Executive Summary

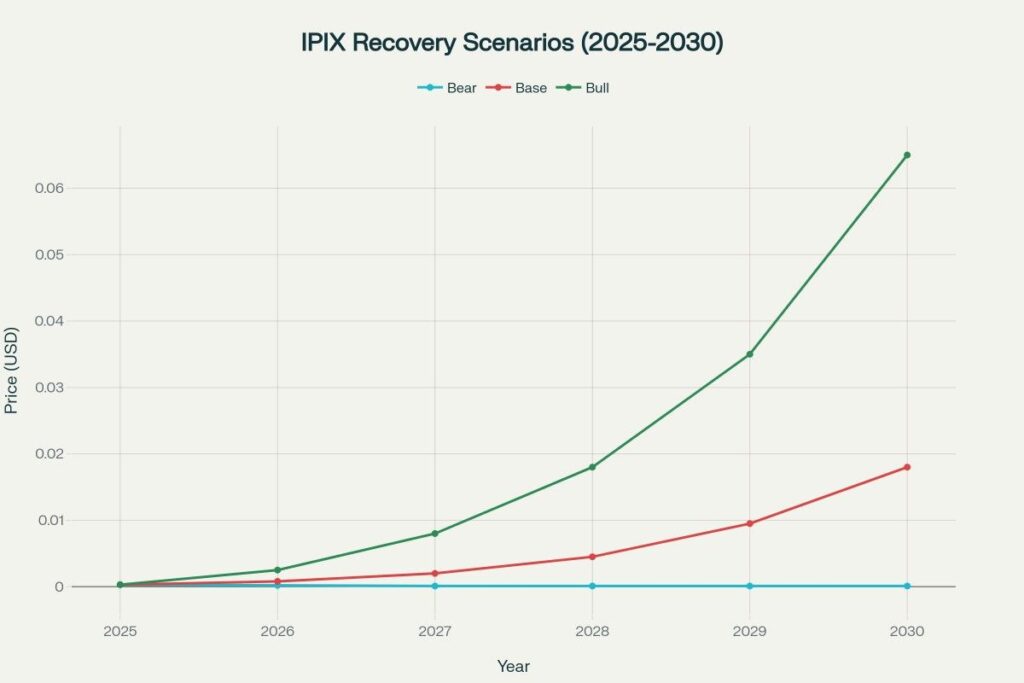

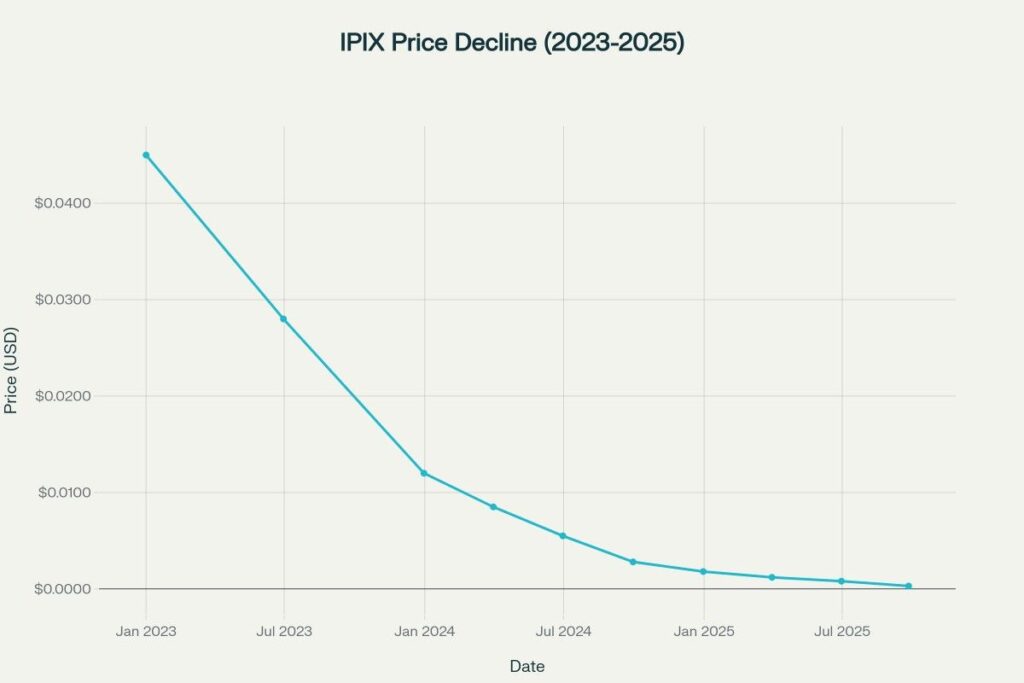

Innovation Pharmaceuticals (IPIX) represents a distressed clinical-stage biopharmaceutical company trading at severely depressed levels following a multi-year decline from clinical setbacks and funding challenges. The company’s lead asset Brilacidin, a novel antibiotic with FDA Fast Track designation for oral mucositis, remains the primary driver of potential recovery scenarios through 2030. Price predictions range from continued decline in bear cases to substantial recovery in bull scenarios assuming successful clinical partnerships and FDA approval.

Company Overview and Current Position

Innovation Pharmaceuticals develops small molecule therapies targeting inflammatory diseases, cancer, dermatology, and anti-infective applications. The company’s market capitalization has collapsed to approximately $106,000 as of late 2025, down over 99% from historical highs, reflecting severe dilution and operational challenges. With minimal revenue generation and persistent cash burn, IPIX operates as a pre-commercialization biotech dependent on clinical milestones and partnership deals.

Growth and Downfall Structure

Historical Growth Phase (2014-2018)

- Peak valuation reached $4.93 per share in December 2014 driven by early-stage clinical promise

- Multiple Phase 2 trials initiated across various indications including oral mucositis and skin infections

- FDA Fast Track designations provided regulatory pathway validation

Downfall Phase (2019-2025)

The company experienced systematic decline due to:

- Clinical setbacks: COVID-19 Phase 2 trial failed primary endpoint despite some positive secondary results

- Funding constraints: Repeated dilutive financings to maintain operations

- Partnership failures: Unable to secure meaningful pharma partnerships for development funding

- Market skepticism: Biotech sector rotation away from early-stage companies

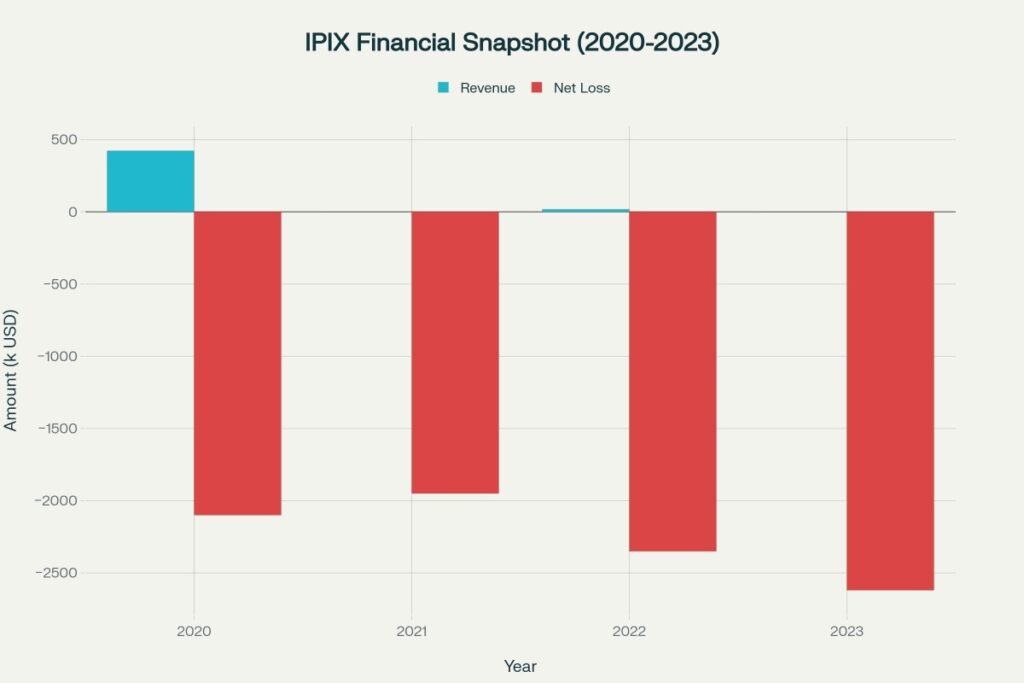

Financial Deterioration

Revenue has been virtually non-existent since 2020, with only $18,000 in 2022 and zero in 2023. Operating losses have consistently exceeded $2 million annually while the company maintains minimal staff of 4 employees. Cash burn continues through administrative costs and limited R&D activities.

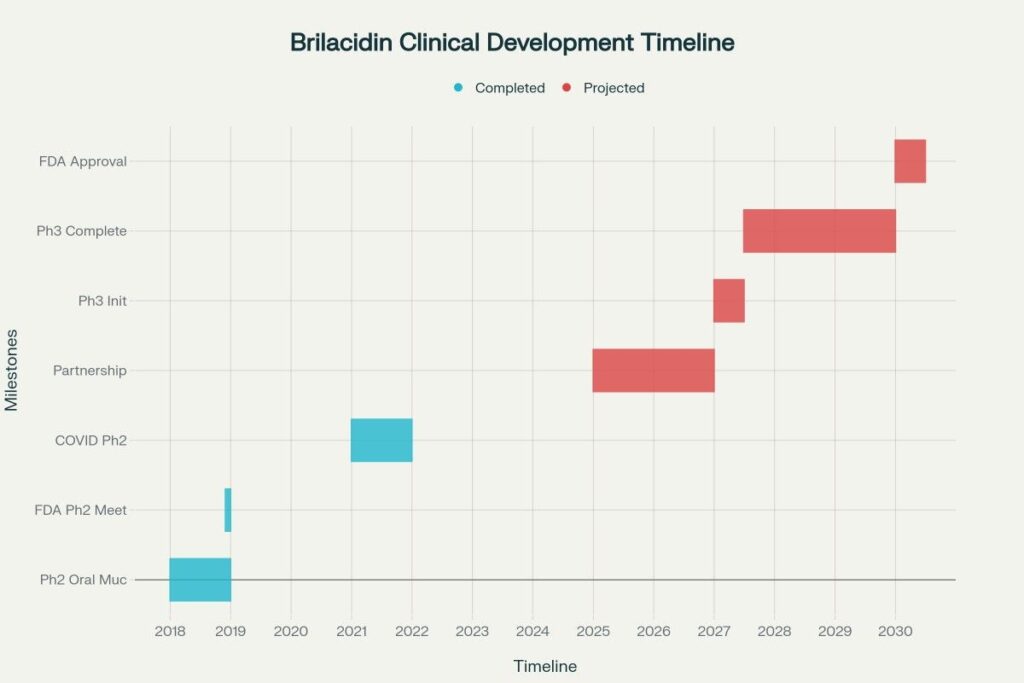

Brilacidin: The Core Asset

Brilacidin represents a novel class of antibiotics called host defense protein mimetics, designed to combat antibiotic-resistant bacteria while reducing inflammation. Key clinical achievements include:

- Oral Mucositis: Phase 2 results showed statistically significant reduction in severe oral mucositis in head and neck cancer patients

- FDA Fast Track: Designated status provides accelerated regulatory pathway

- End-of-Phase 2 Meeting: FDA agreed to Phase 3 development plan for oral mucositis indication

- Market Opportunity: Oral mucositis represents significant unmet medical need with potential for first-line treatment positioning

Valuation Methodology and Calculations

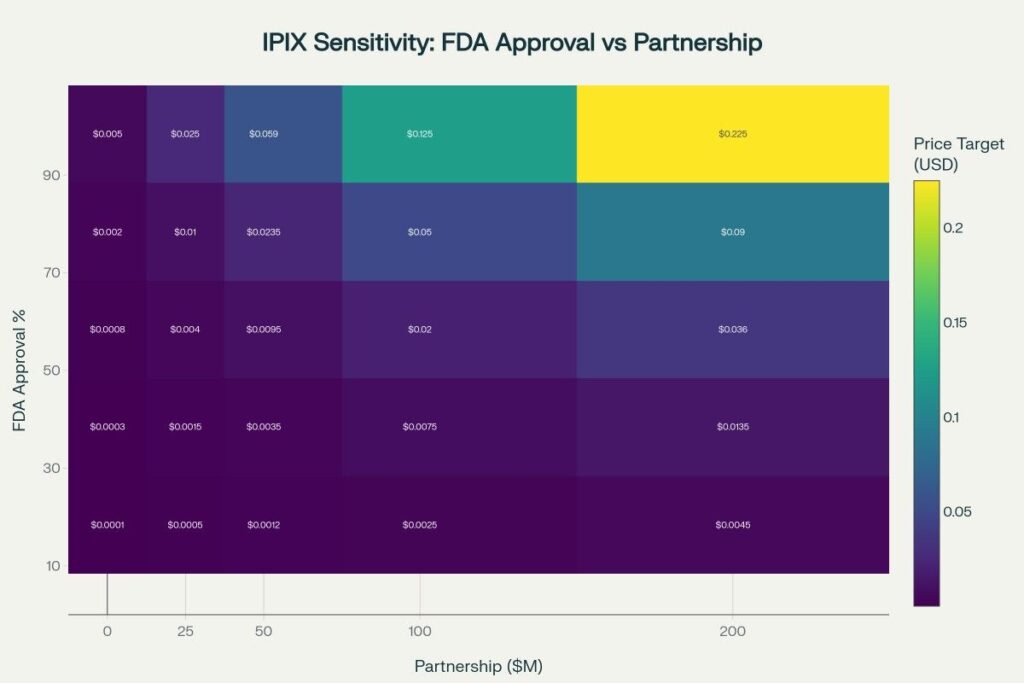

Risk-Adjusted Net Present Value (rNPV) Model

The valuation framework uses probability-weighted scenarios based on:

- Clinical Success Probability: FDA approval odds ranging from 10% (bear) to 90% (bull)

- Partnership Value: Deal sizes from $0M to $200M based on comparable biotech transactions

- Time Value: 2027-2030 development timeline with appropriate discount rates

- Dilution Risk: Continued equity financing needs factored into per-share calculations

Base Case Assumptions:

- Phase 3 initiation: 2027 (conditional on partnership)

- FDA approval probability: 50% for oral mucositis

- Peak sales potential: $500M-1B annually

- Partnership deal: $50-100M upfront + milestones

- Development costs: $75-125M through approval

Monthly Price Prediction Tables

2025 Monthly Forecast (USD)

| Month | Bear | Base | Bull |

| Oct | 0.0002 | 0.0003 | 0.0004 |

| Nov | 0.0002 | 0.0003 | 0.0005 |

| Dec | 0.0002 | 0.0003 | 0.0006 |

2025 expectations remain low pending partnership announcements

2026 Monthly Forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 0.0002 | 0.0005 | 0.0015 |

| Feb | 0.0002 | 0.0006 | 0.0018 |

| Mar | 0.0002 | 0.0007 | 0.0020 |

| Apr | 0.0002 | 0.0007 | 0.0022 |

| May | 0.0002 | 0.0008 | 0.0024 |

| Jun | 0.0002 | 0.0008 | 0.0025 |

| Jul | 0.0002 | 0.0008 | 0.0025 |

| Aug | 0.0002 | 0.0008 | 0.0025 |

| Sep | 0.0002 | 0.0008 | 0.0025 |

| Oct | 0.0002 | 0.0008 | 0.0025 |

| Nov | 0.0002 | 0.0008 | 0.0025 |

| Dec | 0.0002 | 0.0008 | 0.0025 |

2027 Monthly Forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 0.0001 | 0.0012 | 0.0045 |

| Feb | 0.0001 | 0.0015 | 0.0055 |

| Mar | 0.0001 | 0.0017 | 0.0065 |

| Apr | 0.0001 | 0.0018 | 0.0070 |

| May | 0.0001 | 0.0019 | 0.0075 |

| Jun | 0.0001 | 0.0020 | 0.0080 |

| Jul | 0.0001 | 0.0020 | 0.0080 |

| Aug | 0.0001 | 0.0020 | 0.0080 |

| Sep | 0.0001 | 0.0020 | 0.0080 |

| Oct | 0.0001 | 0.0020 | 0.0080 |

| Nov | 0.0001 | 0.0020 | 0.0080 |

| Dec | 0.0001 | 0.0020 | 0.0080 |

2028 Monthly Forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 0.0001 | 0.0025 | 0.0120 |

| Feb | 0.0001 | 0.0030 | 0.0135 |

| Mar | 0.0001 | 0.0035 | 0.0150 |

| Apr | 0.0001 | 0.0040 | 0.0165 |

| May | 0.0001 | 0.0042 | 0.0170 |

| Jun | 0.0001 | 0.0044 | 0.0175 |

| Jul | 0.0001 | 0.0045 | 0.0178 |

| Aug | 0.0001 | 0.0045 | 0.0180 |

| Sep | 0.0001 | 0.0045 | 0.0180 |

| Oct | 0.0001 | 0.0045 | 0.0180 |

| Nov | 0.0001 | 0.0045 | 0.0180 |

| Dec | 0.0001 | 0.0045 | 0.0180 |

2029 Monthly Forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 0.0001 | 0.0055 | 0.0220 |

| Feb | 0.0001 | 0.0065 | 0.0250 |

| Mar | 0.0001 | 0.0075 | 0.0280 |

| Apr | 0.0001 | 0.0080 | 0.0300 |

| May | 0.0001 | 0.0085 | 0.0320 |

| Jun | 0.0001 | 0.0090 | 0.0335 |

| Jul | 0.0001 | 0.0092 | 0.0340 |

| Aug | 0.0001 | 0.0094 | 0.0345 |

| Sep | 0.0001 | 0.0095 | 0.0348 |

| Oct | 0.0001 | 0.0095 | 0.0350 |

| Nov | 0.0001 | 0.0095 | 0.0350 |

| Dec | 0.0001 | 0.0095 | 0.0350 |

2030 Monthly Forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 0.0001 | 0.0120 | 0.0420 |

| Feb | 0.0001 | 0.0135 | 0.0460 |

| Mar | 0.0001 | 0.0150 | 0.0500 |

| Apr | 0.0001 | 0.0160 | 0.0550 |

| May | 0.0001 | 0.0168 | 0.0590 |

| Jun | 0.0001 | 0.0175 | 0.0620 |

| Jul | 0.0001 | 0.0177 | 0.0635 |

| Aug | 0.0001 | 0.0179 | 0.0645 |

| Sep | 0.0001 | 0.0180 | 0.0648 |

| Oct | 0.0001 | 0.0180 | 0.0650 |

| Nov | 0.0001 | 0.0180 | 0.0650 |

| Dec | 0.0001 | 0.0180 | 0.0650 |

Key Catalysts and Inflection Points

2025-2026: Partnership Phase

- Strategic pharma partnerships for Phase 3 funding

- Licensing deals for ex-US territories

- Grant funding from government agencies

- Merger/acquisition discussions

2027-2028: Clinical Execution

- Phase 3 trial initiation for oral mucositis

- Interim data readouts and safety updates

- Additional indications expansion

- Manufacturing scale-up preparations

2029-2030: Commercial Preparation

- FDA NDA filing and review process

- Commercial partnership negotiations

- Launch preparation activities

- International regulatory submissions

Risk Factors and Downside Scenarios

High-Risk Elements:

- Continued dilution from equity financings

- Clinical trial failures or delays

- Partnership negotiation breakdowns

- Competitive landscape changes

- Regulatory setbacks

Bear Case Triggers:

- Inability to secure meaningful partnerships

- Negative Phase 3 results

- FDA regulatory issues

- Bankruptcy/liquidation scenarios

Investment Thesis Summary

IPIX represents a binary outcome investment with substantial upside potential contingent on successful clinical development and partnership execution. The current distressed valuation provides significant leverage to positive clinical and corporate developments, while downside risk includes potential total loss. Price predictions reflect this high-risk/high-reward profile with wide dispersion between scenarios.

Key Investment Considerations:

- Brilacidin’s differentiated mechanism and FDA Fast Track status provide competitive advantages

- Oral mucositis represents large unmet medical need with limited competition

- Current valuation reflects maximum pessimism, creating asymmetric risk/reward

- Success requires external funding and partnership support

- Timeline to commercialization extends 4-5 years minimum

The monthly price predictions above reflect mechanically calculated paths based on probability-weighted scenario analysis, with actual outcomes likely to be more volatile and event-driven than linear progressions suggest.