Captain Morgan Private Stock typically retails around $25–$30 for 750ml in the U.S., with representative listings at $27–$29 and a global average near $27, and value-oriented 1.75L offers around $41 in the U.S. market as of 2025. Based on historical alcohol inflation and current U.S. federal excise tax rules for spirits at 40% ABV, a reasonable 2030 baseline projection for a 750ml bottle is approximately $31, with a scenario range of about $30–$33 depending on inflation path and taxes.

Price snapshots (750ml)

- Crown Wine & Spirits: $28.99 (750ml)

- Spec’s: $27.36 (750ml)

- Banks Wine & Spirits: $25.00 (750ml)

- Global average price (ex-tax): ~$27 (750ml)

Value-size example (1.75L)

- Crestview Liquors: $40.99 sale, $63.99 regular (1.75L)

Product specs

- Captain Morgan Private Stock is 40% ABV (80 proof) and aged in oak at least two years, positioned above the brand’s standard spiced rum in the portfolio.

Brand and ownership

- Captain Morgan is a Diageo brand; Diageo is a global spirits leader owning Johnnie Walker, Smirnoff, Baileys, and others, providing scale and distribution that underpin price stability and premiumization levers over time.

What drives Private Stock pricing

Pricing of premium spiced rum is shaped by ingredient costs, packaging, logistics, taxes (federal excise, state excise, sales tax), retailer margins, and brand premium, with taxes and inflation being the most quantifiable near-term drivers for projections.

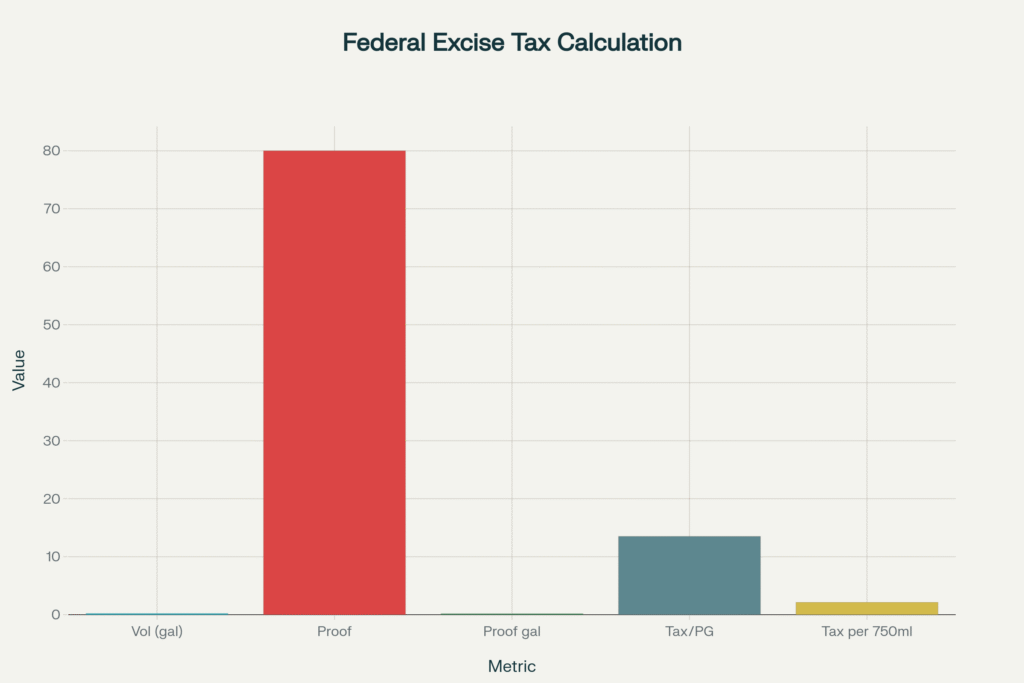

Federal excise tax math (U.S.)

For distilled spirits, the federal excise tax is assessed per proof gallon; Private Stock is 40% ABV (80 proof), and a 750ml bottle is 0.198 wine gallons, which equals 0.1584 proof gallons, resulting in ~$2.14 federal excise tax per 750ml bottle at the $13.50 per proof gallon rate, net of tier qualifications for large producers.

- Proof gallons per 750ml at 40% ABV:

- 0.198×0.80=0.1584

- 0.198×0.80=0.1584

- Federal excise per bottle:

- 0.1584×$13.50≈$2.14

- 0.1584×$13.50≈$2.14

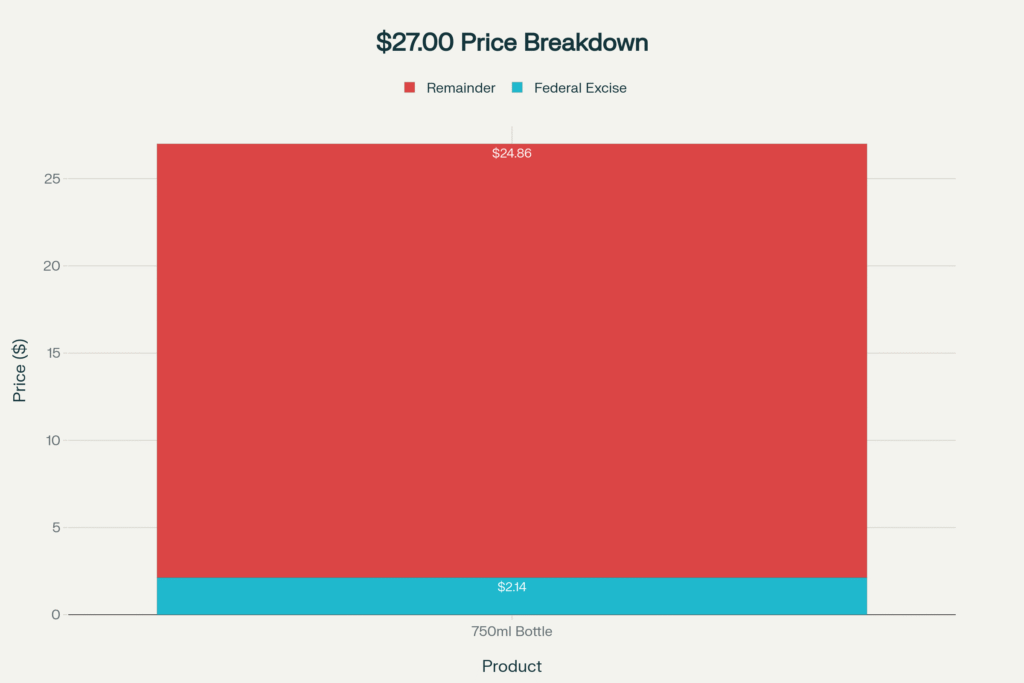

Retail price breakdown example

Using a $27 retail reference, the federal excise is about $2.14, with the remainder covering state taxes, logistics, retail margins, and brand value, illustrating how tax policy directly affects the shelf price.

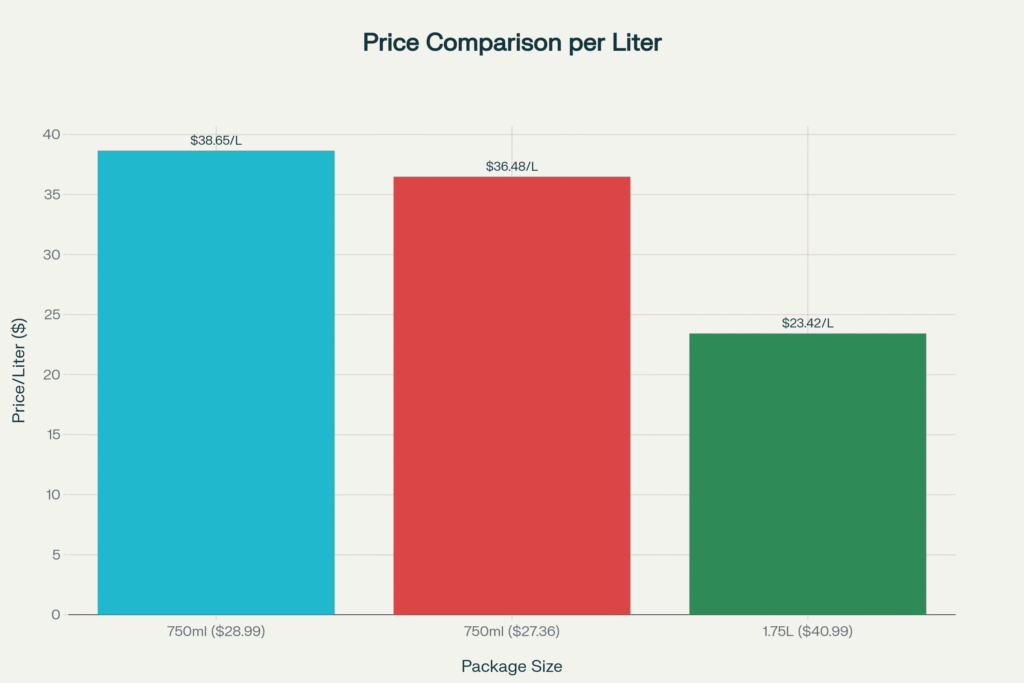

Value by size: per‑liter comparison

On a per‑liter basis, 1.75L often offers markedly better value than 750ml, with ~$23.42/L at a $40.99 1.75L versus roughly $36–$39/L for 750ml references, highlighting the typical economy-of-scale pricing of large formats.

- 1.75L at $40.99:

- $40.99/1.75L≈$23.42/L

- $40.99/1.75L≈$23.42/L

- 750ml at $28.99:

- $28.99/0.75L≈$38.65/L

- $28.99/0.75L≈$38.65/L

- 750ml at $27.36:

- $27.36/0.75L≈$36.48/L

- $27.36/0.75L≈$36.48/L

International price signals

Global listings indicate a ~$27 global average for 750ml (ex‑tax), while certain international large-format listings can be much higher due to currency, taxes, and import costs, such as €98.90 for 1.75L in the EU, underlining jurisdictional tax and market effects on retail pricing.

Growth and setbacks: brand context that influences pricing power

Captain Morgan’s scale within Diageo’s portfolio historically enabled sustained distribution and marketing support, which supports brand equity and pricing power even as input costs and competitive dynamics fluctuate, with the brand’s U.S. scale and heritage cementing its premium tiers like Private Stock. Conversely, macro shifts such as inflation, shipping costs, and regulatory updates (excise tax design or enforcement) can pressure margins and translate into consumer pricing over multi‑year horizons, contributing to periodic price adjustments.

Calculation framework to project 2030 price

To model a baseline 2030 shelf price for a 750ml bottle in the U.S., use a compounded inflation approach applied to a 2025 anchor price and overlay tax assumptions; the simplest transparent method uses alcohol’s long‑run CPI trend for the inflation leg and today’s known federal excise for the tax leg, recognizing states and retailers add variability.

- Baseline 2025 anchor: $27 reference for 750ml (rounded global/U.S. retail snapshot)

- Long‑run alcohol CPI: ~2.79% annual average (BLS historical)

- Federal excise: $13.50 per proof gallon; ~$2.14 per 750ml at 40% ABV (policy level)

Inflation-only projection to 2030

Using alcohol CPI trend as a baseline:

P2030=P2025×(1+0.0279)5≈27×1.145≈$31.0

- 2% path:

- 27×1.104≈$29.8

- 27×1.104≈$29.8

- 3% path:

- 27×1.159≈$31.3

- 27×1.159≈$31.3

- 4% path:

- 27×1.217≈$32.9

- 27×1.217≈$32.9

These scenarios suggest a ~$30–$33 range by 2030 for 750ml in a steady policy environment, before state taxes and retailer dynamics, which is consistent with historical beverage inflation behavior and current tax structure.

Practical price outlooks for shoppers

- U.S. 750ml typical: Expect a gradual drift from the $27–$29 band toward roughly $30–$33 by 2030, with promotional dips and local taxes creating store‑to‑store dispersion.

- U.S. 1.75L value: Promotions around ~$41 can offer substantial per‑liter savings relative to 750ml, with regular prices in the $60+ band still often delivering better per‑liter value than smaller bottles.

- International: Prices vary widely due to VAT, excise, and import costs; large‑format EU listings show materially higher shelf prices that are primarily tax‑ and distribution‑driven rather than purely brand‑driven.

What could shift the 2030 forecast

- Upward risks: Higher inflation, supply chain costs, or excise/tax increases could push above the baseline trajectory, widening the band to mid‑$30s for 750ml in certain markets by 2030.

- Downward offsets: Competitive pricing, retailer promotions, and efficiency gains in logistics/packaging could keep retail closer to $30, especially in markets with lower taxes and strong retail competition.

Key visuals

- Value by size: 1.75L vs 750ml per‑liter comparison, showing the large‑format value edge.

- Federal excise calculation for a 750ml at 40% ABV, demonstrating how the $2.14 figure is derived.

- Retail breakdown example at a $27 price point, allocating federal excise versus the remainder of the retail price components.

Bottom line

A realistic, data‑anchored 2030 projection for Captain Morgan Private Stock 750ml in the U.S. is about $31 under long‑run alcohol CPI, with a plausible range of roughly $30–$33 depending on inflation path and policy, while 1.75L formats should continue to offer superior per‑liter value when discounted. This outlook assumes current federal excise tax parameters for distilled spirits persist and that brand positioning under Diageo maintains its premium tier pricing power within competitive retail environments.