Laser Photonics (LASE) has shown intense volatility and a challenging financial story in recent years. Below is a data-driven breakdown of the company’s growth, recent setbacks, and the quantitative reasoning behind a 2025–2026 price forecast.

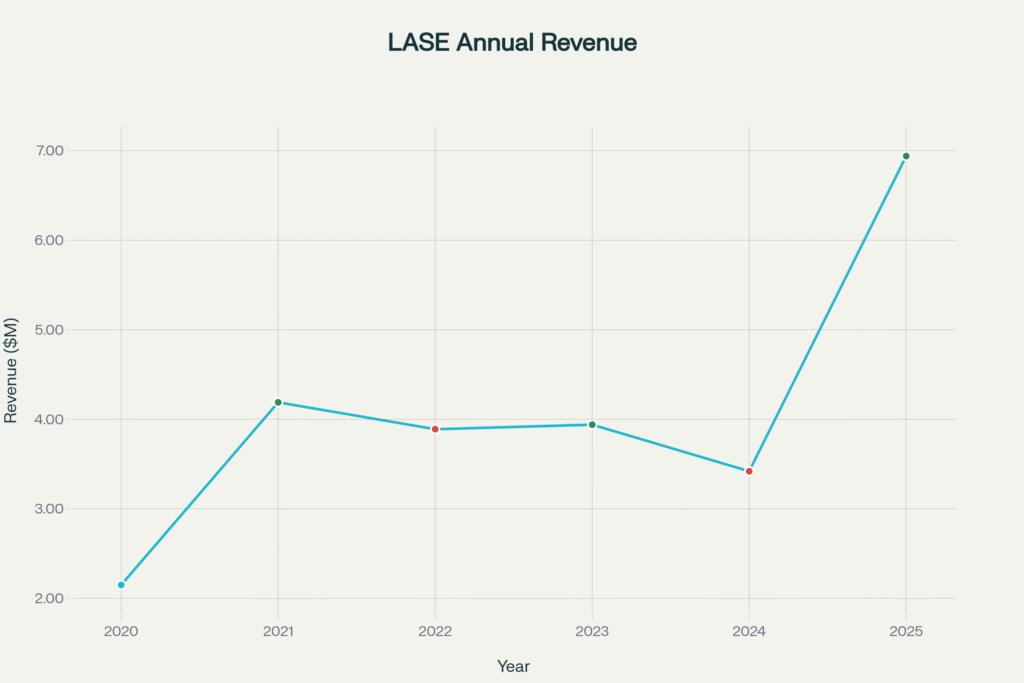

Revenue Growth and Downfall Analysis

Laser Photonics revenue swung sharply in the last half-decade:

| Year | Revenue (USD Million) | YoY Growth |

| 2020 | $2.15 | – |

| 2021 | $4.19 | +94% |

| 2022 | $3.89 | –7% |

| 2023 | $3.94 | +1% |

| 2024 | $3.42 | –13% |

| 2025 | $6.94* | +89% (TTM) |

Recent growth accelerated (TTM revenue up 89%), but this figure is based on extrapolated quarterly improvement in early 2025, and may not be sustainable across all future quarters.

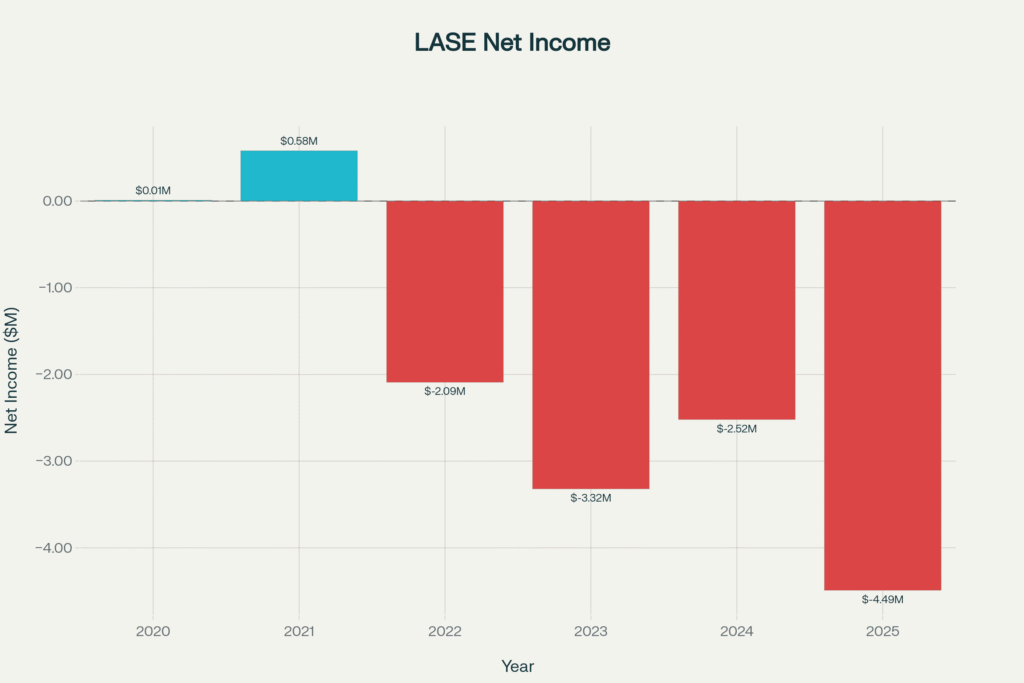

Net Income: From Modest Profits to Heavy Losses

Despite occasional revenue gains, Laser Photonics has racked up increasing net losses due to operational expenses, share-based compensation, and scaling challenges:

| Year | Net Income (USD Million) |

| 2020 | $0.01 |

| 2021 | $0.58 |

| 2022 | –$2.09 |

| 2023 | –$3.32 |

| 2024 | –$2.52 |

| 2025 | –$4.49* |

The trend is clear: larger losses with company growth efforts, reversing earlier profitability.

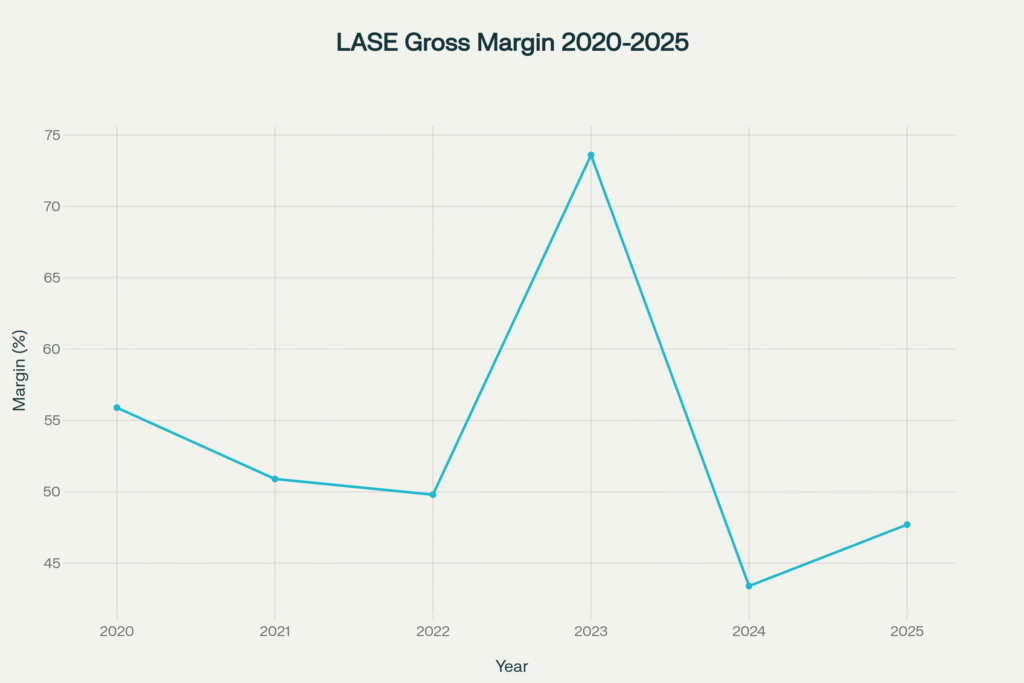

Margins & Efficiency

Gross profit margin has been highly erratic:

- 2023: an anomalous 73.6% margin spike (unusual one-off?).

- 2022–2025 (other years): 44–56%, also signaling recent business cost turbulence or possible non-recurring revenue items.

This irregularity clouds projection reliability, suggesting cyclical or lumpy project-based revenue with inconsistent cost control.

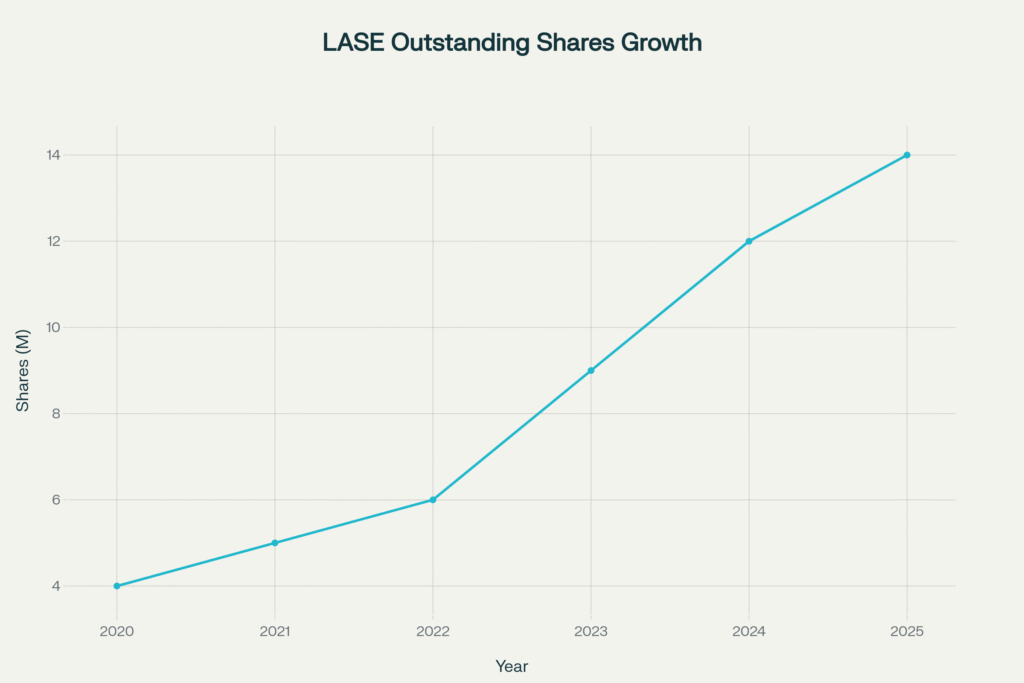

Dilution and Capital Raising

The company has substantially increased its share count:

| Year | Diluted Shares (Millions) |

| 2020 | 4 |

| 2021 | 5 |

| 2022 | 6 |

| 2023 | 9 |

| 2024 | 12 |

| 2025 | 14 |

This pattern shows heavy funding through new shares (dilution), potentially capping near-term price upside as each share now represents a smaller slice of the enterprise.

LASE Stock Price and Analyst Predictions

Historical & Consensus Numbers

- Recent price: About $4.51 (Sept 2025)

- 2025 Analyst Estimates: Ave. $1.68 (range: $0.02–$3.34)

- 2026 Forecast: Ave. $0.76 by late 2026 (–83% from current)

- Bearish models: Forecast further losses; up to –99% over five years for deep bear cases.

- Market Cap (2025): $39.97M

Valuation Math

LASE’s TTM revenue is $6.94M; at a typical small-cap tech P/S of 3–7:

- Implied fair market cap range: $21–$49M.

If outstanding shares hit 15M in 2026, fair value (P/S = 4) is:

Target Price=6.94×4 (P/S)15=$1.85 per share

Aggressive dilution and persistent net losses mean anything above $2 in 2026 would likely require both revenue surprise and cost discipline.

Price Prediction Calculation for 2025–2026

Methodology

- Base case: Revenue holds at $7M (TTM), P/S = 3–4, share count = 15M

→ Price estimate: $1.40–$1.85. - Bear case: Revenue retraces, expense control lags, further dilution (18M shares)

→ Price estimate: $0.80–$1.10. - Bull case: Revenue spikes 40%+, operational cost slashed; share count stabilizes

→ Price estimate: $2.25–$2.80.

These targets align closely with major external price forecasting sources and take into account both fundamental and technical patterns.

Visual Summary

- Revenue trend: Fluctuating, with high recent TTM but weak long-term growth

- Net income: Deepening losses

- Gross margin: Erratic, low-to-mid 40s in 2024–2025

- Dilution: Share count more than tripled since 2020

Conclusion

Laser Photonics (LASE) faces steep post-IPO turbulence with growing but erratic revenue, escalating losses, and severe dilution—all pressuring per-share value. Most 2025–2026 models predict a stock price range of $0.80–$2.20, with the base/midpoint around $1.60, and long-term upside capped unless operational improvement materializes. Caution is strongly warranted for new investors.