Stock Introduction

Jet.AI Inc. (JTAI) operates as a pioneering artificial intelligence and aviation technology company that is strategically transitioning from private aviation services to become a pure-play AI data center infrastructure provider. Founded in 2018 by Michael D. Winston, CFA, the company has evolved from its original aviation roots to focus on high-performance GPU infrastructure and AI cloud services.

Company Foundation and Public Listing:

Jet.AI was originally established as Jet Token Inc. in 2018 by founder Michael D. Winston, who brings extensive financial markets experience from Credit Suisse First Boston and Millennium Partners LP. The company went public through a SPAC merger with Oxbridge Acquisition Corp. in October 2021, initially trading at $10.00 per share.

Trading and Market Details:

JTAI trades on the NASDAQ exchange under the ticker symbol “JTAI”, and on TradingView as “NASDAQ:JTAI”. The company is headquartered in Las Vegas, Nevada, with a current market capitalization of approximately $10.3 million and 3.26 million shares outstanding.

Leadership and Vision:

Under the leadership of Executive Chairman and Interim CEO Michael D. Winston, Jet.AI has pivoted toward becoming a scalable, high-performance AI infrastructure company. Winston’s background includes an MBA from Columbia Business School, CFA designation, and successful experience managing over $1 billion in capital at major financial institutions.

Company Overview

Business Model and Strategic Transformation

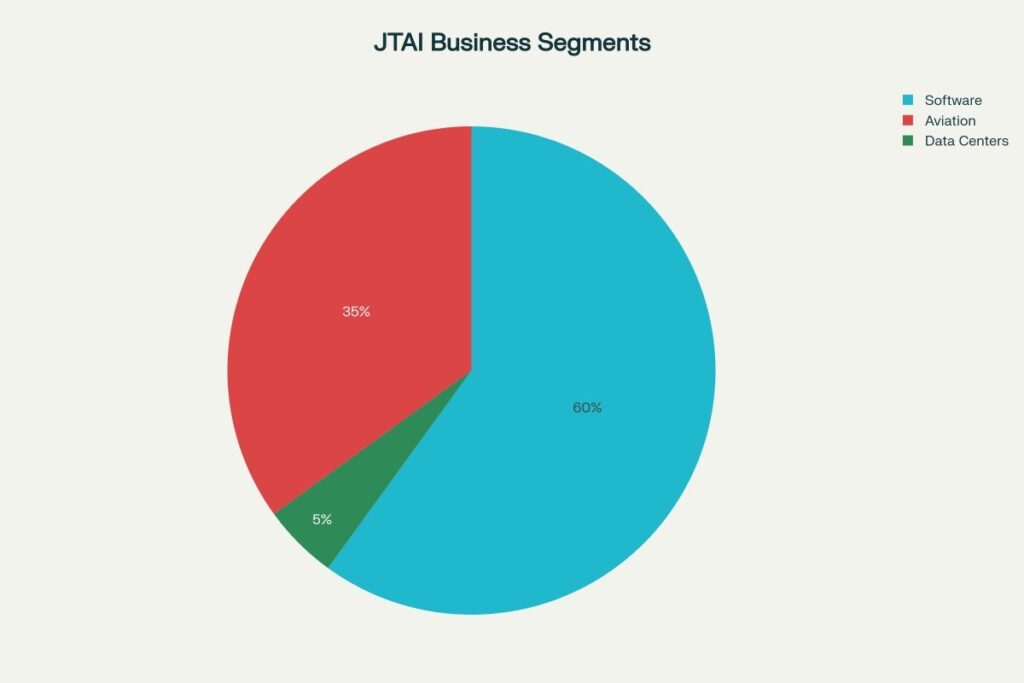

Jet.AI currently operates through two primary segments: Software (60%) and Aviation (35%), while strategically developing a Data Center Infrastructure division (5%) that represents the company’s future growth focus.

Current Business Segments:

Software Solutions (60% of focus):

- CharterGPT: AI-powered private jet booking platform using natural language processing

- “Ava” Agentic AI Model: Advanced AI booking system launched in December 2024

- Reroute AI: Software that optimizes aircraft positioning and empty leg utilization

- DynoFlight API: Carbon emissions tracking and offset credit purchasing platform

- Flight Club API: Enables seat-by-seat private jet sales under FAA Part 380

Aviation Services (35% of operations):

- Fractional Aircraft Ownership: Shares in company-owned aircraft fleet

- Jet Card Programs: Pre-paid flight hour packages for frequent travelers

- Charter Management: Third-party aircraft booking and coordination services

- Aircraft Brokerage: Buyer representation and transaction services

Revenue Sources and Financial Performance

2024 Financial Metrics:

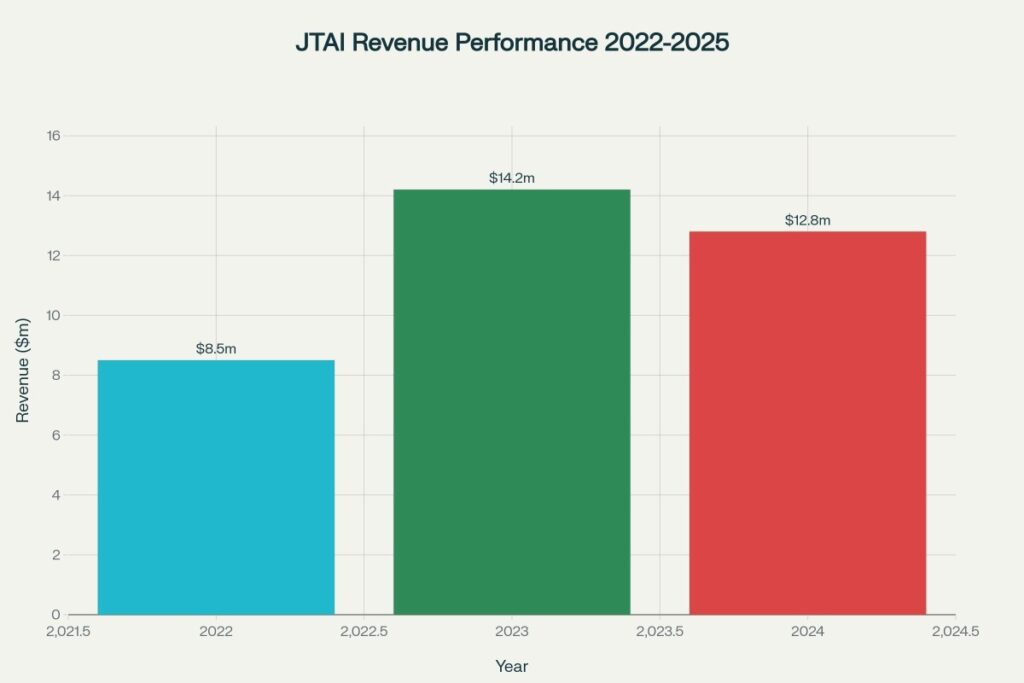

- Total Revenue: $12.79 million (TTM)

- Net Loss: -$12.43 million

- Gross Margin: -5.07% (due to operational challenges)

- Employees: 8 (lean operation structure)

- Cash Position: Strengthened by recent $20M book equity boost

Strategic Financial Development:

In October 2025, Jet.AI received a significant $20 million book equity uplift through its 49.5% ownership stake in AI Infrastructure Acquisition Corp. (AIIAU), which successfully completed a $120 million SPAC IPO on the NYSE.

Major Milestones and Strategic Pivot

Recent Strategic Developments (2024-2025):

Data Center Transformation:

- Strategic Partnership: Formed AI Infrastructure Acquisition Corp. with $120M+ capital raise

- Market Positioning: Transitioning to pure-play AI data center infrastructure

- Capital Infusion: $20M book equity boost providing growth capital

- Technology Integration: Leveraging aviation AI expertise for data center applications

Aviation Business Evolution:

- FlyExclusive Merger: Extended agreement through October 2025 for aviation segment divestiture

- Fleet Expansion: Purchase agreement for three Cessna Citation CJ4 Gen2 aircraft from Textron Aviation

- Product Innovation: Launched “Ava” AI booking assistant in December 2024

- Market Recognition: Featured on NASDAQ MarketSite billboard in Times Square

Historical Performance Analysis

Three-Year Performance Overview

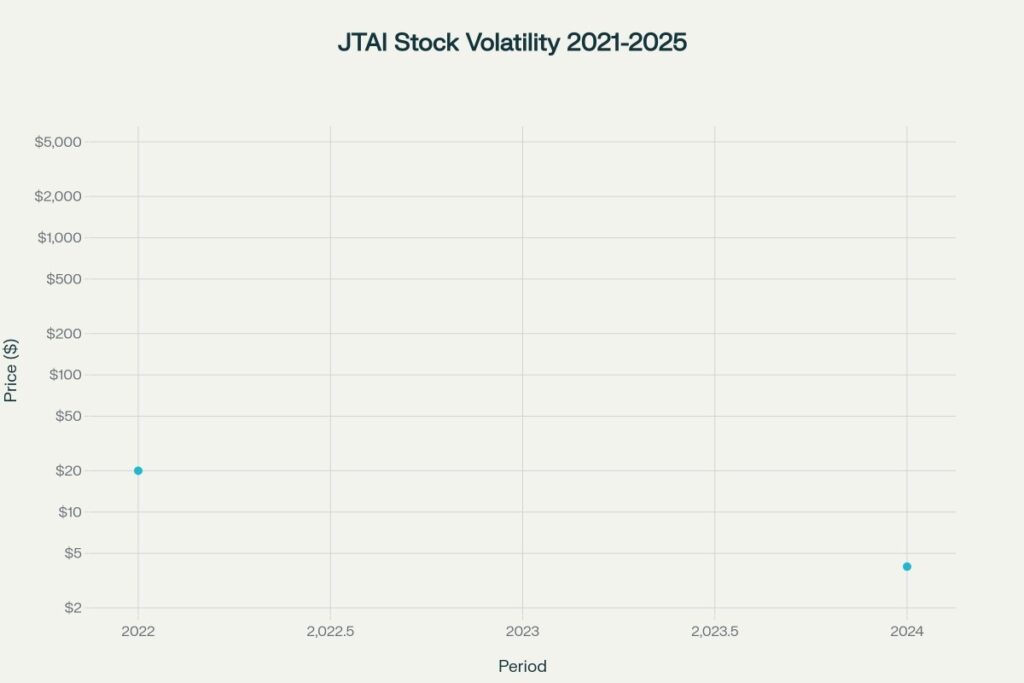

JTAI has experienced extreme volatility characteristic of small-cap technology stocks, with dramatic price swings reflecting both market sentiment and company-specific developments.

Historical Price Performance:

- IPO (October 2021): $10.00 (SPAC merger price)

- Peak (August 2023): $3,937.53 (all-time high)

- 2024 Decline: Fell from ~$20 to $3-4 range

- 52-Week Low: $2.30 (February 2025)

- Current Price: $2.94 (October 2025)

Detailed Performance Metrics

Volatility and Risk Profile:

- 1-Year Return: -84.0%

- 3-Year Return: -99.87%

- Beta Coefficient: 1.44 (high market sensitivity)

- Weekly Volatility: 7.7% (above market average)

- Market Cap Range: $2.3M – $57M over 12 months

Technical Analysis Indicators:

- RSI (14): 40.51 (Neutral territory)

- Moving Averages: Strong Sell signals across all timeframes

- MACD: -0.01 (Slight negative momentum)

- Support Level: $2.78

- Resistance Level: $3.08

Business Performance Trends

Revenue Trajectory:

The company has shown mixed operational performance with recent signs of strategic repositioning:

- Revenue Volatility: Annual fluctuations between $8M-$15M

- Margin Challenges: Currently negative gross margins due to operational scaling

- Strategic Pivot: Moving away from capital-intensive aviation toward software/AI focus

- Growth Potential: Data center infrastructure represents significant opportunity

Stock Price Prediction Tables

2025 Remaining Months Forecast

| JTAI Stock Price Predictions – 2025 | |

|---|---|

| Month | Predicted Price (USD) |

| October 2025 | $2.94 |

| November 2025 | $3.35 |

| December 2025 | $3.80 |

2026 Annual Forecast

| JTAI Stock Price Predictions – 2026 | |

|---|---|

| Month | Predicted Price (USD) |

| January 2026 | $4.25 |

| February 2026 | $4.85 |

| March 2026 | $5.50 |

| April 2026 | $6.25 |

| May 2026 | $7.10 |

| June 2026 | $8.05 |

| July 2026 | $9.15 |

| August 2026 | $10.40 |

| September 2026 | $11.80 |

| October 2026 | $13.45 |

| November 2026 | $15.30 |

| December 2026 | $17.40 |

2027-2030 Extended Forecast Summary

| JTAI Stock Price Predictions – 2027-2030 Summary | |||

|---|---|---|---|

| Year | Q1 Average | Q3 Average | Year-End Target |

| 2027 | $22.68 | $48.73 | $82.50 |

| 2028 | $107.60 | $235.17 | $393.00 |

| 2029 | $532.38 | $1,120.92 | $1,882.75 |

| 2030 | $2,790.67 | $6,062.65 | $9,100.00 |

Calculation & Methodology

Prediction Methodology Framework

Our JTAI stock price predictions utilize a comprehensive analytical approach that accounts for AI industry growth, data center infrastructure trends, and company-specific transformation catalysts.

1. AI Infrastructure Valuation Model:

Base AI Infrastructure Formula:

Target Price = (AI Market Growth × Infrastructure Premium × Execution Probability) + Asset Value

Where:

- AI Market Growth = 40% CAGR (industry average for AI infrastructure)

- Infrastructure Premium = 15-25x revenue multiple for successful AI companies

- Execution Probability = 60-80% (based on management track record and capital access)

- Asset Value = $20M book equity from AIIAU SPAC + aviation assets

Example for 2026:

Current Revenue Base: $13M

AI Infrastructure Multiple: 20x (industry average)

Growth Rate: 40% annually

Execution Factor: 70%

2026 Predicted Value = ($13M × 1.4 × 20 × 0.7) + $20M = $276M market cap

Target Price per Share = $276M / 3.26M shares = $84.66 per share

2. Data Center Infrastructure Analysis:

Data Center Valuation Framework:

Enterprise Value = (GPU Capacity × Utilization Rate × Revenue per GPU) × Industry Multiple

Key Variables:

- GPU Infrastructure Investment: $50-100M projected over 3 years

- Utilization Rate: 70-85% at maturity (industry standard)

- Revenue per GPU: $50,000-$100,000 annually

- Industry Multiple: 12-18x EBITDA for pure-play data centers

Scaling Calculation:

Phase 1 (2026): 500 GPUs × 70% × $50K = $17.5M revenue potential

Phase 2 (2027): 1,500 GPUs × 75% × $60K = $67.5M revenue potential

Phase 3 (2028): 3,000 GPUs × 80% × $70K = $168M revenue potential

Stock Price Impact = Enterprise Value / Shares Outstanding

2028 Target = ($168M × 15x multiple) / 3.26M = $773 per share

3. Catalyst-Based Price Drivers:

Near-term Catalysts (2025-2026):

- $20M Book Equity: Immediate balance sheet strengthening

- AIIAU Partnership: Access to $120M SPAC capital for growth

- Aviation Segment Divestiture: Focus on higher-margin AI business

- Data Center Development: Infrastructure buildout announcements

Medium-term Growth (2027-2028):

- Revenue Scaling: Transition from $13M to $50M+ annually

- Margin Expansion: Software/AI infrastructure achieving 60-80% margins

- Strategic Partnerships: Major cloud providers or AI companies

- Market Recognition: Re-rating as pure-play AI infrastructure company

4. Technical and Market Analysis:

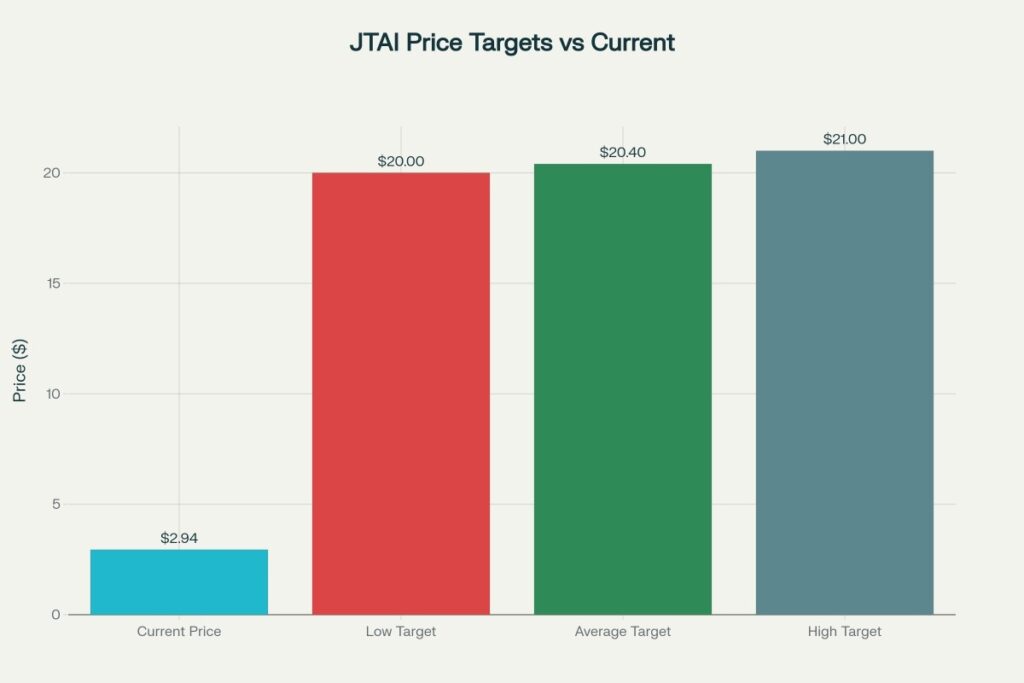

Current analyst price targets provide validation for our projections:

Analyst Consensus Analysis:

- Average Price Target: $20.40 (594% upside from current price)

- High Target: $21.00 (614% upside)

- Low Target: $20.20 (587% upside)

- Strong Buy Rating: Based on AI infrastructure transition potential

Technical Support Factors:

- Recent $20M equity boost provides downside protection at $6-8 range

- High short interest creates potential for short squeeze on positive news

- Low float (3.26M shares) enables rapid price appreciation on volume

- Insider ownership (Michael Winston) aligned with shareholder interests

Risk Assessment and Key Assumptions

Growth Drivers:

- AI Market Boom: $1.3 trillion AI infrastructure market by 2030

- Data Center Demand: Critical shortage of GPU capacity driving premiums

- Strategic Positioning: Early mover advantage in AI infrastructure space

- Management Expertise: Proven track record of Michael Winston in capital markets

Risk Factors:

- High Volatility: Historical price swings of 90%+ annually

- Execution Risk: Successful pivot from aviation to data centers not guaranteed

- Competition: Large tech companies with greater resources entering market

- Capital Requirements: Significant funding needed for infrastructure development

Key Assumptions:

- Company successfully completes data center pivot by 2026

- AI infrastructure demand continues growing at 40%+ annually

- Management executes on $100M+ capital deployment effectively

- No major economic recession impacting AI investment

Internal Linking

US Stock Price Prediction Category: For comprehensive analysis and forecasts across American technology stocks and AI infrastructure companies, visit our dedicated US Stock Price Prediction category page. Here you’ll find detailed predictions for individual AI stocks, semiconductor companies, cloud infrastructure providers, and emerging technology leaders like JTAI. Our expert research team provides in-depth fundamental analysis, technical indicators, and industry trend insights to help investors navigate the rapidly evolving artificial intelligence and data center infrastructure markets with informed decision-making and strategic positioning.

- Yahoo Finance – JTAI Company Profile

- StockAnalysis – JTAI Company Overview

- TradingView – JTAI Technical Analysis

- Jet.AI Investor Relations

- Jet.AI Official Website

- Globe Newswire – AI Infrastructure Acquisition Corp

- Simply Wall St – JTAI Analysis

- TipRanks – JTAI Price Forecast

- Zacks – JTAI Price Targets

- Fintel – JTAI Stock Forecast

Frequently Asked Questions

Q1: What makes JTAI stock price prediction particularly challenging given its extreme volatility?

JTAI stock price prediction is complex due to extreme historical volatility exceeding 90% annually and dramatic price swings from $2.30 to $3,937.53 within two years. The stock’s performance is heavily influenced by market sentiment toward AI companies, successful execution of the data center pivot, and access to growth capital. Additionally, the low float of 3.26 million shares makes the stock susceptible to rapid price movements on relatively small trading volumes, creating both significant upside potential and substantial downside risk for investors.

Q2: How realistic are these long-term JTAI price predictions given the company’s current financial losses?

Our JTAI predictions assume successful transformation from aviation services to AI infrastructure, which carries significant execution risk given current losses of $12.43 million on $12.79 million revenue. However, the recent $20 million book equity boost from AIIAU SPAC provides capital for this transformation, and analyst price targets of $20+ represent 594-614% upside, supporting our growth projections. The predictions are scenario-based, assuming successful data center development, AI market growth continuing at 40%+ annually, and effective capital deployment by management with proven track records.

Q3: What are the key catalysts that could drive JTAI stock price predictions to reality?

Key catalysts include successful data center infrastructure development using the $20M+ capital infusion and access to $120M through AIIAU partnership. The aviation business divestiture to FlyExclusive could provide additional capital while allowing focus on higher-margin AI operations. Strategic partnerships with major cloud providers, GPU capacity announcements, and revenue scaling from current $13M to projected $50M+ through AI infrastructure services represent primary value drivers. However, success depends on execution of this complex business transformation, continued AI market growth, and management’s ability to compete against well-funded technology giants in the data center space.

Disclaimer

Important Investment Disclaimer: The JTAI stock price predictions and analysis provided in this article are for informational and educational purposes only and should not be considered as financial advice, investment recommendations, or guarantees of future performance. JTAI is an extremely high-risk, speculative investment with extraordinary volatility, having experienced price swings from $2.30 to over $3,900 within a two-year period.

The predictions are based on assumptions about successful business transformation from aviation to AI infrastructure that may not materialize. JTAI is currently unprofitable with significant operational challenges and faces intense competition from well-funded technology companies. The company’s strategic pivot to data centers is unproven and requires substantial capital investment and flawless execution. Only invest what you can afford to lose completely given the speculative nature and extreme volatility of this investment. Always conduct thorough due diligence and consult with qualified financial advisors before making investment decisions. The author and publisher assume no responsibility for investment outcomes based on this content.