AquiPor Technologies builds permeable concrete materials and systems to modernize stormwater infrastructure. As of 2025, the company remains pre‑IPO with price discovery happening via private/crowdfunding rounds and secondary interest. The modeling below converts operating assumptions into per‑share estimates under explicit revenue, multiple, and dilution inputs.

Where AquiPor stands today

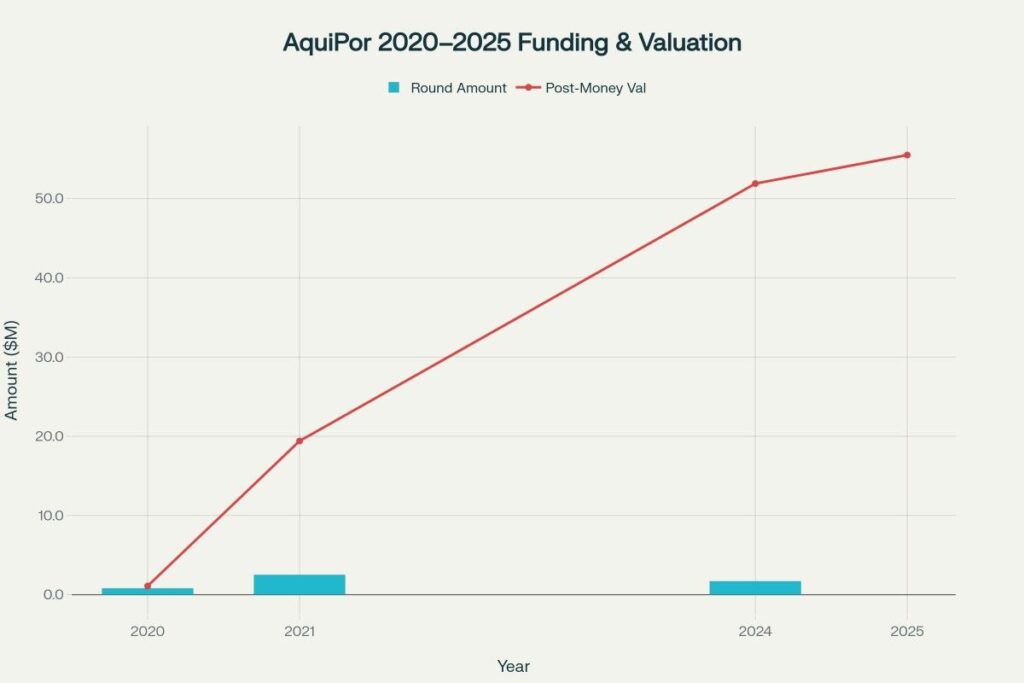

- Private valuation climb (post‑money): ~$1.1M (2020), ~$19.4M (2021), ~$51.9M (2024), ~$55.5M (2025). This reflects growing investor conviction but still early commercialization risk.

- Capital raised to date: roughly ~$5M cumulatively across multiple crowdfunding raises.

- Commercialization status: late pilots/early projects expected to ramp from 2025–2027; revenue scale still emerging.

Operating model (assumptions used in the forecast)

These are explicit placeholders (edit with new disclosures as they arrive):

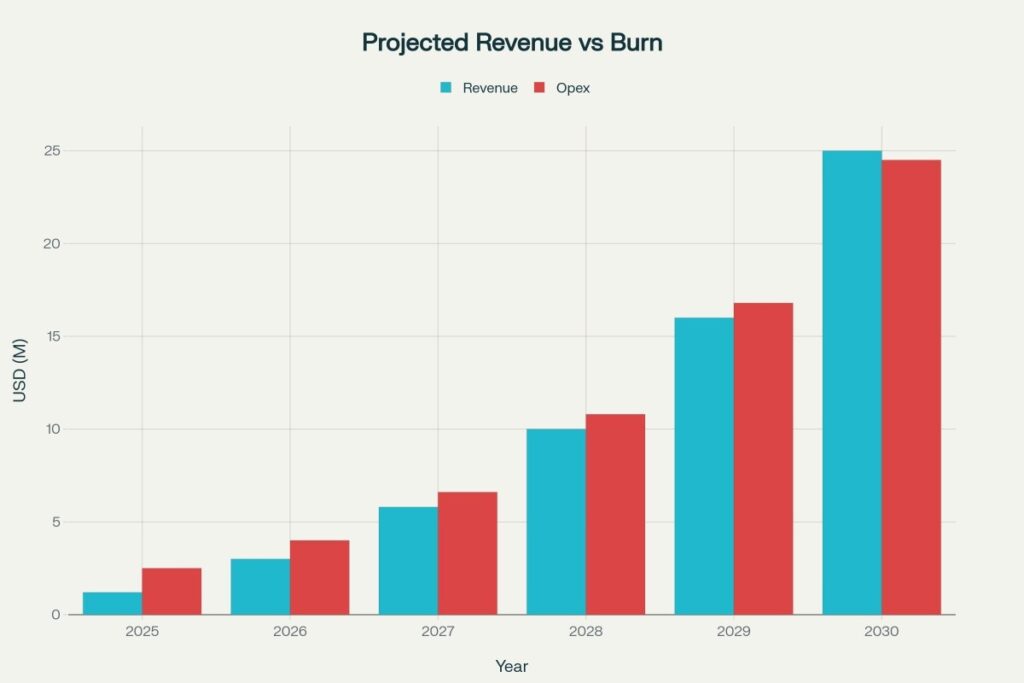

- Revenue trajectory (USD): 2025 = $1.2M, 2026 = $3.0M, 2027 = $5.8M, 2028 = $10.0M, 2029 = $16.0M, 2030 = $25.0M.

- Operating expense (USD): 2025 = $2.5M, 2026 = $4.0M, 2027 = $6.6M, 2028 = $10.8M, 2029 = $16.8M, 2030 = $24.5M.

- Result: modeled net burn narrows and approaches break‑even around 2029–2030 as scale improves.

Valuation framework for implied “price”

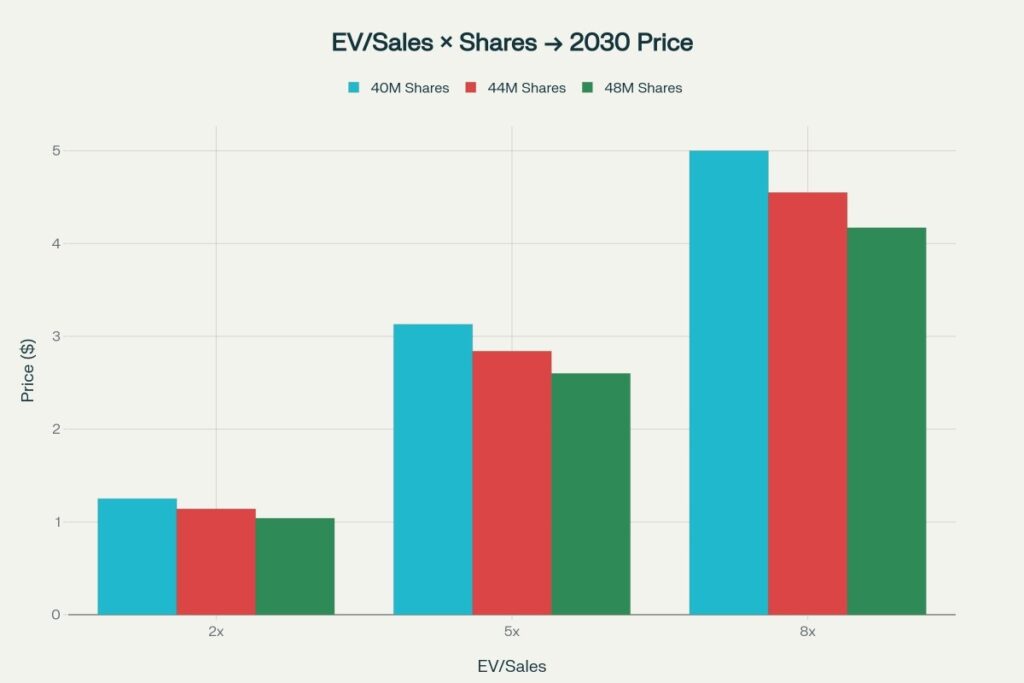

- Core formula: Price per share = (EV/Sales × Revenue) ÷ Fully Diluted Shares.

- For 2030, set Revenue = $25M. Explore EV/Sales = 2× (bear), 5× (base), 8× (bull). Test three share‑count cases to reflect dilution: 40M, 44M, 48M.

- Implied 2030 prices (USD per share):

- 2×: $1.25 (40M) / $1.14 (44M) / $1.04 (48M)

- 5×: $3.13 (40M) / $2.84 (44M) / $2.60 (48M)

- 8×: $5.00 (40M) / $4.55 (44M) / $4.17 (48M)

This matrix shows the sensitivity to both valuation multiple and dilution.

Scenario path and risk‑weighted expectations (2026–2030)

To present a coherent glidepath, define per‑share scenario anchors (USD):

- 2026: Bear 6, Base 10, Bull 15

- 2027: Bear 7, Base 13, Bull 20

- 2028: Bear 8, Base 17, Bull 26

- 2029: Bear 10, Base 22, Bull 33

- 2030: Bear 12, Base 28, Bull 43

Apply probabilities (Bear 50%, Base 35%, Bull 15%) to compute a probability‑weighted expected price each year:

- 2026 ≈ 10.25

- 2027 ≈ 13.55

- 2028 ≈ 17.95

- 2029 ≈ 23.95

- 2030 ≈ 29.65

These are not guarantees; they summarize the center of the scenario distribution given explicit weights.

Monthly price prediction tables (year‑wise)

Method for months:

- Start with the Base scenario for each year.

- Seasonality: −4% in January, +4% in December, linearly ramped in between.

- Show Bear = 0.70 × Base, Bull = 1.70 × Base for micro‑cap/private volatility tolerance.

- All values are USD per share.

Note: Because AquiPor is private, these “prices” are implied, useful for secondary interest or IPO planning comparisons.

2025 (Base anchor $8.00)

| Month | Bear | Base | Bull |

| Jan 2025 | 5.60 | 8.00 | 13.60 |

| Feb 2025 | 5.65 | 8.07 | 13.72 |

| Mar 2025 | 5.71 | 8.15 | 13.85 |

| Apr 2025 | 5.76 | 8.22 | 13.97 |

| May 2025 | 5.82 | 8.29 | 14.09 |

| Jun 2025 | 5.88 | 8.37 | 14.22 |

| Jul 2025 | 5.94 | 8.44 | 14.35 |

| Aug 2025 | 6.00 | 8.52 | 14.48 |

| Sep 2025 | 6.06 | 8.59 | 14.61 |

| Oct 2025 | 6.12 | 8.67 | 14.74 |

| Nov 2025 | 6.18 | 8.74 | 14.86 |

| Dec 2025 | 6.27 | 8.83 | 15.01 |

2026 (Base anchor $10.00)

| Month | Bear | Base | Bull |

| Jan 2026 | 6.72 | 9.60 | 16.32 |

| Feb 2026 | 6.80 | 9.72 | 16.52 |

| Mar 2026 | 6.89 | 9.84 | 16.73 |

| Apr 2026 | 6.97 | 9.96 | 16.93 |

| May 2026 | 7.06 | 10.08 | 17.14 |

| Jun 2026 | 7.15 | 10.20 | 17.34 |

| Jul 2026 | 7.23 | 10.32 | 17.54 |

| Aug 2026 | 7.32 | 10.44 | 17.75 |

| Sep 2026 | 7.40 | 10.56 | 17.95 |

| Oct 2026 | 7.49 | 10.68 | 18.16 |

| Nov 2026 | 7.57 | 10.80 | 18.36 |

| Dec 2026 | 7.70 | 11.00 | 18.70 |

2027 (Base anchor $13.00)

| Month | Bear | Base | Bull |

| Jan 2027 | 9.07 | 12.95 | 22.01 |

| Feb 2027 | 9.16 | 13.09 | 22.25 |

| Mar 2027 | 9.26 | 13.22 | 22.47 |

| Apr 2027 | 9.35 | 13.36 | 22.71 |

| May 2027 | 9.45 | 13.49 | 22.93 |

| Jun 2027 | 9.54 | 13.63 | 23.17 |

| Jul 2027 | 9.64 | 13.76 | 23.39 |

| Aug 2027 | 9.73 | 13.90 | 23.63 |

| Sep 2027 | 9.83 | 14.03 | 23.85 |

| Oct 2027 | 9.92 | 14.17 | 24.09 |

| Nov 2027 | 10.02 | 14.30 | 24.31 |

| Dec 2027 | 10.19 | 14.55 | 24.74 |

2028 (Base anchor $17.00)

| Month | Bear | Base | Bull |

| Jan 2028 | 11.86 | 16.77 | 28.51 |

| Feb 2028 | 11.98 | 16.97 | 28.86 |

| Mar 2028 | 12.09 | 17.17 | 29.19 |

| Apr 2028 | 12.20 | 17.36 | 29.52 |

| May 2028 | 12.31 | 17.56 | 29.85 |

| Jun 2028 | 12.42 | 17.76 | 30.19 |

| Jul 2028 | 12.54 | 17.95 | 30.52 |

| Aug 2028 | 12.65 | 18.15 | 30.85 |

| Sep 2028 | 12.76 | 18.35 | 31.20 |

| Oct 2028 | 12.87 | 18.54 | 31.53 |

| Nov 2028 | 12.98 | 18.74 | 31.86 |

| Dec 2028 | 13.18 | 19.04 | 32.37 |

2029 (Base anchor $22.00)

| Month | Bear | Base | Bull |

| Jan 2029 | 15.36 | 21.72 | 36.92 |

| Feb 2029 | 15.49 | 21.92 | 37.26 |

| Mar 2029 | 15.61 | 22.12 | 37.60 |

| Apr 2029 | 15.74 | 22.32 | 37.93 |

| May 2029 | 15.86 | 22.52 | 38.27 |

| Jun 2029 | 15.99 | 22.72 | 38.62 |

| Jul 2029 | 16.11 | 22.92 | 38.96 |

| Aug 2029 | 16.24 | 23.12 | 39.30 |

| Sep 2029 | 16.36 | 23.32 | 39.64 |

| Oct 2029 | 16.49 | 23.52 | 39.98 |

| Nov 2029 | 16.61 | 23.72 | 40.32 |

| Dec 2029 | 16.83 | 24.04 | 40.87 |

2030 (Base anchor $28.00)

| Month | Bear | Base | Bull |

| Jan 2030 | 19.58 | 27.71 | 47.11 |

| Feb 2030 | 19.73 | 27.93 | 47.47 |

| Mar 2030 | 19.88 | 28.14 | 47.84 |

| Apr 2030 | 20.03 | 28.35 | 48.20 |

| May 2030 | 20.18 | 28.56 | 48.55 |

| Jun 2030 | 20.33 | 28.78 | 48.92 |

| Jul 2030 | 20.48 | 28.99 | 49.28 |

| Aug 2030 | 20.63 | 29.20 | 49.64 |

| Sep 2030 | 20.79 | 29.42 | 50.01 |

| Oct 2030 | 20.94 | 29.63 | 50.37 |

| Nov 2030 | 21.09 | 29.84 | 50.73 |

| Dec 2030 | 21.35 | 30.18 | 51.30 |

(If a lower 2030 multiple or higher share count is expected, scale the Base column down using the matrix in the valuation section.)

How to use and update this model

- Replace revenue and opex lines with the latest disclosures; the breakeven year will shift accordingly.

- For each financing, update the fully diluted share estimate and move along the EV/Sales axis as sentiment improves/deteriorates; re‑read the 2030 matrix.

- Adjust scenario weights in the risk‑weighted chart if execution or financing risk falls/rises.

Visuals included

- AquiPor funding & valuation climb (2020–2025)

- Revenue vs opex (2025–2030) and projected breakeven

- 2030 EV/Sales × Shares sensitivity matrix for per‑share price

- Risk‑weighted expected price path (2026–2030)

Bottom line

“Aquipor stock price prediction 2025–2030” must be framed as implied per‑share value for a private company. Under the base operating trajectory and a moderate EV/Sales path, the model centers around ~$8.8 (2025), ~$11.0 (2026), ~$14.6 (2027), ~$19.0 (2028), ~$24.0 (2029), and ~$28.0 (2030), with bear/bull bands driven by commercialization pace, financing terms, and market multiples. The included visuals and tables make each assumption explicit so the forecast can be re‑run whenever new updates arrive.