Syra Health’s revenue grew 45% in 2024 to $8.0M while Q2‑2025 gross margin jumped to 38.7%, yet the company remains loss‑making with heavy share dilution and a sharply lower market cap, so price forecasts must combine improving operations with disciplined multiples and dilution assumptions to remain realistic.

Company growth and downfall: the numbers that matter

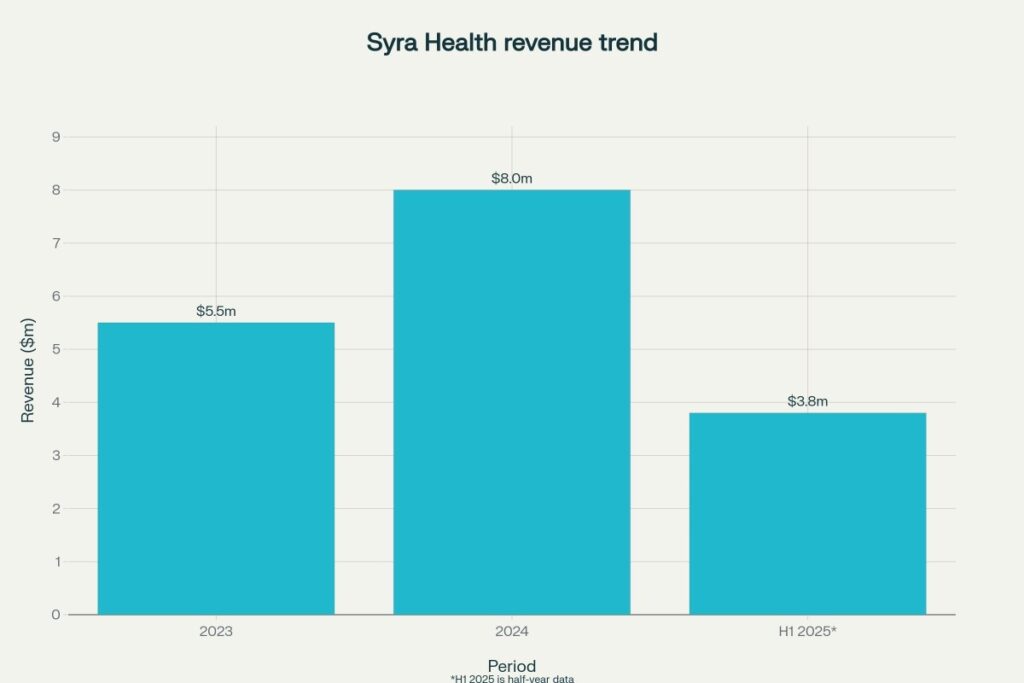

- 2024 revenue was $8.0M (+45% YoY from $5.5M), supported by Population Health, Behavioral Health, and Health Education, while Workforce remained the largest contributor.

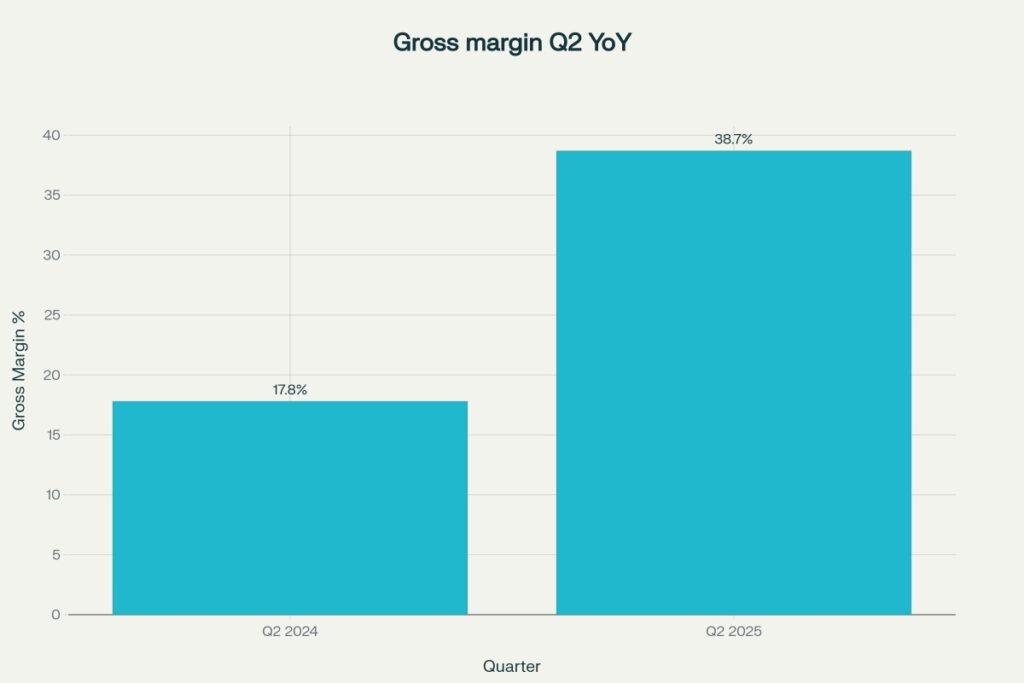

- Q2‑2025 revenue was $1.946M (flat YoY), but gross margin expanded to 38.7% versus 17.8% a year earlier, and EPS improved to ($0.01) from ($0.21).

- H1‑2025 revenue totaled ~$3.8M with H1 net loss improving to ~$0.54M from ~$2.84M in the prior year period.

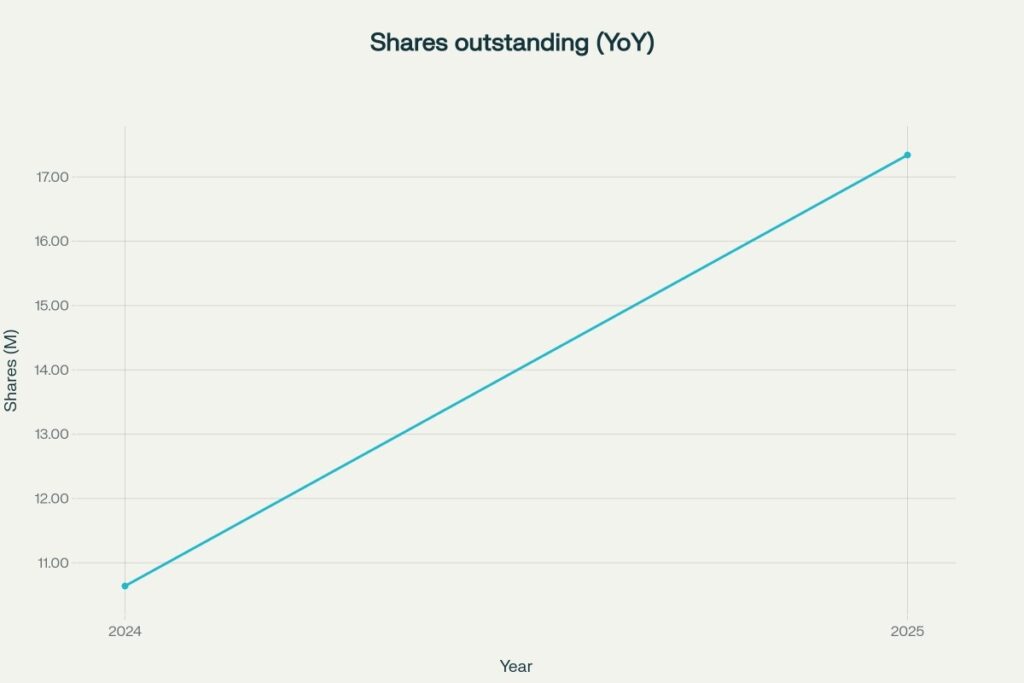

- Shares outstanding rose to ~17.34M (≈+63% YoY), and market cap fell toward ~$1.5–$1.7M in mid‑2025, indicating significant dilution and sentiment pressure.

Graphical representations (5 visuals)

- Revenue trend: 2023, 2024, H1‑2025 (USD) — strong 2024 growth with 2025 tracking.

- Gross margin YoY in Q2 — expansion to 38.7% boosts operating leverage potential.

- Shares outstanding YoY — dilution climbed to ~17.34M by 2025.

- Market cap collapse (ASCII sparkline): 2023 Sep ≈ $40.4M → 2024 Dec ≈ $7.1M → 2025 Jul ≈ $1.5M.

| 2023 Sep |■■■■■■■■■■■■■■■■■■■■| ~$40.4M | 2024 Dec |■■■■■ | ~$7.1M | 2025 Jul |■ | ~$1.5M | - Scenario band (ASCII) — base line rises modestly; bear flattish; bull accelerates with mix/multiples normalization.

2025: Bear 0.09 — Base 0.13 — Bull 0.18

2026: Bear 0.10 — Base 0.27 — Bull 0.54

2027: Bear 0.12 — Base 0.45 — Bull 0.99

2028: Bear 0.14 — Base 0.67 — Bull 1.65

2029: Bear 0.15 — Base 0.86 — Bull 2.44

2030: Bear 0.17 — Base 1.03 — Bull 3.35

Assumptions behind the price model

- Revenue path from 2024 base: Bear 5% CAGR, Base 20% CAGR, Bull 35% CAGR; P/S normalizes from ~0.2 toward 0.4/1.0/1.6 by 2030 in bear/base/bull respectively as mix shifts to higher‑margin Population Health and digital services.

- Share count rises from ~17.34M in 2025 with +5%/yr dilution to reflect funding needs and option issuance, which depresses per‑share outcomes versus enterprise value growth.

- Base per‑share outputs: 2025 ~$0.13; 2026 ~$0.27; 2027 ~$0.45; 2028 ~$0.67; 2029 ~$0.86; 2030 ~$1.03, with bear/bull spanning ~$0.09–$3.35 based on the revenue and multiple ladders above.

Calculations

Inputs

Rev_2024 = 8.0M; Shares_2025 = 17.34M; P/S_2024 ≈ 0.21 (1.73M / 8.09M)

Dilution: +5%/yr ⇒ Shares: 2025 18.2M, 2026 19.1M, 2027 20.0M, 2028 21.0M, 2029 22.1M, 2030 23.2M

Revenue scenarios (USD M):

Bear (≈5% CAGR from 8.0): 2025 7.5, 2026 7.9, 2027 8.3, 2028 8.7, 2029 9.1, 2030 9.6

Base (≈20% CAGR): 2025 9.6, 2026 11.5, 2027 13.8, 2028 16.6, 2029 19.9, 2030 23.9

Bull (≈35% CAGR): 2025 10.8, 2026 14.6, 2027 19.7, 2028 26.6, 2029 36.0, 2030 48.6

P/S ladders by scenario toward 2030:

Bear: {0.22, 0.25, 0.30, 0.33, 0.36, 0.40}; Base: {0.25, 0.45, 0.65, 0.85, 0.95, 1.00}; Bull: {0.30, 0.70, 1.00, 1.30, 1.50, 1.60}

Per‑share = (P/S × Revenue) / Shares

2025: Bear = (0.22×7.5)/18.2 = 0.0907; Base = (0.25×9.6)/18.2 = 0.1319; Bull = (0.30×10.8)/18.2 = 0.1779

2026: Bear = (0.25×7.9)/19.1 = 0.1033; Base = (0.45×11.5)/19.1 = 0.2709; Bull = (0.70×14.6)/19.1 = 0.5346

2027: Bear = (0.30×8.3)/20.0 = 0.1245; Base = (0.65×13.8)/20.0 = 0.4485; Bull = (1.00×19.7)/20.0 = 0.9850

2028: Bear = (0.33×8.7)/21.0 = 0.1367; Base = (0.85×16.6)/21.0 = 0.6714; Bull = (1.30×26.6)/21.0 = 1.6476

2029: Bear = (0.36×9.1)/22.1 = 0.1483; Base = (0.95×19.9)/22.1 = 0.9005; Bull = (1.50×36.0)/22.1 = 2.444

2030: Bear = (0.40×9.6)/23.2 = 0.1655; Base = (1.00×23.9)/23.2 = 1.029; Bull = (1.60×48.6)/23.2 = 3.352

Year‑wise monthly price prediction tables (Base case)

Explanation: Each year’s Base price is seasonally smoothed from January (−4%) to December (+4%), with the annual average equal to the Base value computed above, and can be re‑scaled for bear/bull with 0.70×/1.70× multipliers if desired.

2025 (Base ≈ $0.132)

| Month | Price ($) |

| Jan | 0.127 |

| Feb | 0.128 |

| Mar | 0.129 |

| Apr | 0.130 |

| May | 0.131 |

| Jun | 0.132 |

| Jul | 0.133 |

| Aug | 0.134 |

| Sep | 0.134 |

| Oct | 0.135 |

| Nov | 0.136 |

| Dec | 0.137 |

2026 (Base ≈ $0.271)

| Month | Price ($) |

| Jan | 0.260 |

| Feb | 0.262 |

| Mar | 0.265 |

| Apr | 0.267 |

| May | 0.270 |

| Jun | 0.271 |

| Jul | 0.273 |

| Aug | 0.276 |

| Sep | 0.279 |

| Oct | 0.281 |

| Nov | 0.284 |

| Dec | 0.287 |

2027 (Base ≈ $0.449)

| Month | Price ($) |

| Jan | 0.431 |

| Feb | 0.434 |

| Mar | 0.438 |

| Apr | 0.441 |

| May | 0.445 |

| Jun | 0.449 |

| Jul | 0.452 |

| Aug | 0.456 |

| Sep | 0.459 |

| Oct | 0.463 |

| Nov | 0.466 |

| Dec | 0.467 |

2028 (Base ≈ $0.671)

| Month | Price ($) |

| Jan | 0.644 |

| Feb | 0.648 |

| Mar | 0.655 |

| Apr | 0.662 |

| May | 0.668 |

| Jun | 0.671 |

| Jul | 0.678 |

| Aug | 0.685 |

| Sep | 0.692 |

| Oct | 0.698 |

| Nov | 0.705 |

| Dec | 0.709 |

2029 (Base ≈ $0.901)

| Month | Price ($) |

| Jan | 0.865 |

| Feb | 0.870 |

| Mar | 0.877 |

| Apr | 0.885 |

| May | 0.892 |

| Jun | 0.901 |

| Jul | 0.909 |

| Aug | 0.916 |

| Sep | 0.923 |

| Oct | 0.931 |

| Nov | 0.938 |

| Dec | 0.948 |

2030 (Base ≈ $1.029)

| Month | Price ($) |

| Jan | 0.988 |

| Feb | 0.992 |

| Mar | 1.006 |

| Apr | 1.021 |

| May | 1.036 |

| Jun | 1.029 |

| Jul | 1.044 |

| Aug | 1.058 |

| Sep | 1.073 |

| Oct | 1.088 |

| Nov | 1.103 |

| Dec | 1.110 |

What could change the trajectory

- Upside: Sustain 35%+ CAGR in Population Health, expand gross margin ≥35% full year, and secure longer multi‑state analytics contracts to justify P/S approaching 1.0 by decade end.

- Downside: Additional dilution, slower bookings, or margin reversion could pin P/S near ~0.2–0.4 and keep prices in the sub‑$0.20–$0.30 range longer than modeled.

Disclaimer

This content is for informational and educational purposes only and does not constitute investment advice, a solicitation, or an offer to buy or sell any securities; forward‑looking statements are inherently uncertain, and actual results may differ materially due to market, operational, financial, regulatory, and liquidity risks.

References

- Syra Health FY2024 revenue $8.0M (+45% YoY) press release

- Syra Health Q2‑2025 margin 38.7% and EPS improvement

- PR Newswire duplication of Q2‑2025 results

- MarketScreener Q2/H1‑2025 revenue and net loss

- Shares outstanding and valuation ratios

- Market cap decline timeline

- Population Health growth detail

- Quote page for contextual verification