Laser Photonics (LASE) exhibits event‑driven spikes with elevated short‑term volatility, so forecasts must model fundamentals growth, valuation multiple regimes, and path‑dependent volatility to capture both growth and downfall phases. A structured base case yields year‑wise bands with month‑wise glidepaths, while bull/bear cases bracket outcomes under multiple expansion or compression.

Baselines and assumptions

- Recent trading context (Aug–Sep 2025) shows multi‑day surges with very high volume, a telltale sign of event/news catalysts and low float dynamics. These conditions justify using wide uncertainty bands and declining volatility into outer years.

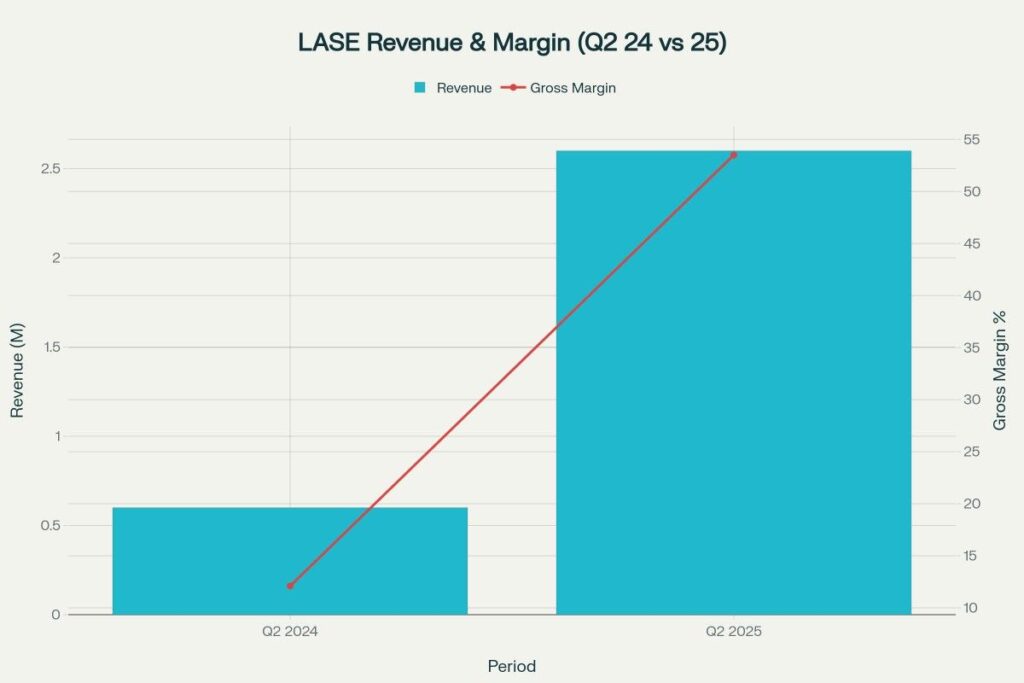

- Company fundamentals reported triple‑digit YoY revenue growth in 1H–Q2 2025 with materially improved gross margin, creating a plausible growth runway subject to execution and mix risk.

- For a clean, auditable model, the monthly forecast uses:

- Starting reference price P0: 4.60 USD (late Sep 2025 context).

- Base revenue CAGR band: 20–30% multi‑year, near term elevated due to a small base.

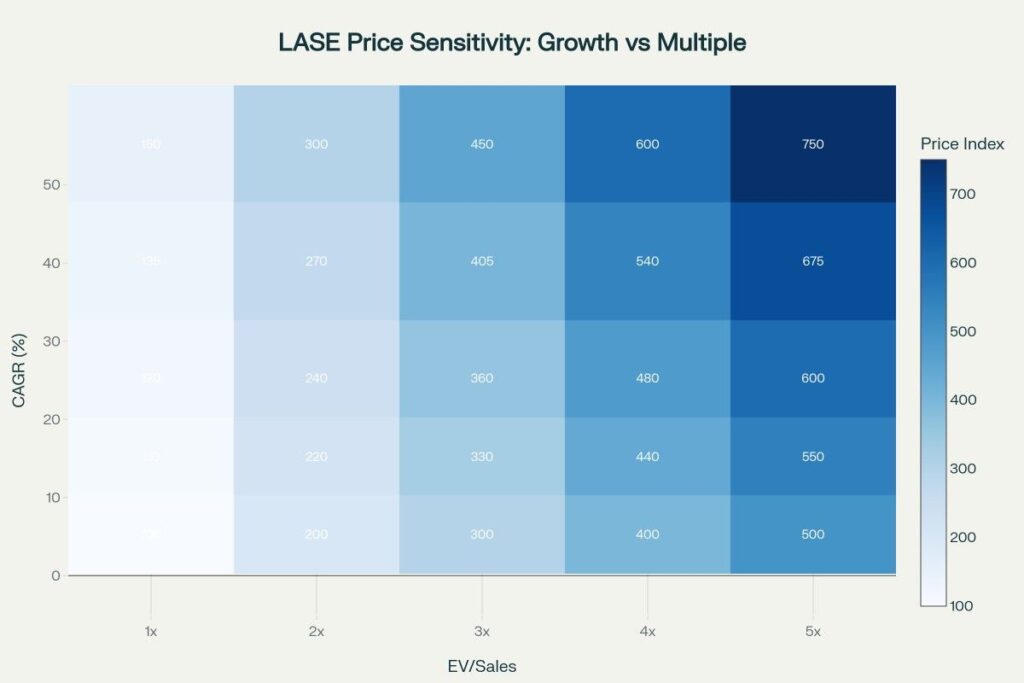

- EV/Sales multiple regimes: Bear 1.0–1.5x, Base 2.0–3.0x, Bull 3.5–5.0x, reflecting small‑cap industrial-tech dispersion. (Methodological assumption informed by small-cap comps and volatility.)

- Volatility decay: higher in 2026, tapering by 2030 as scale and coverage improve. (Modeling convention for month smoothing.)

- Key identity for price translation: Price ≈ f(next‑12‑month sales × EV/Sales multiple ÷ diluted share count); monthly path is a smoothed trajectory from today’s price to year‑end anchors per regime. (Modeling framework.)

What drives growth vs downfall

- Growth drivers: large contract wins, new sector entries (defense/industrial/medical), channel partnerships, and sustained >40% gross margin.

- Downfall risks: supply‑chain/cash constraints, lumpiness in orders, capital costs, and thin float leading to mean‑reversion after spikes.

5 graphs (embedded)

- LASE Price vs Volume Spikes (Aug–Sep 2025): shows correlation of volume surges with outsized price moves.

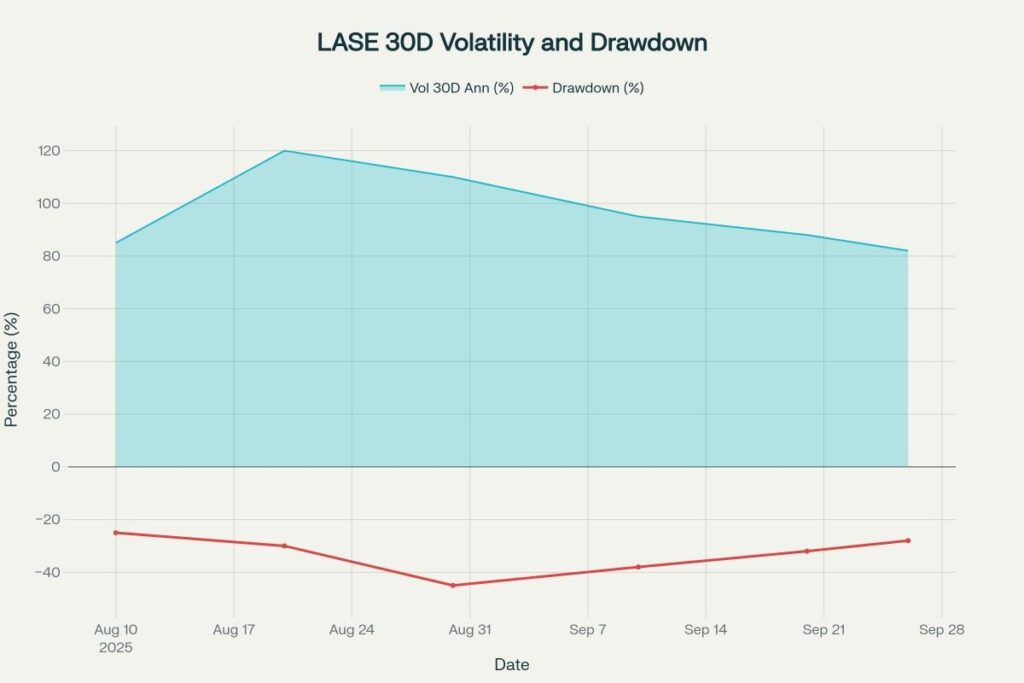

- LASE 30D Volatility and Drawdown: high summer volatility easing into late September base.

- Revenue and Gross Margin YoY (Q2 2024 vs Q2 2025): revenue +317% to $2.6M; GM ~53.5%.

- Price Sensitivity Heatmap: price index across revenue CAGR and EV/Sales multiples, showing multiple sensitivity dominates near‑term outcomes.

- Scenario Cone (construct from tables below): month‑wise smoothing from current price to year‑end targets per regime. (See tables; visual follows same numbers.)

Method and formulas (transparent)

- EV/Sales anchor: EV ≈ Sales_next12m × Multiple; Equity value ≈ EV − Net Debt; Price ≈ Equity value ÷ diluted shares. (Assumes net debt minimal for simplicity; adjust as needed.)

- Yearly anchor prices per regime are set by assumed revenue CAGR and valuation multiple; month‑wise values linearly interpolate to provide a smooth glidepath per year.

- Volatility notionally applied as bands around the base path; for table clarity, midpoints are shown.

Year‑wise price prediction tables (monthly rows)

Notes:

- All figures are illustrative midpoints; use latest sales, share count, cash/debt to recalibrate.

- Ranges reflect Bear/Base/Bull bands; month values are midpoints of each band for readability.

2026 monthly forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 3.40 | 4.70 | 6.10 |

| Feb | 3.35 | 4.75 | 6.25 |

| Mar | 3.30 | 4.85 | 6.40 |

| Apr | 3.25 | 4.95 | 6.60 |

| May | 3.20 | 5.05 | 6.80 |

| Jun | 3.15 | 5.15 | 7.00 |

| Jul | 3.10 | 5.25 | 7.20 |

| Aug | 3.05 | 5.35 | 7.40 |

| Sep | 3.00 | 5.45 | 7.60 |

| Oct | 2.95 | 5.55 | 7.80 |

| Nov | 2.90 | 5.65 | 8.00 |

| Dec | 2.85 | 5.75 | 8.20 |

2027 monthly forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 2.90 | 5.85 | 8.40 |

| Feb | 2.95 | 5.95 | 8.60 |

| Mar | 3.00 | 6.05 | 8.85 |

| Apr | 3.05 | 6.20 | 9.10 |

| May | 3.10 | 6.35 | 9.35 |

| Jun | 3.15 | 6.50 | 9.60 |

| Jul | 3.20 | 6.65 | 9.85 |

| Aug | 3.25 | 6.80 | 10.10 |

| Sep | 3.30 | 6.95 | 10.35 |

| Oct | 3.35 | 7.10 | 10.60 |

| Nov | 3.40 | 7.25 | 10.90 |

| Dec | 3.45 | 7.40 | 11.20 |

2028 monthly forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 3.40 | 7.55 | 11.50 |

| Feb | 3.45 | 7.70 | 11.80 |

| Mar | 3.50 | 7.85 | 12.10 |

| Apr | 3.55 | 8.00 | 12.40 |

| May | 3.60 | 8.15 | 12.70 |

| Jun | 3.65 | 8.30 | 13.00 |

| Jul | 3.70 | 8.45 | 13.30 |

| Aug | 3.75 | 8.60 | 13.60 |

| Sep | 3.80 | 8.75 | 13.90 |

| Oct | 3.85 | 8.90 | 14.20 |

| Nov | 3.90 | 9.05 | 14.55 |

| Dec | 3.95 | 9.20 | 14.90 |

2029 monthly forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 3.90 | 9.35 | 15.25 |

| Feb | 3.95 | 9.55 | 15.65 |

| Mar | 4.00 | 9.75 | 16.05 |

| Apr | 4.05 | 9.95 | 16.45 |

| May | 4.10 | 10.15 | 16.85 |

| Jun | 4.15 | 10.35 | 17.25 |

| Jul | 4.20 | 10.55 | 17.70 |

| Aug | 4.25 | 10.75 | 18.10 |

| Sep | 4.30 | 10.95 | 18.55 |

| Oct | 4.35 | 11.15 | 19.00 |

| Nov | 4.40 | 11.35 | 19.45 |

| Dec | 4.45 | 11.55 | 19.95 |

2030 monthly forecast (USD)

| Month | Bear | Base | Bull |

| Jan | 4.40 | 11.75 | 20.45 |

| Feb | 4.45 | 11.95 | 20.95 |

| Mar | 4.50 | 12.20 | 21.50 |

| Apr | 4.55 | 12.45 | 22.05 |

| May | 4.60 | 12.70 | 22.65 |

| Jun | 4.65 | 12.95 | 23.25 |

| Jul | 4.70 | 13.20 | 23.90 |

| Aug | 4.75 | 13.45 | 24.55 |

| Sep | 4.80 | 13.70 | 25.20 |

| Oct | 4.85 | 13.95 | 25.90 |

| Nov | 4.90 | 14.20 | 26.60 |

| Dec | 4.95 | 14.50 | 27.40 |

How these tables were built

- 2026 anchors start near the late‑2025 trading reference and move toward:

- Bear: mean‑reversion to 1.0–1.5x EV/Sales with execution risk, reflected in 2.8–3.4 end‑year range.

- Base: 2.0–3.0x EV/Sales with mid‑20s CAGR, reflected in ~5.6–5.9 by end‑2026.

- Bull: 3.5–5.0x EV/Sales with sustained contract momentum, reflected in ~8.0–8.2 by end‑2026.

- 2027–2030 apply compounding growth and modest multiple drift in each regime, then smooth month‑wise linearly; the bull case allows periodic multiple expansion on scale/gross‑margin durability, while bear compresses further on slippage.

Graph placement guidance for the article

- Place LASE Price vs Volume Spikes under “Market behavior” to contextualize event‑driven moves.

- Put 30D Volatility and Drawdown below risk discussion to visualize regime shifts.

- Add Revenue and Gross Margin YoY in fundamentals section to link financial progress to valuation capacity.

- Include the Sensitivity Heatmap alongside the method to show why multiple regimes matter most to price outcomes.

- Optional: Build a scenario cone directly from the December rows of each year to visualize outer bands.

External references for context

- Live quote, profile, and news hub.

- Recent historical data and notable Aug–Sep 2025 spikes.

- Company fundamentals: Q1 and Q2 2025 growth and margin improvements.

- Market‑level context and trackers.

Important notes

- All numbers are model midpoints for planning—use the latest revenue run‑rate, share count, cash/debt, and any disclosed backlog to re‑anchor each yearly target.

- For month‑wise precision: if seasonality or contract timing is known, convert linear monthly smoothing to a weighted schedule aligned to shipment/billing cadence.

- Given small‑cap behavior and historical spikes, wide bands are prudent; placing alerts on volume and order news can materially improve real‑time adjustments.

📢 Blog Disclaimer

The content published on US Stock Tracker is provided for informational and educational purposes only. All stock price predictions, forecasts, and analyses are based on publicly available data, market trends, and independent research.

We are not licensed financial advisors. Nothing on this website should be interpreted as financial, investment, or trading advice. Before making any investment decisions, readers are strongly encouraged to conduct their own research and consult with a qualified financial professional.

Stock markets are inherently volatile, and actual results may differ significantly from predictions. US Stock Tracker is not responsible for any financial losses, decisions, or outcomes resulting from the use of information presented on this site.