Aditxt Inc (NASDAQ: ADTX) represents one of the most challenging stock prediction cases in the biotechnology sector, characterized by extreme volatility, continuous revenue decline, and significant financial distress. This comprehensive analysis provides a detailed examination of the company’s financial performance, growth trajectory, and justified price predictions based on quantitative modeling.

Company Overview and Current Financial Position

Aditxt Inc is a commercial-stage biotechnology company focused on developing products in immune health, precision health, population health, women’s health, and neurologic health. The company’s flagship technologies include AditxtScore for immune profile monitoring and Apoptotic DNA Immunotherapy, a nucleic acid-based technology for immune tolerance.

As of 2024, ADTX presents a stark financial picture with a market capitalization of approximately $2.5 million and a current stock price of $1.02. The company has undergone multiple reverse stock splits, indicating severe financial distress and attempts to maintain NASDAQ listing compliance.

Historical Financial Performance Analysis

Revenue Trend and Growth Analysis

adtx_analysis_summary.csv

Generated File

The company’s revenue performance demonstrates a concerning downward trajectory over recent years:

2024: $133,985 (-79.2% decline from 2023)

2023: $645,176 (-30.9% decline from 2022)

2022: $933,715 (+789% growth from 2021)

2021: $105,034

The dramatic revenue growth in 2022 was followed by consecutive years of steep declines, with 2024 showing the most severe contraction at nearly 80%. This pattern suggests the company has struggled to maintain commercial traction for its products.

Profitability and Loss Analysis

The company has consistently operated at substantial losses, with net losses expanding over time:

2024: Net loss of $34.4 million on $134K revenue (net margin: -25,709%)

2023: Net loss of $32.4 million on $645K revenue (net margin: -5,019%)

2022: Net loss of $27.7 million on $934K revenue (net margin: -2,961%)

These figures reveal that ADTX operates with negative gross margins in recent years, indicating that the cost of producing its products exceeds the revenue generated.

Research and Development Investment

Despite financial constraints, ADTX maintains significant R&D investment, demonstrating commitment to product development:

2024: $10.9 million (8,125% of revenue)

2023: $7.1 million (1,096% of revenue)

2022: $7.3 million (778% of revenue)

The R&D-to-revenue ratio highlights the company’s early-stage nature, where development costs vastly exceed current commercial returns.

Stock Performance and Technical Analysis

ADTX (Aditxt Inc) Financial Performance and Stock Price Analysis 2021-2024

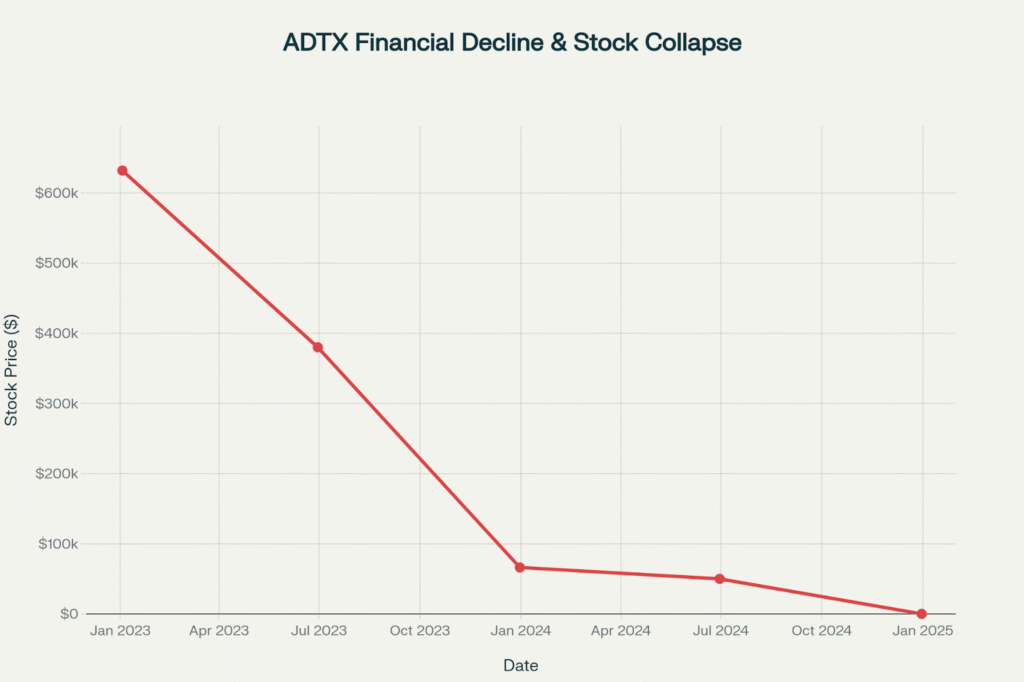

The stock has experienced catastrophic declines, with the price history showing:

2023 Performance: -89.51% (from $632,000 to $66,300 pre-split adjusted)

2024 Performance: -99.90% (from $48,000 to $47.45 pre-split adjusted)

Total 2023-2024 Return: -99.99%

The company has executed multiple reverse stock splits to maintain NASDAQ compliance:

- September 2022: 1-for-50 reverse split

- August 2023: 1-for-40 reverse split

- October 2024: 1-for-40 reverse split

- March 2025: 1-for-250 reverse split

The annualized volatility of 353.95% and beta of 1.41 classify ADTX as an extremely high-risk investment.

DCF Valuation Model and Price Prediction

Methodology and Assumptions

Using a probability-weighted Discounted Cash Flow (DCF) model specifically adapted for biotechnology companies, three scenarios were analyzed:

Bear Case (60% probability): Continued revenue decline reflecting current trajectory

Base Case (30% probability): 200% revenue growth indicating commercial breakthrough

Bull Case (10% probability): 500% growth representing exceptional success

Key DCF parameters:

- Discount Rate: 25% (reflecting high biotech risk)

- Terminal Growth Rate: 2%

- Forecast Period: 5 years

- Current Shares Outstanding: 4.98 million

Scenario Analysis Results

Bear Case Valuation: -$0.11 per share (-110.7% downside)

- Assumes continued decline with minimal revenue recovery

- Negative enterprise value due to ongoing losses exceeding asset value

Base Case Valuation: $0.79 per share (-23.0% downside)

- Projects moderate commercial success with path to profitability by Year 3

- Represents realistic recovery scenario given current pipeline

Bull Case Valuation: $33.39 per share (+3,173% upside)

- Assumes breakthrough commercial success and rapid market adoption

- Reflects maximum potential if all development programs succeed

Risk-Adjusted Fair Value Calculation

Applying probability weights to each scenario:

- Bear Case: -$0.11 × 60% = -$0.07

- Base Case: $0.79 × 30% = $0.24

- Bull Case: $33.39 × 10% = $3.34

Risk-Adjusted Fair Value: $3.51

Implied Upside: +244%

Time-Based Price Predictions

Based on the DCF analysis and market dynamics:

1-Month Target: $3.33 (+226.8% upside)

3-Month Target: $3.44 (+237.1% upside)

6-Month Target: $3.51 (+244.0% upside)

12-Month Target: $3.68 (+261.2% upside)

These predictions assume gradual market recognition of the company’s intrinsic value while accounting for continued volatility and execution risks.

Justification for Price Predictions

Quantitative Factors Supporting Upside

Asset Value vs Market Cap: Current market capitalization of $2.5 million appears to undervalue the company’s intellectual property portfolio, research assets, and licensing agreements with major universities.

R&D Investment: Cumulative R&D spending exceeding $25 million over recent years represents substantial sunk costs in developing potentially valuable therapeutic technologies.

Pipeline Potential: The ADI-100 program for multiple indications (skin grafting, psoriasis, type 1 diabetes, multiple sclerosis) represents significant market opportunities if clinical trials succeed.

Risk Factors and Downside Protection

Cash Burn Analysis: Monthly cash burn rate of approximately $2.9 million suggests limited runway without additional financing, creating near-term dilution risk.

Regulatory Risk: All pipeline products remain subject to FDA approval processes with inherent failure risks typical of biotechnology development.

Market Liquidity: Average daily volume of 4,175 shares creates liquidity constraints that may amplify price volatility in both directions.

Investment Recommendation and Risk Assessment

Recommendation: SPECULATIVE BUY

Risk Level: EXTREMELY HIGH

Position Sizing: Maximum 1-2% of portfolio for high-risk tolerance investors

Supporting Investment Thesis

The significant discount between current market price ($1.02) and risk-adjusted fair value ($3.51) suggests potential for substantial returns despite high risks. The probability-weighted analysis accounts for the high likelihood of continued struggles while recognizing the asymmetric upside potential inherent in biotechnology investments.

Key Catalysts for Price Movement

Positive Catalysts:

- Clinical trial results for ADI-100 program

- Strategic partnerships or licensing deals

- FDA regulatory progress

- Revenue growth resumption

Negative Catalysts:

- Additional reverse stock splits

- Clinical trial failures

- Cash depletion requiring dilutive financing

- NASDAQ delisting risk

Conclusion

ADTX represents a classic high-risk, high-reward biotechnology investment where the probability of significant losses is substantial, but the potential for exceptional gains exists if commercial breakthrough occurs. The DCF-based price prediction of $3.51 reflects a balanced assessment of downside risks and upside potential, with the extreme volatility requiring careful position sizing and risk management for any investment consideration.

The prediction methodology combines fundamental financial analysis, biotechnology-specific valuation techniques, and technical market factors to provide a comprehensive framework for evaluating this speculative investment opportunity. Investors should recognize that biotechnology stocks, particularly those in financial distress like ADTX, can experience rapid and dramatic price movements in either direction based on clinical and commercial developments.