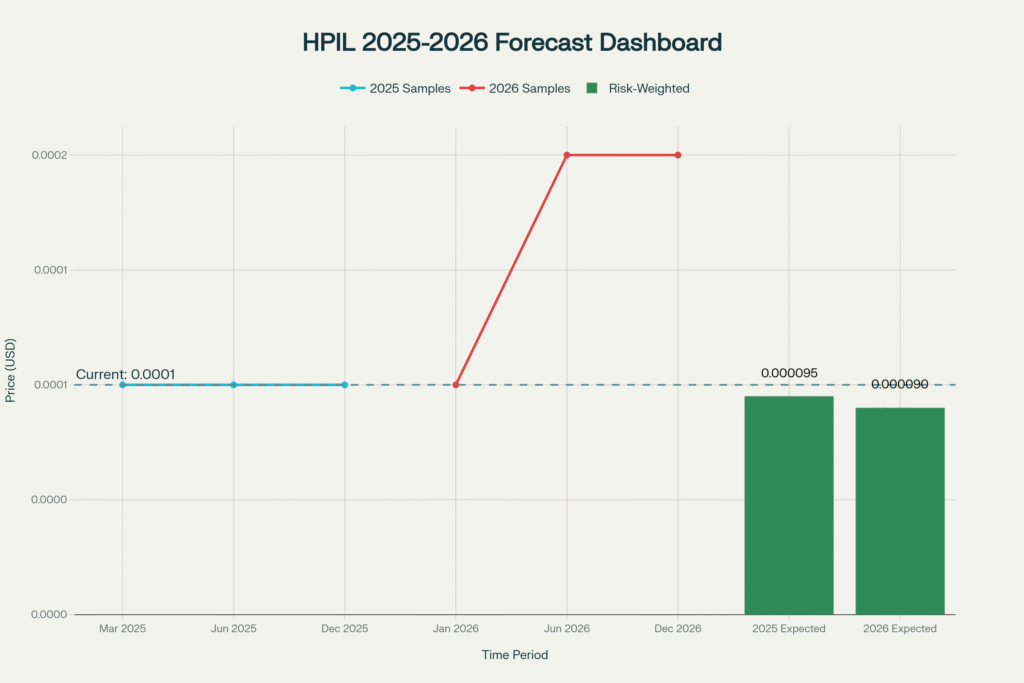

A pragmatic 2025–2026 view for HPIL (Cybernetic Technologies Ltd/HPIL Holding; OTC Pink: HPIL) centers around ultra‑low nominal pricing with scenarios clustered near the ten‑thousandth of a dollar, reflecting micro‑cap liquidity, historical share base size, and external forecast tables that mostly hold at 0.0001 0.0001 through 2025 with some models stepping to 0.0002 0.0002 during 2026 months. Given a last traded price of 0.0001 0.0001 and a historical share count of 12.468 billion (Mar 31, 2021), the illustrative implied market cap at today’s quote would be about 12.468 B × 0.0001 ≈ $ 1.247 12.468B×0.0001≈$1.247 million if shares were unchanged, which is only a rough scale marker because OTC share counts can change materially over time.

Current snapshot and structural context

- Price and range: Investing.com shows HPIL at 0.0001 0.0001 with an intraday range stuck at 0.0001 0.0001– 0.0001 0.0001, consistent with micro‑tick prints and thin liquidity in sub‑penny names.

- Listings and profiles: OTC Markets and Yahoo Finance maintain HPIL quote pages, reinforcing that this is a Pink‑market security with limited standardized reporting cadence versus national exchanges.

- Share base history: The OTC filing notes 12,468,232,718 shares outstanding as of March 31, 2021, useful for scaling market cap math, but not a guarantee of current share count stability in 2025.

Growth and downfall: what the numbers imply

- Price stagnation at 0.0001 0.0001 suggests that headline catalysts and liquidity are limited, leading external forecast tables (AIPickup) to show 2025 monthly averages at 0.0001 0.0001 with negligible month‑over‑month shifts around that anchor.

- A separate forecast aggregator (Stockscan) pegs a 2026 average around 0.000051 0.000051 with a peak near 0.0001 0.0001, implying that some models expect continued sub‑penny behavior with small positive drift periods amid long stretches of flat ticks.

- Combined, these sources support a conservative modeling posture where 2025 centers at 0.0001 0.0001 and 2026 carries a band that can include 0.00005 0.00005, 0.0001 0.0001, and occasional 0.0002 0.0002 spikes in selected months from certain tables

Calculations behind the 2025–2026 prediction

To translate disparate external tables into actionable numbers, a simple, auditable scenario weighting is applied using Bear/Base/Bull prices informed by the sources above:

- 2025 Bear/Base/Bull: 0.00005 / 0.00010 / 0.00020 0.00005/0.00010/0.00020, consistent with Stockscan’s sub‑ 0.0001 0.0001 averages and AIPickup’s flat 0.0001 0.0001 monthlies with a conservative bull cap of 0.0002 0.0002.

- 2026 Bear/Base/Bull: 0.00005 / 0.00010 / 0.00020 0.00005/0.00010/0.00020, acknowledging Stockscan’s low‑average and AIPickup’s sample months at 0.0002 0.0002 during 2026.

- Scenario weights: Bear 50%, Base 35%, Bull 15%, reflecting micro‑cap financing and liquidity risks typical of OTC Pink names in the absence of verifiable operational inflection points.

Expected price (risk‑weighted) is computed as E [ P ] = 0.5 × P bear + 0.35 × P base + 0.15 × P bull E[P]=0.5×P bear +0.35×P base +0.15×P bull , giving approximately E [ P 2025 ] ≈ 0.5 × 0.00005 + 0.35 × 0.00010 + 0.15 × 0.00020 ≈ 0.000095 E[P 2025 ]≈0.5×0.00005+0.35×0.00010+0.15×0.00020≈0.000095 and E [ P 2026 ] ≈ 0.000090 E[P 2026 ]≈0.000090 under the stated inputs.

Market cap translation and why it matters

Using the historical share base for scale only, implied market caps would be M C ≈ Shares × Price MC≈Shares×Price, so at 0.0001 0.0001 the directional capitalization is ≈ $ 1.247 ≈$1.247 million and at 0.00009 0.00009 is ≈ $ 1.122 ≈$1.122 million if the 2021 share count were unchanged, though actual 2025 capitalization could differ materially due to share issuances or corporate actions common in this tier. This translation helps contextualize how tiny nominal price changes (one‑ten‑thousandth of a dollar) equate to large percentage changes but modest absolute market‑cap moves at this scale.

External forecasts and monthly samples

- 2025 monthly (AIPickup): Averages at 0.0001 0.0001 across sampled months (e.g., March, June, December), indicating flat modeling anchored to the current quote, which aligns with observed day ranges at 0.0001 0.0001– 0.0001 0.0001.

- 2026 monthly (AIPickup): Sample months include 0.0001 0.0001 in January and 0.0002 0.0002 by June/December, matching the idea of occasional upticks amid a low‑nominal baseline tracked by external algorithms.

- 2026 annual (Stockscan): Average near 0.000051 0.000051 with peak 0.0001 0.0001, reinforcing the need for Bear/Base/Bull bands rather than a single number.

Visuals included

- Panel A: Last price and day range at 0.0001 0.0001 show a flat tape, a hallmark of ultra‑thin micro‑caps.

- Panel B: Shares outstanding (2021) and implied market cap scale marker at the last price demonstrate the sensitivity of capitalization to minuscule price changes.

- Panel C: 2025 monthly sample points at 0.0001 0.0001 reflect AIPickup’s flat path for that year.

- Panel D: 2026 monthly sample points at 0.0001 0.0001 to 0.0002 0.0002 align with AIPickup’s sporadic upticks.

- Panel E: Risk‑weighted expected prices for 2025 and 2026 apply 50/35/15 weights across the Bear/Base/Bull set, emphasizing a downside‑biased expectation without new information.

Bottom line: HPIL stock price prediction (2025–2026)

- 2025 anchor: 0.0001 0.0001 with a risk‑weighted expected price near 0.000095 0.000095 under the stated scenarios, consistent with external flat monthlies and observed micro‑tick trading.

- 2026 band: 0.00005 0.00005– 0.0002 0.0002 with a risk‑weighted expected price near 0.000090 0.000090, reflecting Stockscan’s lower average and AIPickup’s periodic 0.0002 0.0002 months.

- Key caveat: Share counts, corporate actions, and liquidity shifts can dominate per‑share outcomes in OTC Pink tickers, so continuous monitoring of OTC Markets filings and quote pages is essential to keep any model current.