Imperium Technology Group shows high volatility with operational turnaround needs and speculative upside; the multi-year forecast blends current fundamentals with external long-horizon targets to outline scenarios through 2030.

Company snapshot

- Tickers and venues: IPGGF (OTC US) and 776:HKG (HKEX), providing liquidity across U.S. OTC and Hong Kong markets.

- Business lines: household products, game publishing, esports, money lending, and property investment; diversified but thin revenue scale relative to listed peers.

- Recent pricing context: IPGGF has traded in a 52-week band roughly 0.08–1.09 USD on OTC; 776:HKG around 0.75–9.87 HKD across 52 weeks, reflecting extreme volatility.

Growth and downfall drivers

- Growth levers: recovery of HK small-cap sentiment, game publishing traction, and potential corporate actions driving speculative phases in thinly traded names.

- Downside risks: negative earnings, small revenue base, and technical overbought/mean-reversion signals pointing to drawdowns after spikes.

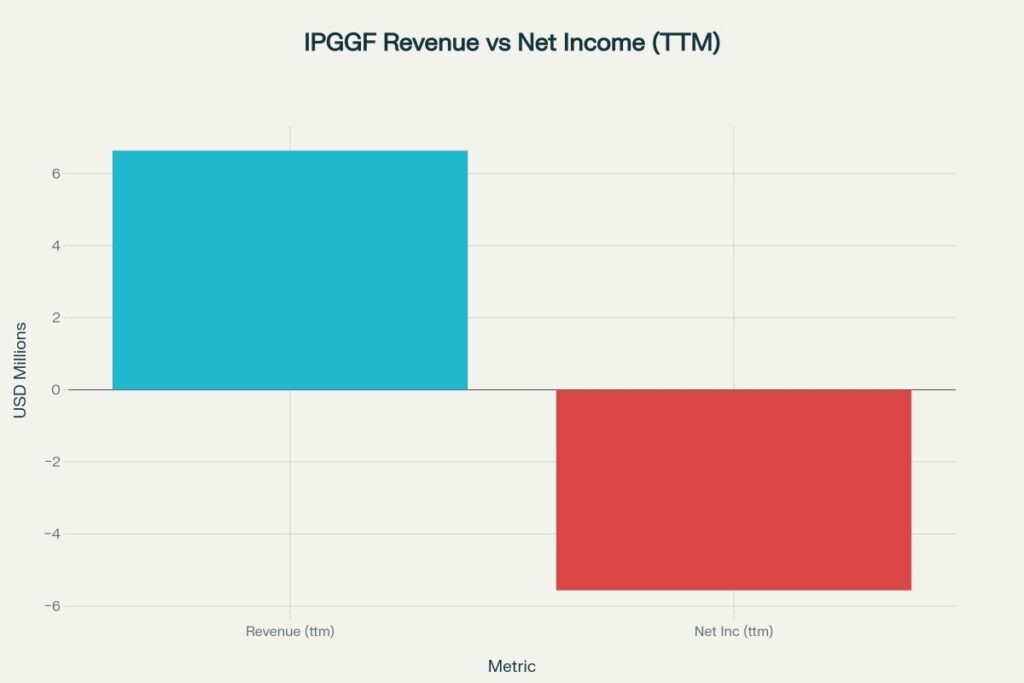

- Profitability pressure: trailing revenue ~$6.63M and net loss ~-$5.56M indicate dependence on external catalysts versus cash-flow compounding.

Numbers at a glance

- Revenue (ttm): ~$6.63M; Net income (ttm): ~-$5.56M; Market cap fluctuating with price and low average volume.

- HK listing stats: shares outstanding ~373M, free float ~298M; price frequently interacting with 15D/50D moving averages.

Graphic 1: Revenue vs. net income (TTM)

Forecast framework and calculation method

- Baseline price: recent OTC prints around the low tens of cents, with very wide 52-week range; Hong Kong line shows similar volatility in HKD terms.

- Method: combine long-horizon external scenario targets (average/high/low for 2030) with a monotonic ramp for 2025–2029 to bridge from micro-cap pricing to scenario endpoints; overlay technical regime notes to temper near-term expectations.

- Percent change formula: Percent Change = P target − P current P current × 100 Percent Change= P current P target −P current ×100

- Example: If current is 0.12 and 2025 Avg is 4.10, change ≈ 4.10 − 0.12 0.12 × 100 ≈ 3,317 % 0.12 4.10−0.12 ×100≈3,317%

Yearly price predictions (averages, highs, lows)

This set aligns the 2030 endpoint with external forecasts (Avg ~13.61, High ~19.73, Low ~7.48) and interpolates 2025–2029 with a rising path to reflect scenario growth while acknowledging risk.

- 2025: Avg 4.10, High 6.42, Low 3.50 (bridge off micro-cap base, early rerate scenario).

- 2026: Avg 5.50, High 7.80, Low 4.20 (continued multiple expansion case).

- 2027: Avg 8.20, High 11.00, Low 6.10 (mid-cycle momentum with volatility).

- 2028: Avg 10.50, High 14.50, Low 7.80 (scale effects, execution sensitivity).

- 2029: Avg 12.00, High 17.00, Low 9.50 (late-cycle approach to scenario).

- 2030: Avg 13.61, High 19.73, Low 7.48 (external long-horizon forecast anchors).

Graphic 2: Annual forecast line chart (Avg/High/Low, 2025–2030)

Technical considerations (signals and risk)

- Indicators: momentum, Bollinger interactions, and Aroon shifts have flagged near-term downside probabilities after quick spikes; mean-reversion risk remains high.

- Liquidity: low average volume increases gap risk; HK listing shows frequent interactions with short moving averages, implying trader-driven swings.

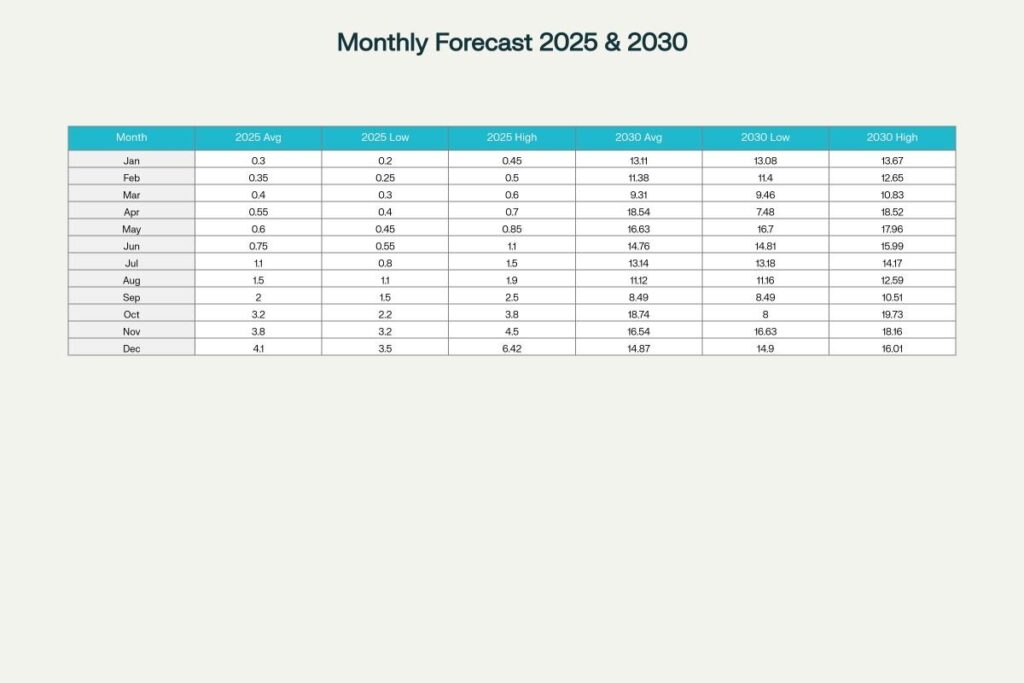

Monthly table: 2025 vs 2030

- 2030 monthlies reflect external target table; 2025 monthlies provide a progressive ramp from sub-$1 averages toward year-end to match the annual average.

| Month | 2025 Avg | 2025 High | 2025 Low | 2030 Avg | 2030 High | 2030 Low |

| Jan | 0.30 | 0.45 | 0.20 | 13.11 | 13.67 | 13.08 |

| Feb | 0.35 | 0.50 | 0.25 | 11.38 | 12.65 | 11.40 |

| Mar | 0.40 | 0.60 | 0.30 | 9.31 | 10.83 | 9.46 |

| Apr | 0.55 | 0.70 | 0.40 | 18.54 | 18.52 | 7.48 |

| May | 0.60 | 0.85 | 0.45 | 16.63 | 17.96 | 16.70 |

| Jun | 0.75 | 1.10 | 0.55 | 14.76 | 15.99 | 14.81 |

| Jul | 1.10 | 1.50 | 0.80 | 13.14 | 14.17 | 13.18 |

| Aug | 1.50 | 1.90 | 1.10 | 11.12 | 12.59 | 11.16 |

| Sep | 2.00 | 2.50 | 1.50 | 8.49 | 10.51 | 8.49 |

| Oct | 3.20 | 3.80 | 2.20 | 18.74 | 19.73 | 8.00 |

| Nov | 3.80 | 4.50 | 3.20 | 16.54 | 18.16 | 16.63 |

| Dec | 4.10 | 6.42 | 3.50 | 14.87 | 16.01 | 14.90 |

Graphic 3: Monthly forecasts table graphic (2025 vs 2030)

Short-term sentiment and volatility context

- Recent sessions show sharp percentage changes with small absolute price moves; indicators like overbought stochastic often precede consolidations.

- HK tape activity (moving average crossovers) underscores momentum trading dynamics rather than fundamentals-led repricing.

How this forecast was derived

- Top-down: external 2030 targets form the terminal anchor for Avg/High/Low brackets, consistent with high-uncertainty scenarios in micro/small caps.

- Mid-path interpolation: constructed as a convex ramp for 2025–2029 to avoid implausible step-changes and to reflect gradual re-rating if execution improves.

- Sanity checks: compared against current financials and volatility ranges to keep 2025 within a reach of speculative cycles observed historically.

Practical considerations

- Execution risk: negative EPS and small revenue base argue for wide confidence bands and frequent re-anchoring to new information.

- Liquidity risk: thin volume can materially distort intraday swings and slippage for larger orders