Colossal Biosciences is a private synthetic biology company with an audacious mission—reviving extinct species and advancing conservation technologies. As it heads towards a possible IPO, here’s a data-driven look at funding, valuation, growth, projected financials, and the rational basis for 2025–2026 price expectations.

Funding History: Accelerated Growth

Colossal Biosciences has completed five major funding rounds since launch in 2021:

- Seed (May 2021): $15M

- Series A (March 2022): $60M

- Series B (Jan 2023): $162.6M

- Venture (Nov 2023): $10.5M

- Series C (Jan 2025): $200M

Total funding by Jan 2025 stands at $448.1M. This capital supports R&D, staff expansion, and high-profile partnerships across the globe.

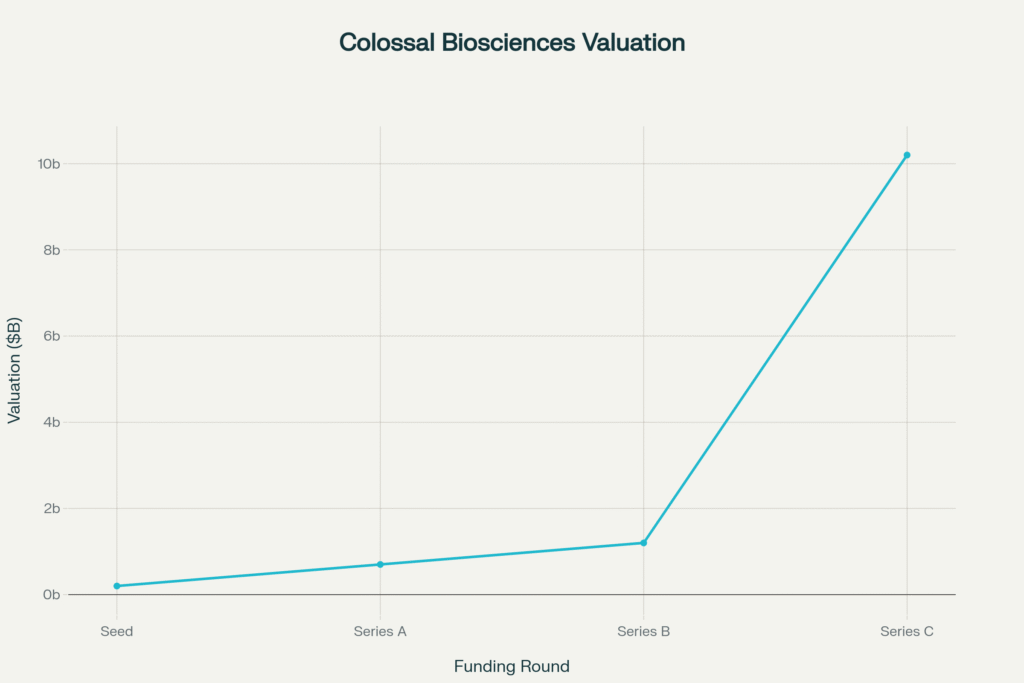

Valuation Growth: Dramatic Upswing

Company valuations leaped with each round, culminating in a milestone:

- 2021 Seed: $0.2B (estimate)

- 2022 Series A: $0.7B

- 2023 Series B: $1.2B

- 2025 Series C: $10.2B

Colossal Biosciences’ 2025 private valuation places it among the world’s most valuable synthetic biology startups.

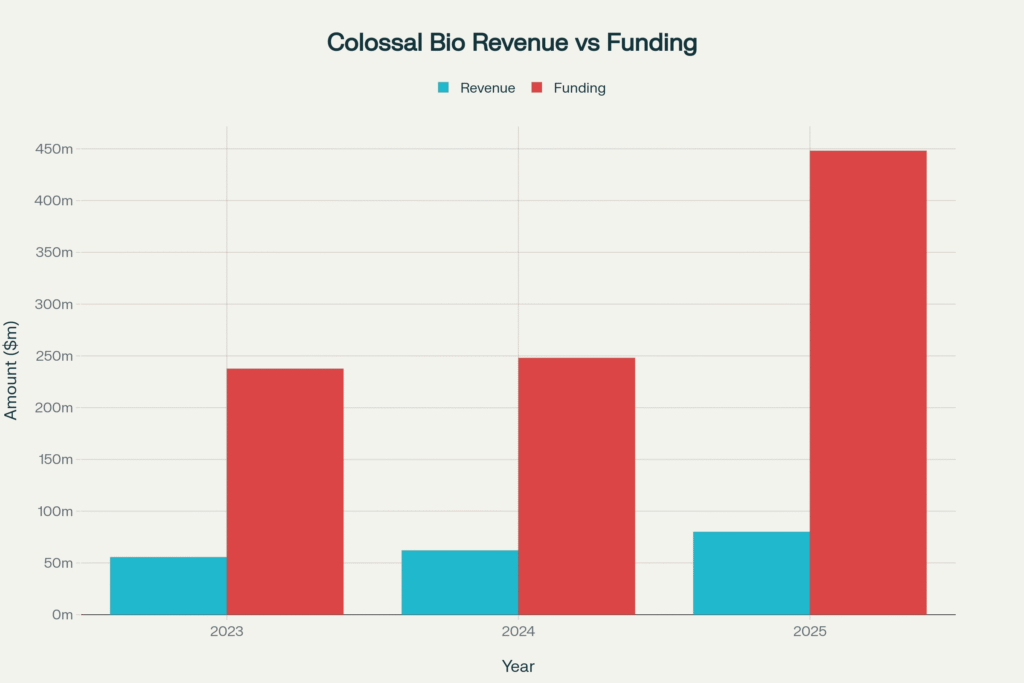

Revenue vs. Funding: Scale and Cash Burn

While funding and valuation have soared, revenue is still nascent compared to biotech peers:

- Revenue 2023: $55.6M (estimate)

- Revenue 2024: $62M (projection)

- Revenue 2025: $80M (forecast)

- Cumulative funding: $237.6M (2023), $248M (2024), $448.1M (2025)

Despite rapid growth, revenue remains a fraction of total investment—emphasizing ongoing R&D and expansion, with limited nearest-term profitability.

Business Model & Expense Structure

Colossal is projected to spend aggressively in 2025, with anticipated $120M outlays (labs, headcount, tech spinouts, regulatory work), implying a net cash burn rate greater than $40M for the year despite rising revenue:

| Year | Revenue (USD Million) | Expenses (USD Million) |

| 2025 | $80M | $120M |

This heavy burn is typical of pre-IPO biotech, which relies on cash infusions and strategic partnerships to finance growth.

Market Opportunity & Expansion

- Synthetic biology global market: $14.5B (2024), $126.9B (2034); 24.2% CAGR.

- Wildlife conservation market: $29B (2024), $41.6B (2029); 7.2% CAGR.

- Bioinformatics (Form Bio spinout): $14.3B (2024), $50.3B (2030); 13.4% CAGR.

- Colossal’s tech spinouts and conservation services provide a diversified revenue future as ecosystem credits, government contracts, and bioengineering services gain traction.

Detailed Calculation for Price Prediction

Approach

Assuming an IPO is pursued at the $10.2B valuation, using a typical biotech revenue multiple (EV/revenue) of 30–50× for top-tier startups:

2025 EV/REV=$10.2B/$80M=127.5×

If listed, actual market multiples would likely compress to 20–40× (post-listing risk adjustment).

Per-share price rationale

If issued shares total 50M at IPO, initial price is:

Expected IPO Price=$10.2B/50M≈$204 per share

2026 forecast:

- If revenues double (to $160M) and valuation holds, fair value:

$10.2B/50M=$204

If multiples compress (to 40× revenue) and revenues rise:

Valuation=40×$160M=$6.4B; price =$6.4B/50M=$128

Upside: Partnerships, spinouts, regulatory breakthroughs

Downside: High cash burn, technology risk, slow market adoption

Visual Summary

- Funding rounds: Exponential growth over four years

- Valuation jumps: 50× from Seed to Series C

- Revenue vs funding: Persistent heavy reliance on VC, slow revenue

- Expense vs revenue: Large losses ahead of potential IPO

Conclusion & 2025–2026 Price Prediction

Colossal Biosciences may price between $130–$210 at IPO (assuming current valuation and typical biotech market multiples) if offered in 2025, with post-IPO trading potentially stabilizing between $120–$170 in 2026, depending on revenue acceleration and risk profile.

Caution: As a pre-IPO, privately held company, all price predictions are theoretical until a listing occurs and public market forces apply.