A reasonable private-share target range for Mode Mobile in 2025 is $0.15–$0.55, with a base case near $0.32 anchored to recent crowdfunding prices, top-line growth, and EV/Sales sensitivity checks under plausible dilution assumptions.

This forecast explicitly references Mode Mobile’s recent private-round pricing and operating disclosures, not unrelated public tickers or the MODE crypto asset, to avoid misidentification and ensure relevance to pre‑IPO equity pricing in 2025.

Company snapshot

Mode Mobile operates a rewards-driven smartphone ecosystem that monetizes user attention via EarnOS and EarnPhone, reporting tens of millions in cumulative revenue and a large registered beta user base across 170+ countries as it prepares for public markets.

Management communications and investor materials emphasize a consumer-facing model, strong user traction, and a roadmap to expand licensing and international monetization beyond a historically U.S.-heavy revenue mix.

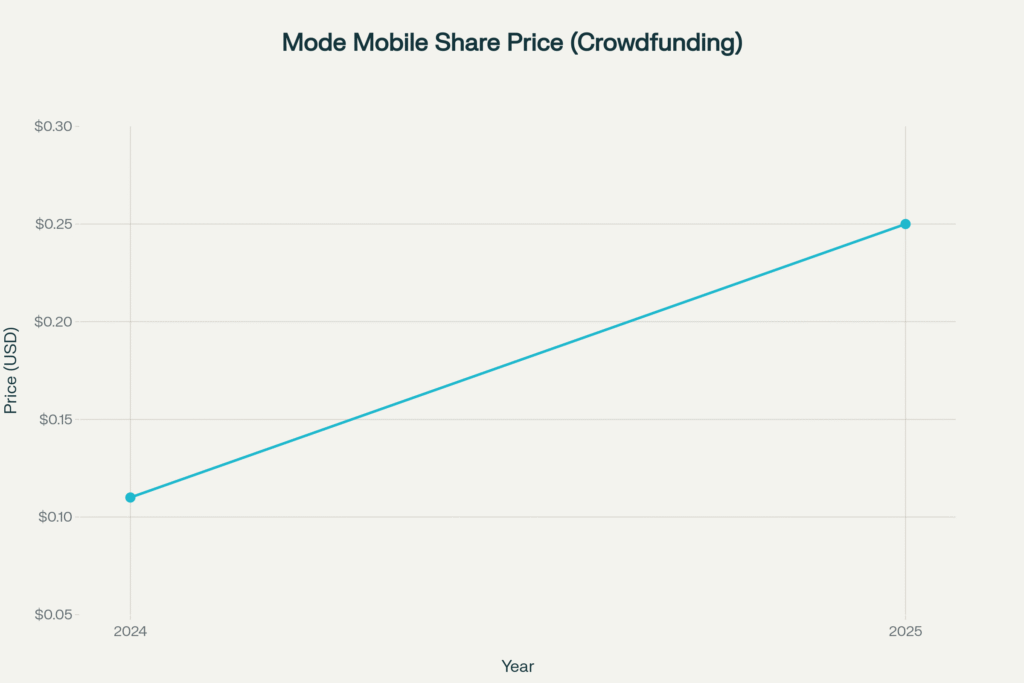

Recent private pricing

Recent private offerings progressed from roughly $0.11 per share in 2024 (Republic) to $0.25 per share in 2025 (FrontFundr), establishing the core price anchors used in this prediction framework.

An independent tracker also notes a contemporaneous $0.30 per-share reference in a 2025 DealMaker-linked review, highlighting platform-to-platform variation and timing effects during ongoing raises.

Mode Mobile’s mid‑year 2025 communications reiterated forward-looking growth and earnings discussions on its scheduled financial call, reinforcing that pricing and valuation remain closely tied to execution milestones pre‑IPO.

Chart: Private share price trend (2024 → 2025)

Mode Mobile private share prices in recent crowdfunding rounds

Growth versus setbacks

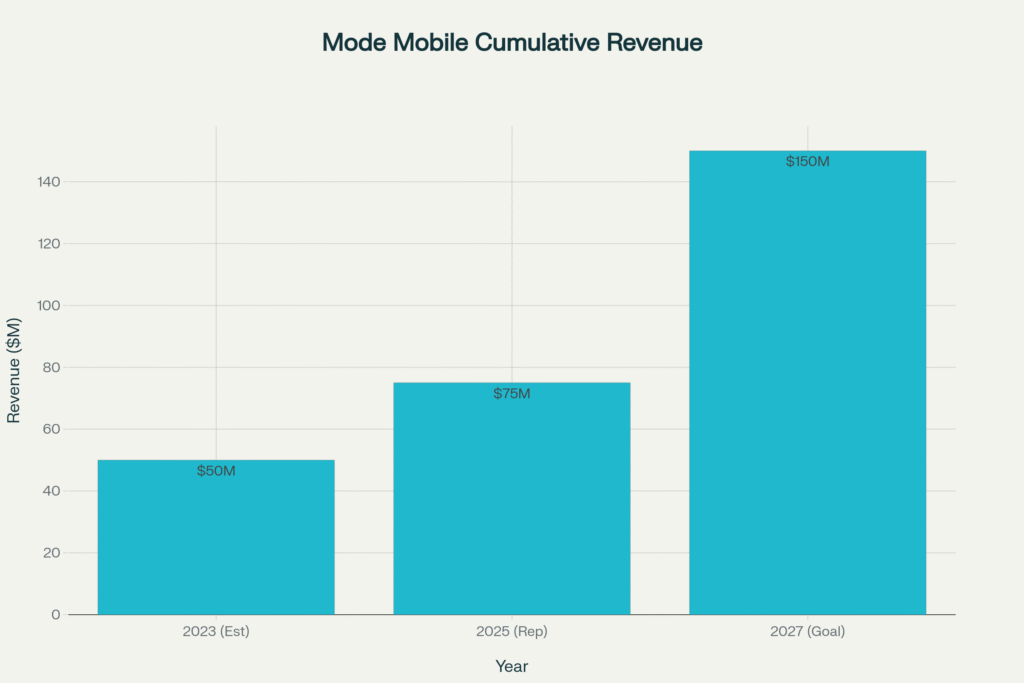

Cumulative revenue statements from Mode Mobile and investor pages cite $50M+ historically, while third-party coverage suggests momentum through 2024 and into 2025, with management and media posts indicating mid‑eight figure annualized traction at year-end 2024.

The company also communicated cumulative capital commitments and cross-listed crowdfunding successes across Republic, Seedrs, and FrontFundr, supporting ongoing scaling but implying potential future dilution if growth is funded by equity raises rather than cash flow.

Chart: Cumulative revenue milestones

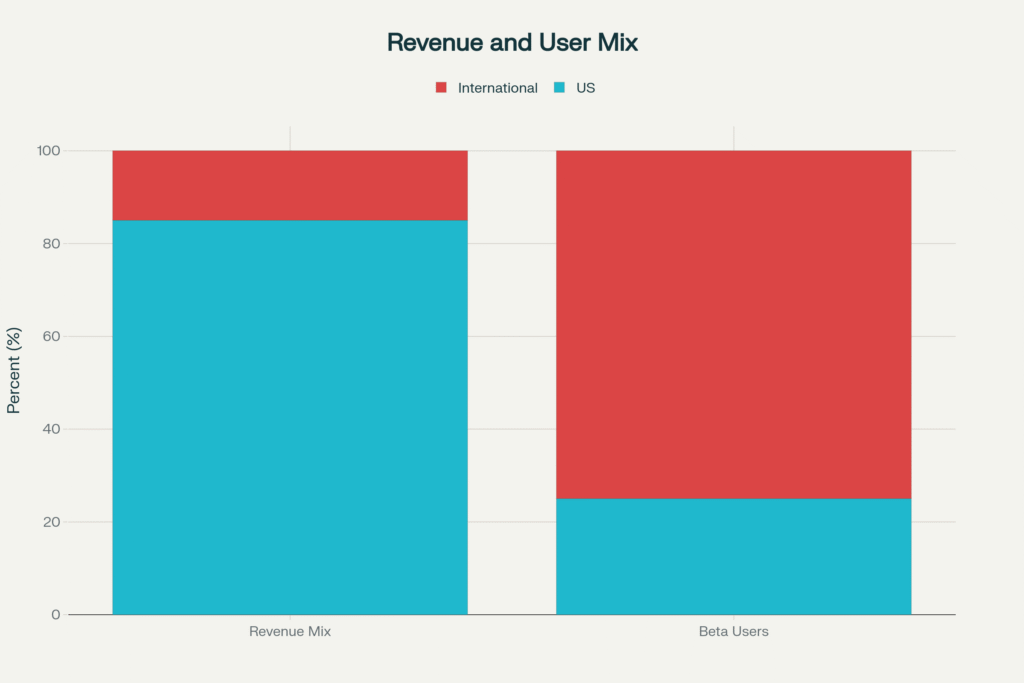

U.S. revenue vs global users

Disclosures emphasize that a large portion of realized revenue skews toward the United States, while a majority of registered beta users are international, suggesting future activation upside if licensing and ad-yield models localize effectively outside the U.S..

This imbalance frames the investment thesis: sustained U.S. monetization provides a base while international conversion offers optionality for step‑ups in daily active users and yield per user over time.

Chart: US-heavy revenue vs international-heavy users

Price prediction method

A simple scenario formula is used: Target = P 0 × ( 1 + g − d ) × s Target=P 0 ×(1+g−d)×s, where g g is growth premium, d d is dilution penalty, and s s is a sentiment factor bounded 0.8–1.2 for near‑term risk-on/risk-off effects, which reflects private-round dynamics rather than exchange-driven intraday volatility

- Bear: modest growth and higher dilution with risk-off sentiment yields ~$0.15–$0.18 per share, aligning with the lower bound for adverse fundraising or execution conditions in 2025.

- Base: balanced growth and dilution at neutral sentiment yields ~$0.28–$0.35 per share, centering near ~$0.32 as the most likely outcome if user monetization and U.S. yield stabilize while international activation begins.

- Bull: strong growth, controlled dilution, and risk-on sentiment yields ~$0.45–$0.55 per share, which requires meaningful licensing traction and efficient capital formation in 2025.

Chart: 2025 scenario target prices

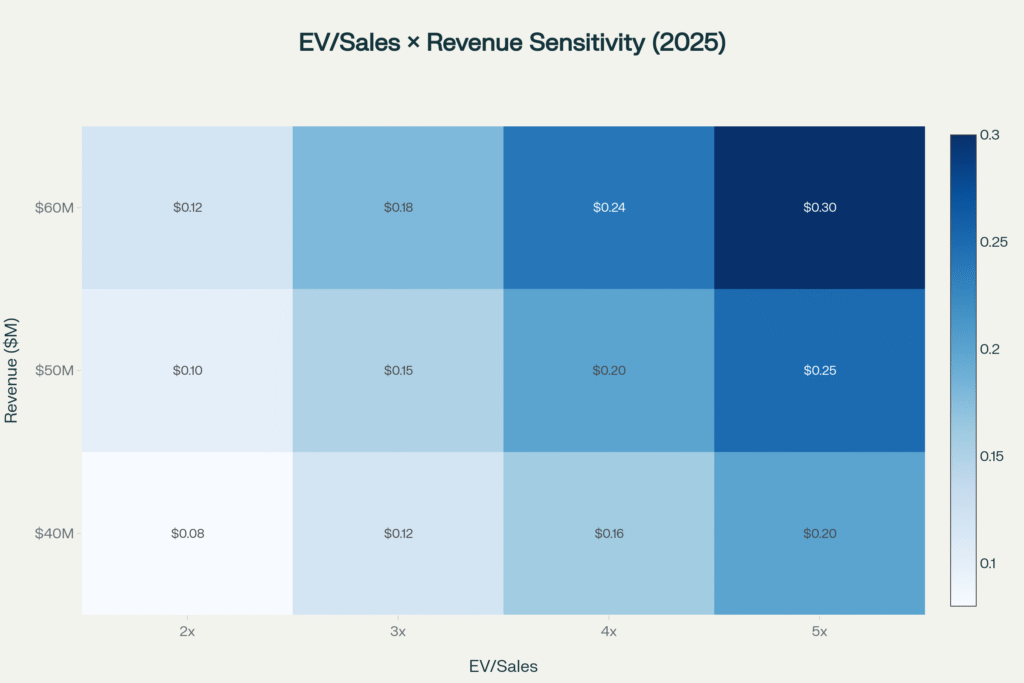

EV/Sales cross-check

To cross-check scenarios with a fundamentals lens, a pre‑IPO EV/Sales framework is applied to a $40–$60M revenue band and a notional fully diluted share count of ~1,000M, which is a simplifying placeholder for sensitivity rather than a representation of any formal cap table.

At 2–5× EV/Sales on $40–$60M, implied per‑share estimates roughly span $0.08–$0.30 under the 1,000M-share assumption, which triangulates with the scenario outputs and emphasizes the importance of revenue scale and dilution control on per‑share value.

Chart: EV/Sales × revenue sensitivity (per‑share)

Catalysts and risks

Catalysts for upside include EarnOS licensing to device partners, increased ad integrations, and measurable gains in international DAU monetization, which collectively can expand revenue and compress unit costs as scale advantages kick in pre‑IPO.

Key risks include higher-than-expected dilution from extended fundraising cycles, user churn, platform policy shifts, and execution delays in large‑scale international activation, any of which can push private share pricing toward the bear scenario.

2025 price conclusion

Synthesizing private-round anchors, reported operating momentum, and EV/Sales sensitivity suggests a 2025 private-share target range of $0.15–$0.55, with a base case near $0.32 if growth and dilution roughly balance and sentiment remains neutral in the run‑up to any public listing plans.

This range is meant for pre‑IPO private equity context and should not be conflated with public market tickers or unrelated assets named MODE that may trade under different instruments and dynamics during 2025.

Notes on sources and scope

This article draws on Mode Mobile’s investor pages, crowdfunding updates, independent deal trackers, and press coverage to reflect private-market pricing and operating disclosures rather than exchange-traded market data, which is not applicable until an IPO or direct listing is consummated.

All projections remain contingent on execution, capital formation terms, macro conditions, and policy factors that can materially affect early-stage consumer and adtech business outcomes in short timeframes.