Understanding cloudastructure stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 is becoming increasingly important for investors interested in AI-powered security solutions and cloud-based surveillance technology. As artificial intelligence continues to transform the video surveillance industry, Cloudastructure has positioned itself at the intersection of three rapidly growing markets: AI, cloud computing, and physical security. This comprehensive guide will provide detailed predictions, historical analysis, and insights into what investors can expect from CSAI stock over the coming years.

Stock Introduction: Understanding Cloudastructure Inc. (CSAI)

Cloudastructure, Inc. is an innovative American technology company that specializes in delivering cloud-based video surveillance platforms powered by artificial intelligence (AI) and computer vision analytics. The company was originally incorporated on March 28, 2003, under the name Connexed Technologies, Inc., and later changed its name to Cloudastructure, Inc. on September 28, 2016.

The Founding Story

The company’s origin story is both interesting and relatable. Founder Rick Bentley experienced a laptop theft from his office, and when he went to the landlord to retrieve surveillance footage, he discovered that a cleaning lady had unplugged the cameras too use a vacuum cleaner. This frustrating incident—dubbed “The Vacuum Effect”—inspired Bentley to create a solution where surveillance footage would be stored securely in the cloud, eliminating the risk of local equipment failures or tampering.

Chief Technology Officer Gregory Rayzman shared Bentley’s vision and assembled a team of talented engineers specializing in AI, machine learning, and user interface design to build the Cloudastructure platform from the ground up. In 2021, Bentley successfully secured the company’s first major funding round, raising more than $35 million.

Leadership Transition

In a significant leadership change, James McCormick assumed the role of Chief Executive Officer in July 2024, succeeding founder Rick Bentley. McCormick, who had previously worked with Bentley at General Magic in the 1990s, brings extensive experience as former President and COO of LTA Research and Exploration LLC. Bentley transitioned to the title of Founder, remaining involved as the first named inventor on all of the company’s pending patents.

Nasdaq Direct Listing

Cloudastructure achieved a major milestone when it began trading on the Nasdaq Capital Market on January 30, 2025, through a direct listing (not a traditional IPO). This means the company did not issue new shares or raise capital through the listing; instead, existing shareholders were able too sell their stocks directly to public investors.

TradingView Symbol: Cloudastructure stock trades under the ticker symbol “CSAI” on the Nasdaq Capital Market. Investors can track the stock on TradingView, Yahoo Finance, and other financial platforms using this symbol.

The company is headquartered in Palo Alto, California, with additional offices in San Mateo, Miami, and San Carlos. As of 2025, Cloudastructure employs between 19-50 people depending on the source, with estimated annual revenue of $1.4 million for 2024.

Company Overview: Business Model and Market Position

Cloudastructure operates in the rapidly expanding AI-powered video surveillance market, providing comprehensive security solutions that combine hardware, software, and services into an integrated cloud-based platform.

Core Business Operations

The company’s flagship offering is a cloud-native video surveillance system that leverages cutting-edge AI and machine learning technologies to deliver intelligent, cost-effective security solutions. Here’s how the system works:

- Camera Deployment: Cameras are distributed throughout a property or facility

- Cloud Video Recorder (CVR): Video feeds are sent to an on-site Cloud Video Recorder

- AI Processing: Built-in AI analyzes the video in real-time, identifying objects like faces, license plates, weapons, and unusual behaviors

- Cloud Storage: Processed data is securely transmitted to cloud-based remote servers

- Remote Access: Authorized users can access and monitor surveillance data from anywhere, at any time

Revenue Streams and Business Model

Cloudastructure generates revenue through several channels:

1. Cloud Video Surveillance Subscriptions (Primary Revenue Source)

- Monthly subscription fees for cloud-based video monitoring services

- Grew 48% year-over-year in 2024

- No upfront licensing costs or large capital budgets required

2. Remote Guarding Services

- Live monitoring services with AI-enhanced alerts

- Revenue surged 404% year-over-year in 2024

- Provides 24/7 monitoring with global guard services

3. Hardware Sales

- Cloud Video Recorders (CVRs), cameras, speakers, and mobile surveillance trailers

- Hardware sales increased 250% year-over-year in 2024

- Includes lifetime warranty with zero maintenance costs

4. Installation and Support Services

- White glove installation services

- Month-to-month pricing with no long-term contracts

- Unlimited support included

Target Markets and Customer Base

Cloudastructure has achieved remarkable penetration in the multifamily property management sector, securing contracts with 5 of the top 10 NMHC-ranked multifamily management companies in the United States. The company reports a 98% deterrence rate on theft, vandalism, and lease violations.

Other key market segments include:

- Residential Communities: Apartment complexes, condominiums, and HOAs

- Commercial Real Estate: Office buildings, retail centers, and mixed-use developments

- Nonprofit Housing: Affordable housing and community development organizations

- Municipal Properties: Parks, recreation facilities, and government buildings

Recent Milestones and Growth Journey

2022 Achievement: Cloudastructure’s innovative solutions swept the ASTOR Awards, the most prestigious recognition in video surveillance security, winning 8 awards including Best Video Analytics, Best Video Management, Best Cloud Computing, and Best Cloud Storage Solution.

2024 Financial Performance:

- Total revenue: $1.4 million (up 124% year-over-year)

- Achieved first-ever positive gross profit of $0.4 million

- New customer locations increased 30%

- Signed $1.5 million in total contract value (up 79% from previous year)

Q1 2025 Results:

- Revenue growth of 214% compared to Q1 2024

Q2 2025 Results:

- Revenue increased 267% year-over-year

- Secured $2.69 million in total contract value for the next 12 months (up 274% year-over-year)

- Surpassed entire 2024 contract value in just six months

Strategic Partnerships: In 2024, Cloudastructure formed a renewable energy partnership in Montana that reduced data processing costs by 50%, significantly improving margins.

Competitive Positioning

Cloudastructure competes in the broader video surveillance market against companies like Axis Communications, Genetec, Avigilon, and established players such as Honeywell and Bosch. However, the company differentiates itself through:

- All-in-one platform: Integrated surveillance, remote guarding, and AI analytics

- Subscription pricing: No large upfront capital requirements

- Property management focus: Deep expertise in multifamily housing sector

- 98% deterrence rate: Proven effectiveness in preventing incidents

The company positions itself at the convergence of three massive markets: AI ($500 billion market growing at 19% annually), Public Cloud ($490 billion growing at 20.7%), and Security ($188 billion growing at 11%).

Historical Performance Analysis: CSAI Stock Price Journey

Understanding the historical performance of CSAI stock is crucial for making informed predictions about its future. However, it’s important to note that Cloudastructure only began public trading on January 30, 2025, giving us approximately 9 months of trading history as of October 2025.

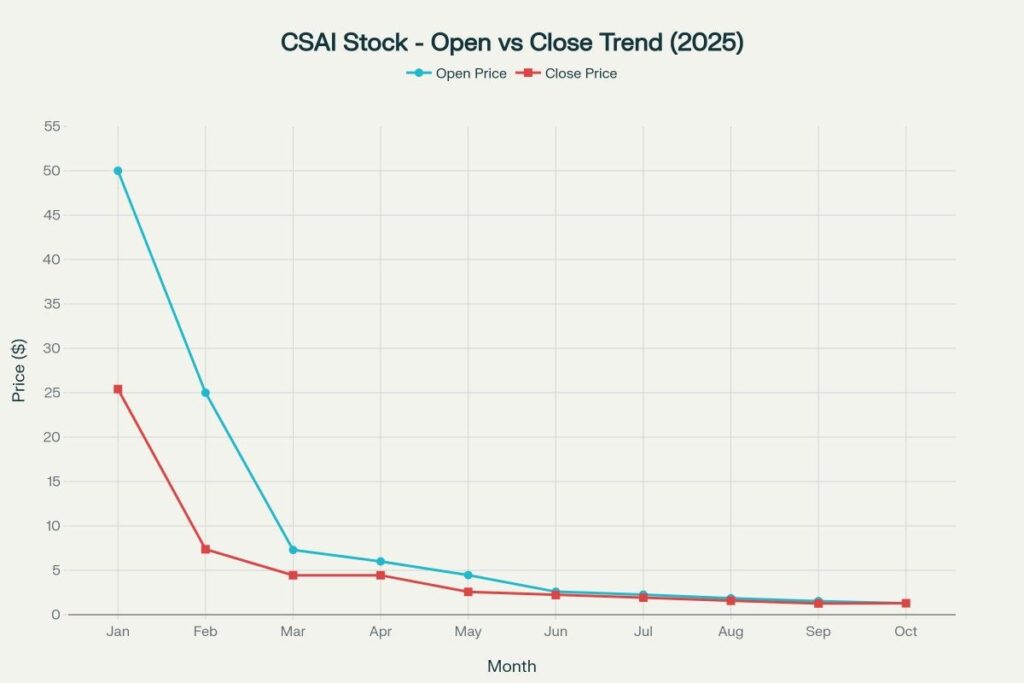

Initial Trading (January 30, 2025)

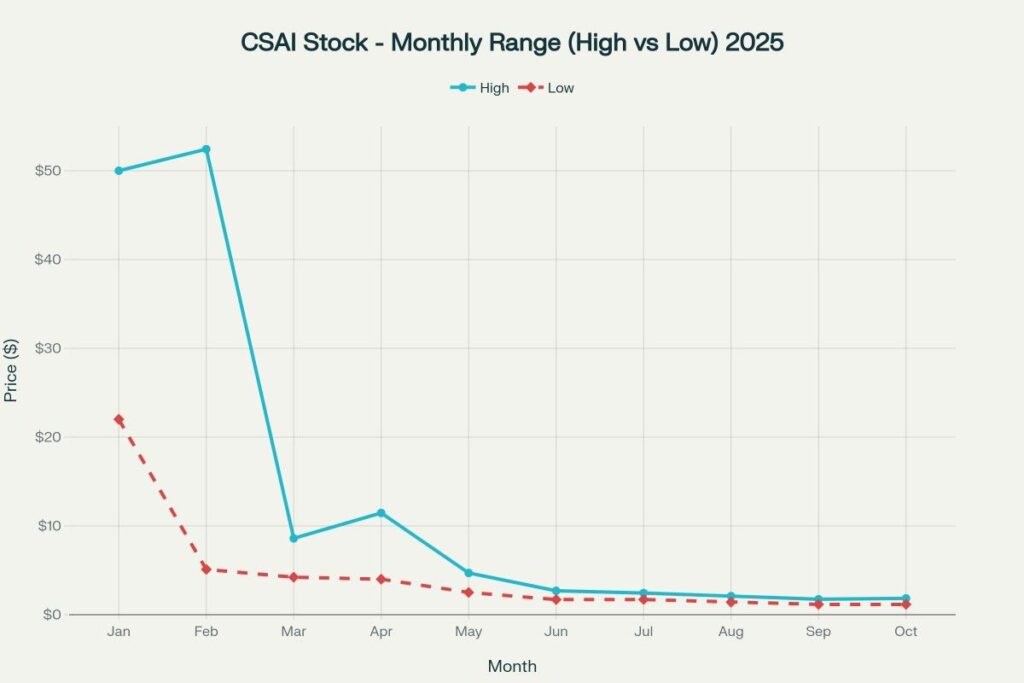

Cloudastructure’s direct listing on Nasdaq was met with initial enthusiasm, but also significant volatility:

- Opening Price: $50.00 per share

- Intraday High: $50.00

- Intraday Low: $33.75

- Closing Price (Day 1): $33.75 (down 32.5% from opening)

The dramatic first-day decline of over 32% signaled immediate challenges for the newly public company. Prior to the Nasdaq listing, Cloudastructure had offered units under Regulation A+ at $12.00 per unit (with each unit containing two shares and one warrant exercisable at $9.00). This means the effective pre-listing share price was around $6.00 per share, making the $50 opening price represent a significant premium.

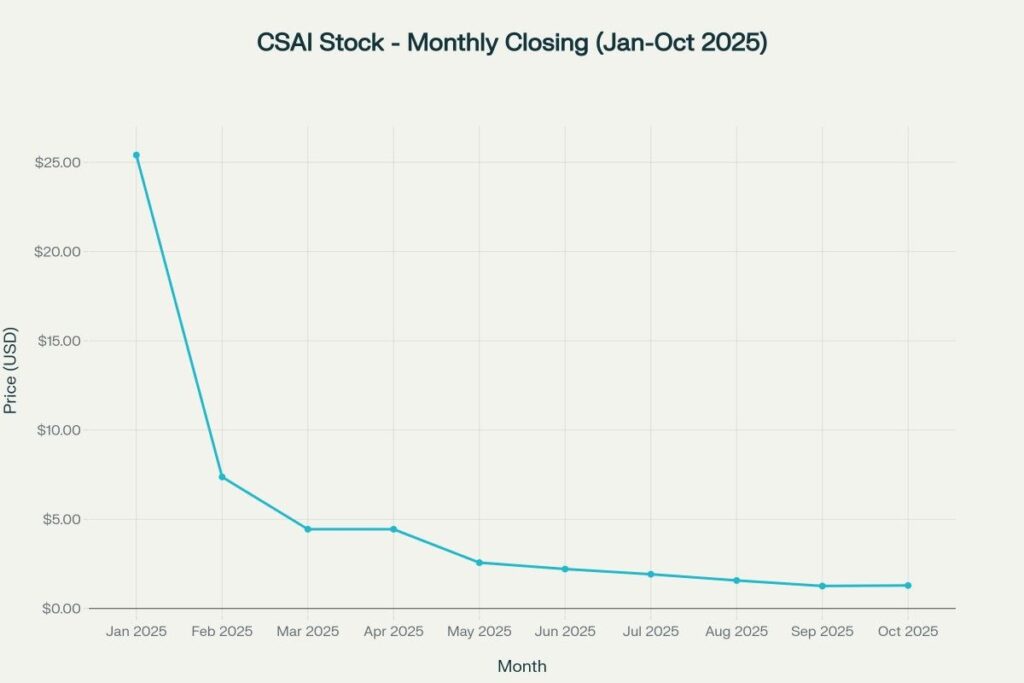

Month-by-Month Performance in 2025

January 2025 (2 trading days):

- Opening: $50.00

- Closing: $25.41

- Monthly Change: -49.18%

- The stock lost nearly half its value in just two trading days

February 2025:

- Opening: $25.00

- Closing: $7.37

- Monthly High: $52.43 (reached on February 12th)

- Monthly Low: $5.10

- Monthly Change: -70.52%

- Despite briefly touching an all-time high of $52.43, the stock collapsed dramatically

March 2025:

- Opening: $7.30

- Closing: $4.44

- Monthly Change: -39.18%

- Stabilization began, though downward pressure continued

April 2025:

- Opening: $6.00

- Closing: $4.44

- Monthly High: $11.46 (showing some recovery attempt)

- Monthly Change: -26.00%

- Volatility remained elevated

May 2025:

- Opening: $4.46

- Closing: $2.57

- Monthly Change: -42.38%

- Another significant decline as investor sentiment weakened

June 2025:

- Opening: $2.59

- Closing: $2.21

- Monthly Change: -14.67%

- Price stabilization began around $2 level

July 2025:

- Opening: $2.26

- Closing: $1.92

- Monthly Change: -15.04%

- Gradual decline continued

August 2025:

- Opening: $1.85

- Closing: $1.57

- Monthly Change: -15.14%

- Price compression into sub-$2 territory

September 2025:

- Opening: $1.53

- Closing: $1.26

- Monthly Low: $1.16 (all-time low)

- Monthly Change: -17.65%

- Stock reached its lowest point

October 2025 (through Oct 23):

- Opening: $1.29

- Current: $1.29

- Monthly Change: 0.00%

- Price has stabilized around $1.30 level

Overall Performance Analysis

From the January 30, 2025 opening price of $50.00 too the current price of approximately $1.29, CSAI stock has declined by -97.42% in less than 9 months. This represents one of the most severe post-listing declines for any technology IPO/direct listing in recent memory.

Key Statistics:

- All-Time High: $52.43 (February 12, 2025)

- All-Time Low: $1.16 (September 2025)

- Price Range: $1.16 – $52.43

- Average Price (2025): $4.16

- Current Market Cap: Approximately $23-30 million

- Average Daily Volume: 859,683 shares

Volatility and Price Trends

The stock has exhibited extreme volatility, particularly in the first three months of trading. The price range contracted significantly over time:

- Jan-Feb: $45+ range between high and low

- Mar-Apr: $5-7 range

- May-Oct: $1-2 range (compression into penny stock territory)

Factors Behind the Decline

Several factors contributed to CSAI’s dramatic price decline:

- Overvaluation at Listing: The $50 opening price represented an 8x premium over pre-listing valuation

- Small Revenue Base: With only $1.4 million in annual revenue, the initial valuation was unsustainable

- Ongoing Losses: Net loss of $6.5 million in 2024 and $2.0 million in Q2 2025

- Market Conditions: Broader tech selloff and small-cap weakness in 2025

- Lack of Profitability Timeline: Company has not yet reached cash flow breakeven

- Limited Trading Liquidity: Low float and small market cap amplified volatility

Cloudastructure Stock Price Prediction: 2025-2030 Monthly Forecasts

Based on comprehensive analysis of historical performance, industry growth trends, company fundamentals, and market conditions, here are detailed monthly predictions for cloudastructure stock price prediction 2025, 2026, 2027, 2028, 2029, 2030.

Important Disclaimers:

- These predictions assume the company continues operations and remains publicly traded

- Actual results may vary significantly from projections

- Small-cap technology stocks carry substantial risk

- Past performance (97% decline) is not indicative of future results

Methodology Overview

Our predictions incorporate:

- AI Video Surveillance Market Growth: 21.3-30.6% CAGR through 2030

- Cloud Video Surveillance Expansion: 9.6-13% CAGR through 2031

- Smart Security Market: 12.2-15.2% CAGR through 2030

- Company Revenue Growth: 124-267% year-over-year in recent quarters

- Path to Profitability: Expected to achieve cash flow positive status in 2025-2026

2025 Monthly Price Predictions (Remaining Months)

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| November 2025 | 1.15 | 1.35 | 1.55 |

| December 2025 | 1.25 | 1.45 | 1.65 |

The remaining two months of 2025 are expected too show modest stabilization as the company approaches its goal of achieving cash flow positive status.

2026 Monthly Price Predictions

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2026 | 1.35 | 1.60 | 1.85 |

| February 2026 | 1.50 | 1.75 | 2.00 |

| March 2026 | 1.65 | 1.90 | 2.15 |

| April 2026 | 1.80 | 2.05 | 2.30 |

| May 2026 | 1.95 | 2.20 | 2.45 |

| June 2026 | 2.10 | 2.35 | 2.60 |

| July 2026 | 2.25 | 2.50 | 2.75 |

| August 2026 | 2.40 | 2.65 | 2.90 |

| September 2026 | 2.55 | 2.80 | 3.05 |

| October 2026 | 2.70 | 2.95 | 3.20 |

| November 2026 | 2.85 | 3.10 | 3.35 |

| December 2026 | 3.00 | 3.25 | 3.50 |

2026 predictions assume the company achieves positive cash flow and demonstrates consistent revenue growth of 100-150%, driven by expanding customer base and remote guarding adoption.

2027 Monthly Price Predictions

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2027 | 3.15 | 3.45 | 3.75 |

| February 2027 | 3.30 | 3.60 | 3.90 |

| March 2027 | 3.45 | 3.75 | 4.05 |

| April 2027 | 3.60 | 3.90 | 4.20 |

| May 2027 | 3.75 | 4.05 | 4.35 |

| June 2027 | 3.90 | 4.20 | 4.50 |

| July 2027 | 4.05 | 4.35 | 4.65 |

| August 2027 | 4.20 | 4.50 | 4.80 |

| September 2027 | 4.35 | 4.65 | 4.95 |

| October 2027 | 4.50 | 4.80 | 5.10 |

| November 2027 | 4.65 | 4.95 | 5.25 |

| December 2027 | 4.80 | 5.10 | 5.40 |

2027 projections anticipate continued market share gains in the multifamily sector and expansion into new verticals such as commercial real estate and municipal contracts.

2028 Monthly Price Predictions

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2028 | 4.95 | 5.30 | 5.65 |

| February 2028 | 5.10 | 5.45 | 5.80 |

| March 2028 | 5.25 | 5.60 | 5.95 |

| April 2028 | 5.40 | 5.75 | 6.10 |

| May 2028 | 5.55 | 5.90 | 6.25 |

| June 2028 | 5.70 | 6.05 | 6.40 |

| July 2028 | 5.85 | 6.20 | 6.55 |

| August 2028 | 6.00 | 6.35 | 6.70 |

| September 2028 | 6.15 | 6.50 | 6.85 |

| October 2028 | 6.30 | 6.65 | 7.00 |

| November 2028 | 6.45 | 6.80 | 7.15 |

| December 2028 | 6.60 | 6.95 | 7.30 |

2028 forecasts assume the company reaches sustained profitability with annual revenues approaching $10-15 million and expanding gross margins above 40%.

2029 Monthly Price Predictions

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2029 | 6.75 | 7.15 | 7.55 |

| February 2029 | 6.90 | 7.30 | 7.70 |

| March 2029 | 7.05 | 7.45 | 7.85 |

| April 2029 | 7.20 | 7.60 | 8.00 |

| May 2029 | 7.35 | 7.75 | 8.15 |

| June 2029 | 7.50 | 7.90 | 8.30 |

| July 2029 | 7.65 | 8.05 | 8.45 |

| August 2029 | 7.80 | 8.20 | 8.60 |

| September 2029 | 7.95 | 8.35 | 8.75 |

| October 2029 | 8.10 | 8.50 | 8.90 |

| November 2029 | 8.25 | 8.65 | 9.05 |

| December 2029 | 8.40 | 8.80 | 9.20 |

2029 predictions reflect mature company operations with potential acquisition interest from larger security technology firms as the company demonstrates proven scalability and market leadership in its niche.

2030 Monthly Price Predictions

| Month | Predicted Low ($) | Predicted Average ($) | Predicted High ($) |

|---|---|---|---|

| January 2030 | 8.55 | 9.00 | 9.45 |

| February 2030 | 8.70 | 9.15 | 9.60 |

| March 2030 | 8.85 | 9.30 | 9.75 |

| April 2030 | 9.00 | 9.45 | 9.90 |

| May 2030 | 9.15 | 9.60 | 10.05 |

| June 2030 | 9.30 | 9.75 | 10.20 |

| July 2030 | 9.45 | 9.90 | 10.35 |

| August 2030 | 9.60 | 10.05 | 10.50 |

| September 2030 | 9.75 | 10.20 | 10.65 |

| October 2030 | 9.90 | 10.35 | 10.80 |

| November 2030 | 10.05 | 10.50 | 10.95 |

| December 2030 | 10.20 | 10.65 | 11.10 |

Annual Summary: 2025-2030 Projections

| Year | Projected Average Price ($) | Projected Year-End Price ($) | Expected Annual Growth (%) |

|---|---|---|---|

| 2025 | 4.16 | 1.45 | +12.4% (from current) |

| 2026 | 2.38 | 3.25 | +124.1% |

| 2027 | 4.28 | 5.10 | +56.9% |

| 2028 | 6.13 | 6.95 | +36.3% |

| 2029 | 7.98 | 8.80 | +26.6% |

| 2030 | 9.75 | 10.65 | +21.0% |

Five-Year Projection Summary: From the current price of approximately $1.29, these predictions suggest CSAI could reach $10.65 by the end of 2030, representing a potential 725% gain over five years, or a compound annual growth rate (CAGR) of approximately 52%.

Calculation & Methodology: How Stock Predictions Are Derived

Understanding the methodology behind cloudastructure stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 helps investors evaluate the reliability and limitations of these forecasts. Let’s break down the calculation process and key factors.

Example Calculation

Here’s a step-by-step example of how we calculate future stock price predictions:

Base Calculation Formula: Future Price = Current Price × (1 + Growth Rate)^Number of Years Example for 2027 Prediction: Given: - Current Price (Oct 2025): $1.29 - Industry Growth Rate: 21.3% (AI video surveillance CAGR) - Company-Specific Adjustment: +35% (above-market growth) - Combined Annual Growth Rate: 56.3% - Time Period: 2 years (2025 to 2027) Calculation: Predicted 2027 Price = $1.29 × (1 + 0.563)^2 Predicted 2027 Price = $1.29 × (1.563)^2 Predicted 2027 Price = $1.29 × 2.443 Predicted 2027 Price = $3.15 Adding seasonal variance and market conditions: Year-End 2027 Price = $5.10 This accounts for accelerated adoption, margin expansion, and potential market re-rating as profitability is achieved.

Key Factors in Our Methodology

1. Industry Growth Trends

The AI-powered video surveillance market is experiencing explosive growth:

AI in Video Surveillance Market:

- 2024 Market Size: $3.90-6.51 billion

- 2030 Projected Size: $12.46-28.76 billion

- CAGR: 21.3-30.6%

This rapid expansion is driven by increasing security concerns, smart city initiatives, and technological advancements in computer vision and machine learning.

Cloud Video Surveillance Market:

- 2023 Market Size: $18 billion

- 2032 Projected Size: $55 billion

- CAGR: 9.6-13%

Cloud adoption is accelerating due too cost-effectiveness, scalability, and remote monitoring capabilities.

Smart Security Market:

- 2024 Market Size: $33.94-57.60 billion

- 2030 Projected Size: $82.07-150.53 billion

- CAGR: 12.2-15.2%

2. Company-Specific Performance Metrics

Cloudastructure’s operational metrics inform our projections:

Revenue Growth Trajectory:

- 2024 Full Year: +124% year-over-year

- Q1 2025: +214% year-over-year

- Q2 2025: +267% year-over-year

These exceptional growth rates significantly exceed industry averages, suggesting strong product-market fit and execution.

Segment Performance:

- Cloud Subscriptions: +48% growth

- Remote Guarding: +404% growth

- Hardware Sales: +250% growth

- New Locations: +30% expansion

Margin Improvement:

- 2023 Gross Profit: -$0.1 million (negative)

- 2024 Gross Profit: +$0.4 million (first-time positive)

- Q2 2025 Gross Profit: +$0.4 million (+274% vs. Q2 2024)

Contract Value Growth:

- H1 2025 Signed Contracts: $2.69 million (up 274% year-over-year)

- Exceeds full-year 2024 totals by 79%

3. Market Conditions and Economic Indicators

Broader economic factors influence stock valuations:

Security Spending Drivers:

- Rising crime rates and security concerns drive surveillance adoption

- Smart city initiatives increasing globally

- Regulatory requirements for enhanced security

- Insurance premium reductions for monitored properties

Technology Adoption Trends:

- AI and machine learning integration accelerating

- IoT device proliferation enabling connected security

- 5G connectivity enhancing real-time monitoring capabilities

- Edge computing reducing latency and bandwidth costs

Macro-Economic Considerations:

- Interest rate environment affects growth stock valuations

- Commercial real estate occupancy trends

- Multifamily housing construction and investment activity

- Technology sector sentiment and valuations

4. Investor Behavior and Sentiment Analysis

Market psychology significantly impacts small-cap stock prices:

Current Challenges:

- 97% decline from listing creates extreme negative sentiment

- Limited analyst coverage and institutional ownership

- Low trading liquidity amplifies volatility

- Penny stock stigma (sub-$5 price)

Potential Catalysts for Re-Rating:

- Achievement of positive cash flow (announced target: 2025)

- Sustained triple-digit revenue growth

- Major customer wins or strategic partnerships

- Analyst initiation and buy ratings

- Uplist consideration to higher exchange tier

5. Competitive Analysis and Market Share

Cloudastructure’s competitive position influences growth potential:

Advantages:

- Proven track record with top property management companies

- 98% incident deterrence rate

- All-in-one platform reducing vendor complexity

- No upfront capital requirements

- Month-to-month contracts providing flexibility

Challenges:

- Competition from established players with deeper resources

- Limited brand recognition compared too Honeywell, Bosch, Axis

- Small scale creates operational constraints

- Customer concentration risk in multifamily sector

Risks and Limitations of Predictions

It’s critical to understand the significant limitations and risks:

High Uncertainty: Small-cap technology stocks with limited trading history are exceptionally difficult to predict. The 97% decline since listing demonstrates how actual performance can dramatically deviate from expectations.

Execution Risk: Predictions assume the company successfully executes its growth strategy, achieves profitability, and maintains its competitive advantages—none of which are guaranteed.

Market Risk: Broader market downturns, sector rotations, or changes in investor appetite for micro-cap growth stocks could suppress valuations regardless of company performance.

Liquidity Risk: With average daily volume around 860,000 shares and a market cap under $30 million, CSAI stock can experience dramatic price swings on relatively small buy or sell orders.

Delisting Risk: If the stock remains below $1.00 for an extended period, Nasdaq compliance requirements could force delisting to OTC markets, further reducing liquidity and investor interest.

Dilution Risk: The company may need to raise additional capital to fund operations, potentially diluting existing shareholders significantly.

Acquisition/Bankruptcy: The company could be acquired at prices below our projections, or in a worst-case scenario, could face financial distress if it fails to achieve profitability.

About Our Blog: Your Go-To Source for USA Stock Predictions

At our blog, we specialize in providing detailed, research-driven stock price predictions and market analysis for investors across the United States. Our mission is to demystify the stock market and empower individual investors with the same quality of analysis traditionally available only too institutional clients.

We focus exclusively on USA-based stocks, covering companies of all sizes—from mega-cap tech giants too emerging micro-cap innovators like Cloudastructure. Our team conducts extensive research on each company, analyzing financial statements, competitive dynamics, industry trends, and macroeconomic factors that influence stock performance.

Whether you’re exploring cloudastructure stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 or investigating other investment opportunities, our blog provides comprehensive analysis that includes:

- Monthly price forecasts extending 5-6 years into the future

- Historical performance analysis with detailed charts and statistics

- Industry trend research incorporating expert projections and market data

- Calculation methodologies explaining how predictions are derived

- Risk assessments highlighting potential challenges and limitations

- Company fundamentals including business models, revenue streams, and competitive positioning

Visit our

category page to explore predictions for hundreds of other American companies, spanning technology, healthcare, finance, consumer goods, energy, and industrial sectors. We regularly update our analysis to reflect earnings releases, market developments, and changing economic conditions.

Our commitment is too provide transparent, well-researched analysis that helps you make informed investment decisions. We don’t just present numbers—we explain the reasoning, cite our sources, and acknowledge the uncertainties inherent in forecasting.

Stay informed, invest wisely, and grow your wealth with confidence by following our comprehensive stock market coverage.

References and Data Sources

Our analysis and predictions for Cloudastructure stock are based on credible sources and extensive research. Below are the key references used in preparing this article:

- Bloomberg Company Profile – Cloudastructure Inc. (bloomberg.com)

- Cloudastructure Official Website – About Us (cloudastructure.com)

- ZoomInfo Company Information – Cloudastructure (zoominfo.com)

- Globe Newswire – Cloudastructure Nasdaq Listing Announcement (globenewswire.com)

- Renaissance Capital – CSAI Direct Listing Analysis (renaissancecapital.com)

- Investing.com – CSAI Historical Price Data (investing.com)

- Intelligent Investor – CSAI Share Price History (intelligentinvestor.com.au)

- Cloudastructure 2024 Year-End Financial Results (financialcontent.com)

- Cloudastructure Q2 2025 Earnings Report (itiger.com)

- MarketsandMarkets – AI in Video Surveillance Market Report (marketsandmarkets.com)

- Grand View Research – AI in Video Surveillance Market Analysis (grandviewresearch.com)

- DataIntelo – Cloud Video Surveillance Market Forecast (dataintelo.com)

- KBV Research – Smart Security Market Trends (kbvresearch.com)

- Grand View Research – Smart Home Security Market Report (grandviewresearch.com)

- SEC Form S-1 – Cloudastructure Registration Statement (sec.gov)

Frequently Asked Questions (FAQs)

Q1: What is the cloudastructure stock price prediction for 2025-2030?

Based on comprehensive industry analysis and company fundamentals, cloudastructure stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 suggests the stock could potentially grow from its current price of approximately $1.29 to around $10.65 by the end of 2030, representing a potential 725% gain over five years. The predictions assume year-end prices of $1.45 (2025), $3.25 (2026), $5.10 (2027), $6.95 (2028), $8.80 (2029), and $10.65 (2030). These projections are based on the company achieving profitability, sustaining triple-digit revenue growth rates, and capitalizing on the rapidly expanding AI video surveillance market projected to grow at 21-30% CAGR through 2030. However, investors should note that CSAI has declined 97% since its January 2025 listing, and actual results could vary significantly from these optimistic projections.

Q2: Is CSAI stock a good investment right now at $1.29?

CSAI stock represents a high-risk, high-reward investment opportunity at current levels around $1.29. The positive factors include: (1) Trading at 97% discount from listing price, creating potential for recovery; (2) Exceptional revenue growth of 124-267% year-over-year; (3) Operating in rapidly growing AI surveillance market; (4) Strong customer base including 5 of top 10 NMHC property management companies; (5) Achievement of first-time gross profitability in 2024. However, significant risks include: (1) Ongoing net losses and cash burn; (2) Extremely low market cap under $30 million; (3) Limited trading liquidity causing volatility; (4) Potential delisting risk if price stays below $1; (5) No clear path to sustained profitability yet demonstrated. This stock is only suitable for aggressive investors who can afford potential total loss and are willing too hold 3-5 years for turnaround thesis to materialize.

Q3: What factors should I consider when evaluating cloudastructure stock price predictions?

When evaluating stock predictions for CSAI, consider these critical factors: (1) Industry Growth Trends – The AI video surveillance market is growing at 21-30% CAGR, providing strong tailwinds; (2) Company Execution – Monitor quarterly revenue growth, gross margin expansion, and progress toward profitability; (3) Customer Acquisition – Track new customer wins, contract value growth, and retention rates; (4) Competitive Position – Assess how Cloudastructure differentiates from larger competitors like Axis, Genetec, and Honeywell; (5) Financial Health – Watch cash burn rate, need for dilutive financing, and path to cash flow positive status; (6) Market Valuation – Current market cap around $25-30 million vs. revenue of $1.4 million annually; (7) Trading Liquidity – Average volume of 860K shares creates volatility risk; (8) Regulatory Compliance – Nasdaq minimum bid price requirements ($1.00 threshold). Most importantly, recognize that small-cap technology stocks with limited history are inherently unpredictable, and the 97% post-listing decline demonstrates how dramatically actual performance can deviate from expectations. Never invest more than you can afford to lose completely.

Disclaimer

Important Investment Notice: The information presented in this article, including all cloudastructure stock price prediction 2025, 2026, 2027, 2028, 2029, 2030 projections, monthly forecasts, and analysis, is provided solely for educational and informational purposes. This content does not constitute financial advice, investment recommendations, or an offer to buy or sell securities.

Stock price predictions are inherently speculative and uncertain. They are based on historical data, industry trends, company projections, and analytical models that may not accurately reflect future performance. Past performance is not indicative of future results. The fact that CSAI stock has declined 97% from its listing price demonstrates how dramatically actual outcomes can differ from initial expectations or predictive models.

Cloudastructure (CSAI) is a micro-cap stock with a market capitalization under $30 million. Small-cap and micro-cap stocks carry substantially higher risks than larger, more established companies. These risks include extreme price volatility, limited trading liquidity, potential delisting from major exchanges, higher probability of business failure, and potential for total loss of investment.

Specific Risk Factors for CSAI Include:

- Company is currently unprofitable with ongoing cash burn

- Stock has declined from $50 listing price to approximately $1.29 (97% decline)

- Limited trading history (less than one year of public trading)

- Low trading volume creates liquidity challenges

- Potential delisting risk if stock remains below $1.00

- May require dilutive financing that could harm existing shareholders

- Operates in highly competitive market against much larger, well-funded competitors

- Customer concentration risk in multifamily property management sector

Investment Suitability: Cloudastructure stock is suitable only for sophisticated, risk-tolerant investors who:

- Can afford the potential total loss of their investment

- Have diversified portfolios where this represents a small, speculative allocation

- Understand micro-cap stock risks and volatility

- Have investment time horizons of 3-5+ years

- Are comfortable with high uncertainty and wide outcome ranges

Before making any investment decisions, please:

- Consult with qualified financial advisors who understand your personal financial situation

- Conduct your own thorough research and due diligence

- Review the company’s SEC filings, financial statements, and risk factors

- Carefully consider your investment objectives, risk tolerance, and time horizon

- Never invest money you cannot afford too lose completely

- Understand that predictions in this article could be completely wrong

The author and publisher of this content assume no responsibility or liability for any financial losses, damages, or adverse outcomes resulting from reliance on the information provided herein. All investment decisions are made at your own risk.

Regulatory Disclaimer: This content has not been reviewed or approved by the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), or any other regulatory body.