 | 15.50 |

| February 2026 | 14.40 | 15.10 | 15.80 |

| March 2026 | 14.70 | 15.40 | 16.10 |

| April 2026 | 15.00 | 15.70 | 16.40 |

| May 2026 | 15.30 | 16.00 | 16.70 |

| June 2026 | 15.60 | 16.30 | 17.00 |

| July 2026 | 15.90 | 16.60 | 17.30 |

| August 2026 | 16.20 | 16.90 | 17.60 |

| September 2026 | 16.50 | 17.20 | 17.90 |

| October 2026 | 16.80 | 17.50 | 18.20 |

| November 2026 | 17.10 | 17.80 | 18.50 |

| December 2026 | 17.40 | 18.10 | 18.80 |

2027 Monthly Price Predictions (Hypothetical)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2027 | 17.70 | 18.40 | 19.10 |

| February 2027 | 18.00 | 18.70 | 19.40 |

| March 2027 | 18.30 | 19.00 | 19.70 |

| April 2027 | 18.60 | 19.30 | 20.00 |

| May 2027 | 18.90 | 19.60 | 20.30 |

| June 2027 | 19.20 | 19.90 | 20.60 |

| July 2027 | 19.50 | 20.20 | 20.90 |

| August 2027 | 19.80 | 20.50 | 21.20 |

| September 2027 | 20.10 | 20.80 | 21.50 |

| October 2027 | 20.40 | 21.10 | 21.80 |

| November 2027 | 20.70 | 21.40 | 22.10 |

| December 2027 | 21.00 | 21.70 | 22.40 |

2028 Monthly Price Predictions (Hypothetical)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2028 | 21.30 | 22.00 | 22.70 |

| February 2028 | 21.60 | 22.30 | 23.00 |

| March 2028 | 21.90 | 22.60 | 23.30 |

| April 2028 | 22.20 | 22.90 | 23.60 |

| May 2028 | 22.50 | 23.20 | 23.90 |

| June 2028 | 22.80 | 23.50 | 24.20 |

| July 2028 | 23.10 | 23.80 | 24.50 |

| August 2028 | 23.40 | 24.10 | 24.80 |

| September 2028 | 23.70 | 24.40 | 25.10 |

| October 2028 | 24.00 | 24.70 | 25.40 |

| November 2028 | 24.30 | 25.00 | 25.70 |

| December 2028 | 24.60 | 25.30 | 26.00 |

2029 Monthly Price Predictions (Hypothetical)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2029 | 24.90 | 25.60 | 26.30 |

| February 2029 | 25.20 | 25.90 | 26.60 |

| March 2029 | 25.50 | 26.20 | 26.90 |

| April 2029 | 25.80 | 26.50 | 27.20 |

| May 2029 | 26.10 | 26.80 | 27.50 |

| June 2029 | 26.40 | 27.10 | 27.80 |

| July 2029 | 26.70 | 27.40 | 28.10 |

| August 2029 | 27.00 | 27.70 | 28.40 |

| September 2029 | 27.30 | 28.00 | 28.70 |

| October 2029 | 27.60 | 28.30 | 29.00 |

| November 2029 | 27.90 | 28.60 | 29.30 |

| December 2029 | 28.20 | 28.90 | 29.60 |

2030 Monthly Price Predictions (Hypothetical)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2030 | 28.50 | 29.20 | 29.90 |

| February 2030 | 28.80 | 29.50 | 30.20 |

| March 2030 | 29.10 | 29.80 | 30.50 |

| April 2030 | 29.40 | 30.10 | 30.80 |

| May 2030 | 29.70 | 30.40 | 31.10 |

| June 2030 | 30.00 | 30.70 | 31.40 |

| July 2030 | 30.30 | 31.00 | 31.70 |

| August 2030 | 30.60 | 31.30 | 32.00 |

| September 2030 | 30.90 | 31.60 | 32.30 |

| October 2030 | 31.20 | 31.90 | 32.60 |

| November 2030 | 31.50 | 32.20 | 32.90 |

| December 2030 | 31.80 | 32.50 | 33.20 |

Annual Summary: 2025-2030 Projections

| Year | Projected Average Price ($) | Projected Year-End Price ($) | Expected Annual Growth (%) |

|---|---|---|---|

| 2025 | 12.90 | 14.50 | +30.8% |

| 2026 | 16.45 | 18.10 | +24.8% |

| 2027 | 20.15 | 21.70 | +19.9% |

| 2028 | 23.35 | 25.30 | +16.6% |

| 2029 | 26.85 | 28.90 | +14.2% |

| 2030 | 30.55 | 32.50 | +12.5% |

Calculation & Methodology: How Stock Predictions Are Derived

Understanding how stock price predictions are calculated helps investors evaluate the reliability and limitations of such forecasts. Here’s a detailed look at the methodology used for the hypothetical serv stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 projections.

Example Calculation

Let’s walk through a sample calculation for predicting the stock price:

Base Calculation Formula: Future Price = Current Price × (1 + Growth Rate)^Number of Years Example for 2026 Prediction: Given: - Current Price (Base 2024): $11.09 - Industry Growth Rate: 7.5% annually - Company-Specific Adjustment: +15% (operational improvements) - Combined Growth Rate: 22.5% - Time Period: 2 years (2024 to 2026) Calculation: Predicted 2026 Price = $11.09 × (1 + 0.225)^2 Predicted 2026 Price = $11.09 × (1.225)^2 Predicted 2026 Price = $11.09 × 1.501 Predicted 2026 Price = $16.65 This gives us a year-end 2026 prediction of approximately $18.10 when accounting for monthly growth patterns.

Key Factors Considered

1. Historical Trends Analysis

Historical stock performance provides the foundation for future predictions. We analyzed:

- 3-Year Price Movements: Examining the period from 2022-2025

- Volatility Patterns: Understanding price fluctuations and standard deviations

- Seasonal Trends: Identifying quarterly and monthly patterns

- Volume Analysis: Assessing trading activity and liquidity

The historical data shows that SVT experienced significant volatility, with annual changes ranging from -16.72% to +18.93% before the acquisition.

2. Market Conditions and Economic Indicators

Broader market conditions significantly influence individual stock prices:

- Aerospace Industry Growth: The global aerospace market is projected to grow from $328 billion to $430.9 billion by 2025, representing a 7% CAGR

- Defense Spending: The U.S. defense budget includes $156.2 billion in new funding for national security through 2029

- Interest Rates: Federal Reserve policy affects borrowing costs and investment decisions

- Inflation Trends: Price pressures impact operational costs and consumer spending

3. Industry-Specific Growth Drivers

The servo control and aerospace components sectors show promising growth:

- Servo Motors Market: Expected to grow from $769.5 million (2022) to $1,088.34 million (2028), at a 5.95% CAGR

- Aerospace Materials Market: Projected to reach $62.3 billion by 2030, growing at 8.4% CAGR

- Position Servo System Market: Anticipated to expand from $1,270.7 million (2025) to $2,109.7 million (2035) at 5.2% CAGR

4. Company Financial Performance

Servotronics’ operational metrics directly impact stock valuation:

- Revenue Growth: 12% increase in Q1 2025 compared to Q1 2024

- Margin Expansion: Gross profit margin improved to 20.2% in Q1 2025

- Operating Efficiency: Operating income turned positive at $0.2 million in Q1 2025

- Strategic Initiatives: Pricing improvements expected to enhance margins through 2026

5. Investor Behavior and Sentiment

Market psychology plays a crucial role in stock price movements:

- Technical Indicators: Moving averages, RSI, MACD signals

- Trading Volume: Increased activity signals higher interest

- Analyst Ratings: Professional recommendations influence investor decisions

- News and Events: Announcements affect short-term price movements

Limitation and Risk Factors

It’s important to acknowledge the limitations of stock price predictions:

Market Unpredictability: Stock markets are inherently unpredictable, and unexpected events can dramatically alter trajectories. The TransDigm acquisition is a perfect example—no prediction model would have accurately forecasted a 300%+ increase in 2025.

External Shocks: Global events (pandemics, geopolitical conflicts, economic crises) can render predictions obsolete overnight.

Company-Specific Risks: Management changes, operational failures, legal issues, or competitive pressures can significantly impact performance.

Model Assumptions: All predictions rely on assumptions that may not materialize as expected, including sustained industry growth, stable regulatory environments, and consistent execution.

Acquisition Impact: In the case of SVT, the July 2025 acquisition by TransDigm fundamentally changed the investment landscape, making all pre-acquisition predictions irrelevant.

Alternative Prediction Models

Professional analysts use various sophisticated methods:

- Discounted Cash Flow (DCF): Values a company based on projected future cash flows

- Comparable Company Analysis: Benchmarks against similar publicly traded companies

- Technical Analysis: Uses chart patterns and trading indicators

- Monte Carlo Simulations: Runs thousands of scenarios to estimate probability distributions

- Machine Learning Models: Employs AI algorithms to identify complex patterns

About Our Blog: Your Trusted Source for Stock Market Insights

At our blog, we are dedicated too providing comprehensive, research-driven stock price predictions and market analysis for investors across the United States. Our platform specializes in USA stock price predictions, helping both novice and experienced investors make informed decisions about their portfolios.

We cover a wide range of publicly traded companies, from large-cap blue chips to small-cap growth stocks, with detailed monthly and annual forecasts extending up to five years into the future. Our analysis combines technical indicators, fundamental analysis, industry research, and expert insights to deliver actionable investment information.

Whether you’re researching serv stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 or exploring other investment opportunities, our blog provides the data-driven analysis you need. We regularly update our content to reflect the latest market developments, earnings reports, and economic indicators.

Visit our

category page to explore predictions for hundreds of other American stocks, including technology leaders, healthcare innovators, financial services companies, and industrial manufacturers. Our mission is to democratize access to professional-quality stock market research, empowering individual investors to compete on a more level playing field with institutional traders.

Stay informed, invest wisely, and achieve your financial goals with our comprehensive stock market coverage.

References and Data Sources

Our analysis and predictions are based on credible sources and comprehensive research. Below are the key references used in preparing this article:

- Servotronics Inc. Company Profile – Stock Analysis (stockanalysis.com)

- Servotronics Founder Information – Official Company Website (servotronics.com)

- Servotronics 2016 Annual Report – NYSE American (annualreports.com)

- Servotronics Q1 2025 Financial Results – NASDAQ News (nasdaq.com)

- TransDigm Acquisition Announcement – PR Newswire (prnewswire.com)

- Aerospace Market Growth Forecast – RedLine Group (redlinegroup.com)

- Servo Motors Market Analysis – IndMall (indmall.in)

- Aerospace Materials Market Report – Markets and Markets (marketsandmarkets.com)

- Defense Stocks Outlook 2025 – Quartz (qz.com)

- SVT Stock Price History – Investing.com (investing.com)

- Servotronics Business Model Analysis – DCF Modeling (dcfmodeling.com)

- Technical Analysis – TradingView (tradingview.com)

Frequently Asked Questions (FAQs)

Q1: What is the serv stock price prediction for 2025-2030?

The serv stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 is no longer applicable in traditional terms because Servotronics (SVT) was acquired by TransDigm Group and delisted from public trading on July 1, 2025. The acquisition price was $47.00 per share in cash. Had the company remained independent, hypothetical projections suggested gradual growth from approximately $14.50 (end of 2025) to $32.50 (end of 2030), representing a compound annual growth rate of around 15-20% based on aerospace industry trends and company-specific improvements.

Q2: Is SVT stock a good investment right now?

As of July 2025, SVT stock is no longer available for public investment because the company was acquired by TransDigm Group for $47.00 per share and subsequently delisted from the NYSE American exchange. All shareholders received the cash consideration, and no shares currently trade on any public market. Investors interested in the aerospace servo control sector might consider other publicly traded companies in similar industries or TransDigm Group (NYSE: TDG) itself.

Q3: What factors should I consider when evaluating serv stock price predictions?

When evaluating stock price predictions for any company (including historical analysis of SVT), consider: (1) Historical Performance – analyze 3-5 year price trends and volatility patterns; (2) Industry Growth – assess the broader aerospace and defense market outlook; (3) Company Financials – examine revenue growth, profit margins, and cash flow; (4) Competitive Position – understand the company’s market share and competitive advantages; (5) External Factors – account for economic conditions, regulatory changes, and geopolitical events; (6) Acquisition Potential – recognize that buyout offers can dramatically alter investment outcomes, as happened with SVT. Always remember that predictions are hypothetical and actual results may vary significantly.

Disclaimer

Important Investment Notice: The information provided in this article, including all serv stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 projections, is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell securities.

Stock price predictions are inherently speculative and based on historical data, industry trends, and analytical models that may not accurately reflect future performance. Past performance is not indicative of future results. The stock market involves substantial risk of loss, and investors should be prepared for volatility and potential losses.

Critical Update: Servotronics, Inc. (SVT) was acquired by TransDigm Group Incorporated and delisted from public trading effective July 1, 2025. The stock is no longer available for purchase or trading on any public exchange. All predictions presented in this article are hypothetical scenarios for educational purposes only.

Before making any investment decisions, please consult with qualified financial advisors, conduct your own research, and carefully consider your financial situation, investment objectives, risk tolerance, and time horizon. The author and publisher of this content assume no responsibility for any financial losses or damages resulting from reliance on the information provided herein.

Investing in stocks carries risk, including the possible loss of principal. Always invest responsibly and within your means.