The Discounted Cash Flow model is one of the most powerful tools investors use to determine what a stock is really worth. If you’ve ever wondered whether a company’s share price is justified or if your buying at a discount, the DCF method gives you the answer. By forecasting future cash flows and discounting them back to today’s value, you can figure out a stock’s true intrinsic value and make smarter investment choices.

What Is the DCF Model?

The DCF model estimates a company’s intrinsic value by calculating the present value of its expected future cash flows. The concept is rooted in the time value of money principle, which states that a dollar today is worth more than a dollar tomorrow because of its earning potential.

Unlike market-based valuations that rely on stock price fluctuations, the DCF focuses on a company’s ability to generate cash over time. This makes it particularly useful for long-term investors who want to look beyond short-term market noise and understand the fundamental value of a business.

Key Components You Need to Know

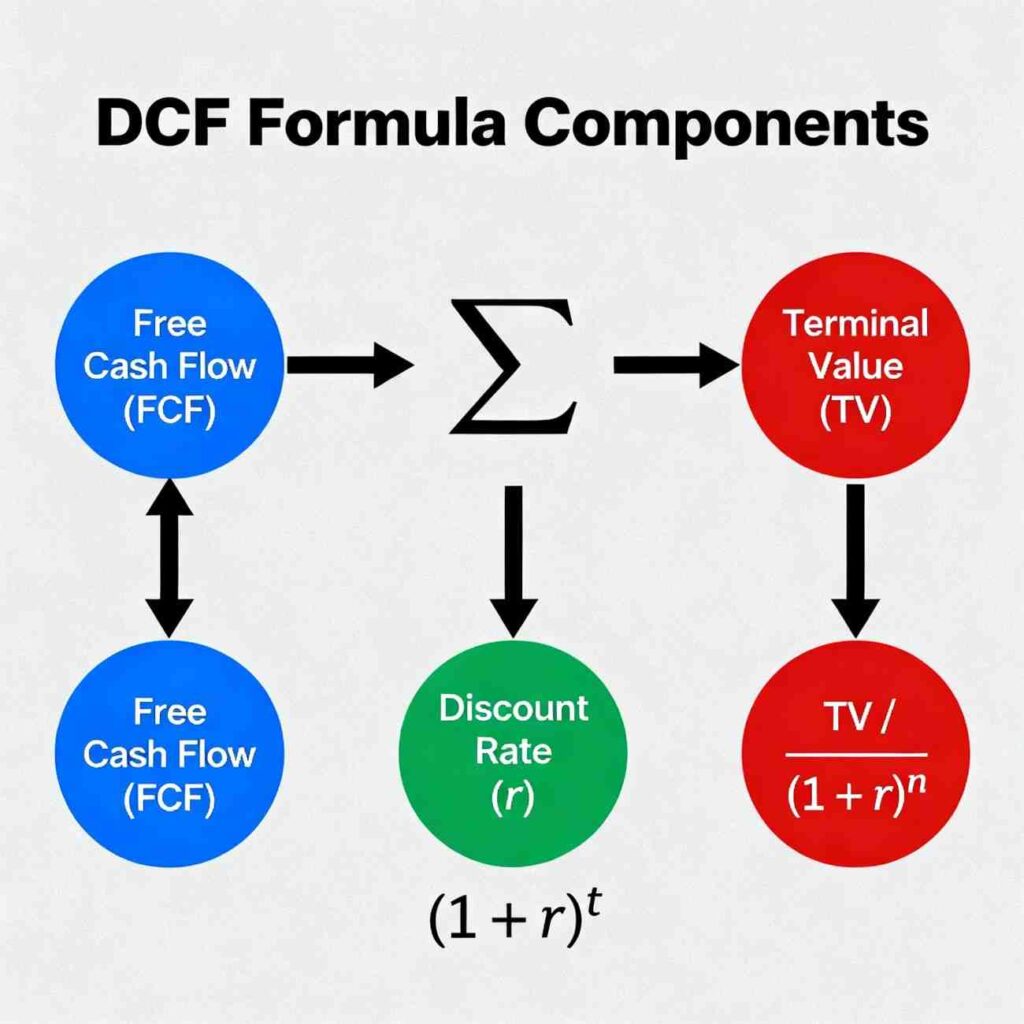

Before diving into the calculation, lets understand the main building blocks of a DCF analysis.

Free Cash Flow (FCF) represents the cash generated by a company’s operations after accounting for capital expenditures. It’s the money available to all investors—both debt and equity holders. The formula is:

FCF = Cash from Operations – Capital Expenditures

Alternatively, you can calculate it as:

FCF = EBIT × (1 – Tax Rate) + Non-Cash Expenses – Change in Working Capital – CAPEX

Discount Rate (WACC) is the weighted average cost of capital, which reflects the return investors expect from the company. The WACC formula is:

WACC = (E/V × Cost of Equity) + (D/V × Cost of Debt × (1 – Tax Rate))

Where E is market value of equity, D is market value of debt, and V is total value (E + D).

Terminal Value captures the value of all cash flows beyond your forecast period. Since you can’t forecast forever, terminal value typically accounts for about 75% of the total DCF valuation. There are two methods to calculate it:

- Growth in Perpetuity Approach: Terminal Value = (Final Year FCF × (1 + Growth Rate)) ÷ (Discount Rate – Growth Rate)

- Exit Multiple Approach: Terminal Value = Final Year EBITDA × Exit Multiple

📌 Step-by-Step DCF Calculation

Step 1: Project Future Free Cash Flows (FCF)

Estimate the company’s Free Cash Flow for the next 5–10 years.

Free Cash Flow (FCF) = Cash from Operations − Capital Expenditures

➡ Example:

You project FCF for the next 5 years:

- Year 1: $100M

- Year 2: $110M

- Year 3: $121M

- Year 4: $133M

- Year 5: $146M

(Here we used 10% annual growth)

Step 2: Determine Discount Rate (WACC)

The Weighted Average Cost of Capital (WACC) is used to discount future cash flows back to present value.

Let’s assume:

- WACC = 9%

Step 3: Calculate Terminal Value (TV)

Terminal value accounts for cash flows beyond year 5.

Formula: TV=FCFYear 5×(1+g)(WACC−g)TV = \frac{FCF_{Year\,5} \times (1 + g)}{(WACC – g)}TV=(WACC−g)FCFYear5×(1+g)

Assume perpetual growth rate:

- g=3%g = 3\%g=3%

TV=146M×1.030.09−0.03=150.38M0.06≈2,506MTV = \frac{146M \times 1.03}{0.09 – 0.03} = \frac{150.38M}{0.06} ≈ 2,506MTV=0.09−0.03146M×1.03=0.06150.38M≈2,506M

Step 4: Discount All Cash Flows to Present Value

Discount each FCF & Terminal Value using WACC: PV=FCF(1+WACC)nPV = \frac{FCF}{(1+WACC)^n}PV=(1+WACC)nFCF

| Year | Cash Flow | Discount Factor (9%) | Present Value |

|---|---|---|---|

| 1 | $100M | 0.917 | $91.7M |

| 2 | $110M | 0.842 | $92.6M |

| 3 | $121M | 0.772 | $93.4M |

| 4 | $133M | 0.708 | $94.1M |

| 5 | $146M | 0.650 | $94.9M |

| Terminal Value | $2,506M | 0.650 | $1,629M |

➡ Total Present Value = $2,105.7M

Step 5: Subtract Net Debt

Intrinsic Value = Total Firm Value − Net Debt

Assume:

- Net Debt = $300M

Intrinsic Value=2,105.7M−300M=1,805.7MIntrinsic\ Value = 2,105.7M – 300M = 1,805.7MIntrinsic Value=2,105.7M−300M=1,805.7M

Step 6: Calculate Intrinsic Value Per Share

Value Per Share=Intrinsic ValueShares OutstandingValue\ Per\ Share = \frac{Intrinsic\ Value}{Shares\ Outstanding}Value Per Share=Shares OutstandingIntrinsic Value

Assume:

- Shares = 100M

Value\ Per\ Share = \frac{1,805.7M}{100M} = **$18.06 per share**

✅ Final Interpretation

| Market Price | Intrinsic Value | Result |

|---|---|---|

| $14 | $18.06 | ✅ Stock is Undervalued |

| $22 | $18.06 | ❌ Stock is Overvalued |

📌 Key Inputs That Impact DCF the Most

- Growth rate (FCF projections)

- Discount rate (WACC)

- Terminal value assumptions

- Net debt

- Number of shares outstanding

Even small changes can shift valuation significantly — always test multiple scenarios.

Practical Example

Let’s say you’re valuing a company with projected FCF of $10 million next year, growing at 5% annually for five years, then 3% thereafter. With a WACC of 8%, you would:

- Discount years 1-5 cash flows to present value (totaling approximately $46 million)

- Calculate terminal value using perpetuity growth method (approximately $263 million)

- Discount terminal value to present (approximately $179 million)

- Add them together for enterprise value ($225 million)

- Subtract net debt and divide by shares to get per-share intrinsic value

If this intrinsic value is higher than the current market price, the stock might be undervalued and could represent a buying opportunity.

Advantages and Limitations

The DCF model offers several benefits—it’s based on fundamental cash generation ability rather than market sentiment, and it forces you to understand the business deeply. However, it also has limitations. Small changes in assumptions (especially terminal value and discount rate) can dramatically impact results. The model is also highly sensitive to growth rate assumptions and works best for mature companies with predictable cash flows.

Final Thoughts

Mastering the DCF model takes practice, but it’s an essential skill for serious investors who want to understand what they’re really paying for. While no valuation method is perfect, combining DCF analysis with other approaches gives you a well-rounded view of a stock’s true worth. Remember that your assumptions matter more than the formula itself, so always stress-test different scenarios to see how sensitive your valuation is to changes in key inputs.

By understanding how to calculate intrinsic value using the DCF method, you’re equipped to make more informed investment decisions based on a company’s fundamental ability to generate cash for shareholders.