Cryptocurrency Introduction

Tevaera Coin Price Prediction: Tevaera (TEVA) is an innovative blockchain gaming token that powers a comprehensive onchain gaming ecosystem built on zkSync’s ZK Stack technology. Founded by Robin Babu and Gav Negi, Tevaera emerged as a pioneering solution to the challenges facing Web3 gaming, including unfriendly user experiences and steep learning curves. The project launched its Initial Exchange Offering (IEO) on December 25-27, 2024, on major platforms including Gate.io and KuCoin, with an initial offering price of $0.015 per token.

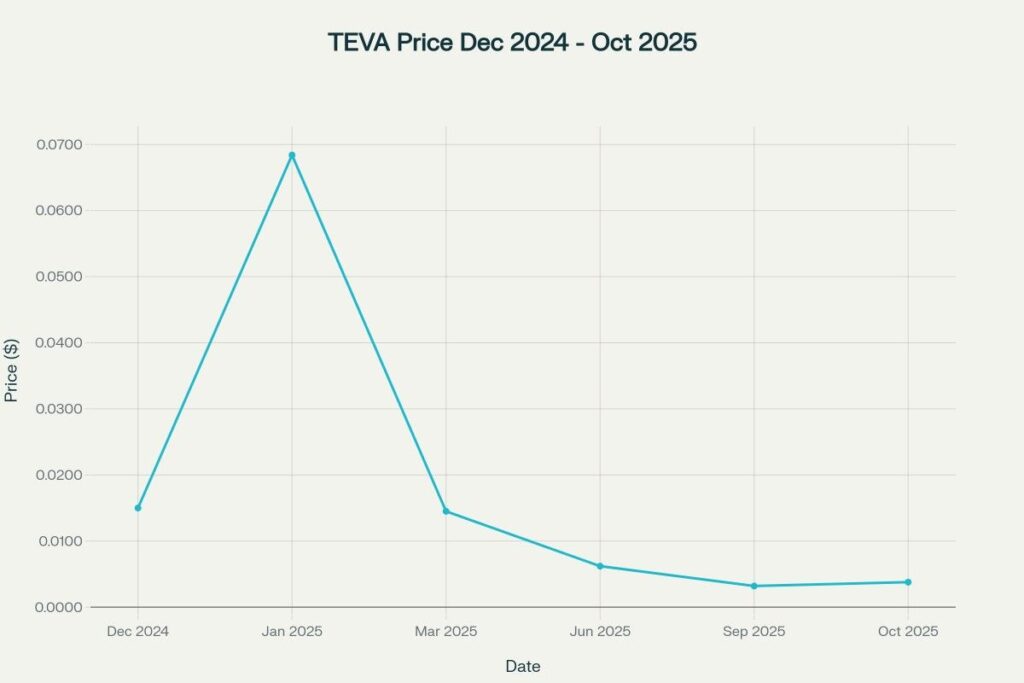

Unlike traditional stocks with IPO launches, Tevaera conducted a Token Generation Event (TGE) and began trading on December 27, 2024, on multiple cryptocurrency exchanges. The token achieved remarkable initial success, reaching an all-time high of $0.0684 on January 3, 2025, representing a 356% gain from its IEO price within just one week of launch. This dramatic appreciation reflected strong initial investor interest in the blockchain gaming sector.

Tevaera secured $5 million in strategic funding in April 2024, led by Laser Digital (part of Nomura Group) with participation from prestigious investors including HashKey Capital, Fenbushi Capital, and Animoca Brands. This institutional backing validated Tevaera’s vision of creating a unified gaming platform where players truly own their in-game assets and participate in a sustainable play-to-earn economy.

TradingView Symbol: While not yet listed on TradingView’s main platform, TEVA trades under the symbol TEVAUSD on crypto-focused charting platforms

Platform Overview

Tevaera operates as a full-stack blockchain gaming platform that brings together guilds, games, governance, and markets into one seamless ecosystem powered by Teva Protocol. The platform’s business model centers on creating a self-sovereign gaming economy where tokenized guilds and native games drive user engagement and token utility through multiple revenue mechanisms.

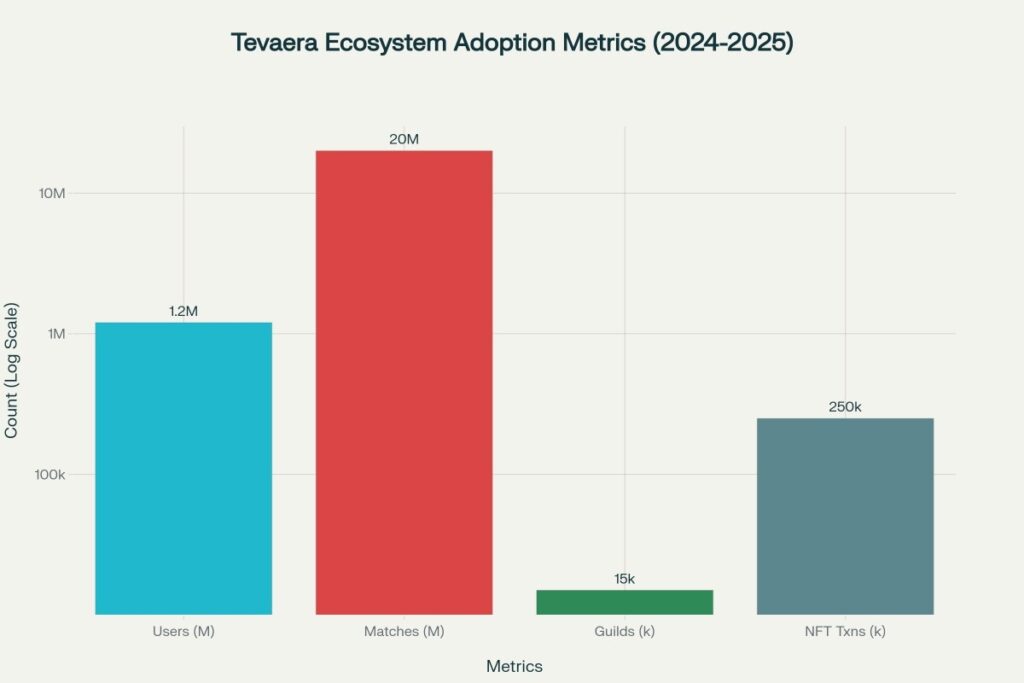

The ecosystem’s major operational components include Teva Chain (a Layer 3 gaming hyperchain built on zkSync), Teva Market (an NFT marketplace for in-game assets), Teva DEX (a decentralized exchange for gaming tokens), and multiple native games including the flagship title Teva Run. These integrated platforms create a comprehensive gaming environment that has already achieved significant traction with over 1.2 million Soulbound Gamers and 20 million multiplayer matches played.

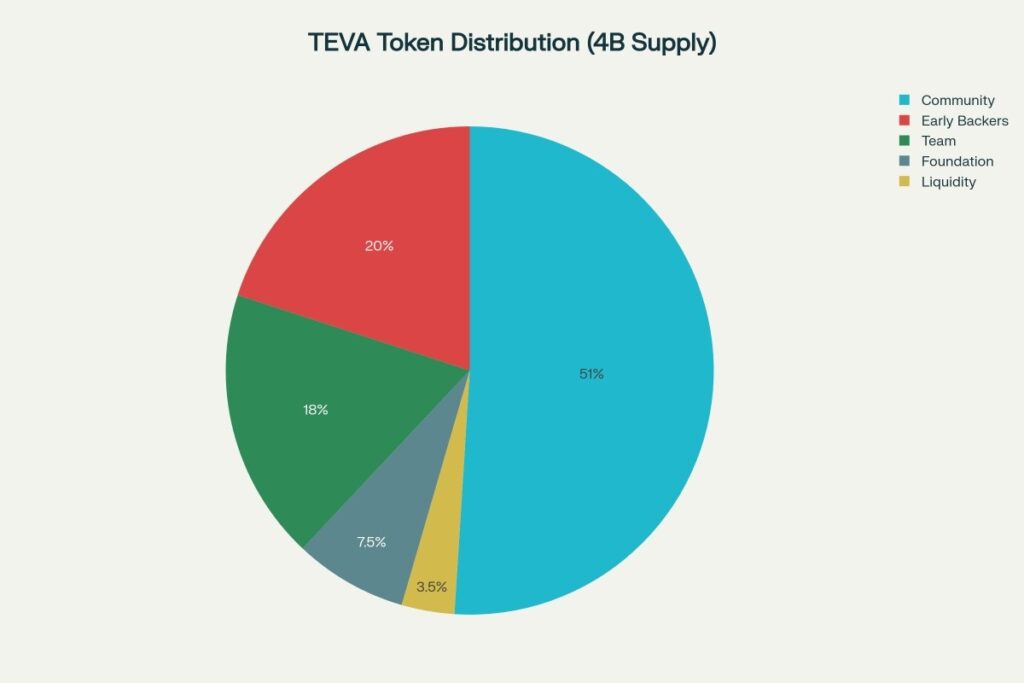

Revenue sources for the Tevaera ecosystem include transaction fees on Teva Chain (paid in TEVA tokens), marketplace commissions on NFT trades, DEX trading fees, and platform services for game developers utilizing Teva Stack’s SDKs and APIs. The platform employs a sustainable tokenomics model with 51% of the 4 billion total token supply allocated to community and ecosystem growth, ensuring long-term incentive alignment.

Major growth milestones include launching Teva Run across web, iOS, and Android platforms, establishing partnerships with leading blockchain infrastructure providers, and building a thriving community of 15,000+ active gaming guilds. The platform’s integration with zkSync Era ensures fast, low-cost transactions secured by Ethereum’s consensus, addressing the scalability challenges that have plagued earlier blockchain gaming attempts.

Historical Performance Analysis

Tevaera’s price history, while brief, demonstrates the typical volatility pattern of newly launched gaming tokens. Since its IEO launch at $0.015 on December 27, 2024, TEVA experienced a dramatic rally to $0.0684 within one week as early adopters and gaming enthusiasts accumulated positions. This 356% initial surge reflected market enthusiasm for Tevaera’s innovative approach to blockchain gaming and strong institutional backing.

Following the initial euphoria, TEVA entered a price discovery and consolidation phase, declining to a low of $0.0032 on September 28, 2025, representing a 95% correction from its all-time high. This steep correction is typical for new token launches and reflects profit-taking by early investors, broader cryptocurrency market weakness, and the reality of token unlock schedules bringing additional supply to market.

Currently trading around $0.00378, TEVA has shown signs of stabilization with a market capitalization of approximately $2.4 million and 640.9 million tokens in circulation out of a 4 billion maximum supply. The token maintains 24-hour trading volumes ranging from $700,000 to $1.3 million, indicating sustained interest despite the price correction.

Ecosystem growth metrics provide a more encouraging picture than price performance alone. The platform has achieved 20 million multiplayer matches, 1.2 million registered users, 15,000 active tokenized guilds, and 250,000 NFT transactions on Teva Market. These engagement metrics demonstrate that Tevaera is building real utility and user adoption, which historically precedes sustainable token price appreciation in the gaming sector.

The token distribution model shows strong community focus with 51% allocated to community and ecosystem growth, while team and advisor tokens remain subject to 12-month cliffs and 48-month vesting periods, reducing near-term selling pressure from insiders. Early backer tokens (20%) have already begun unlocking, contributing to current price suppression but ensuring broader token distribution over time.

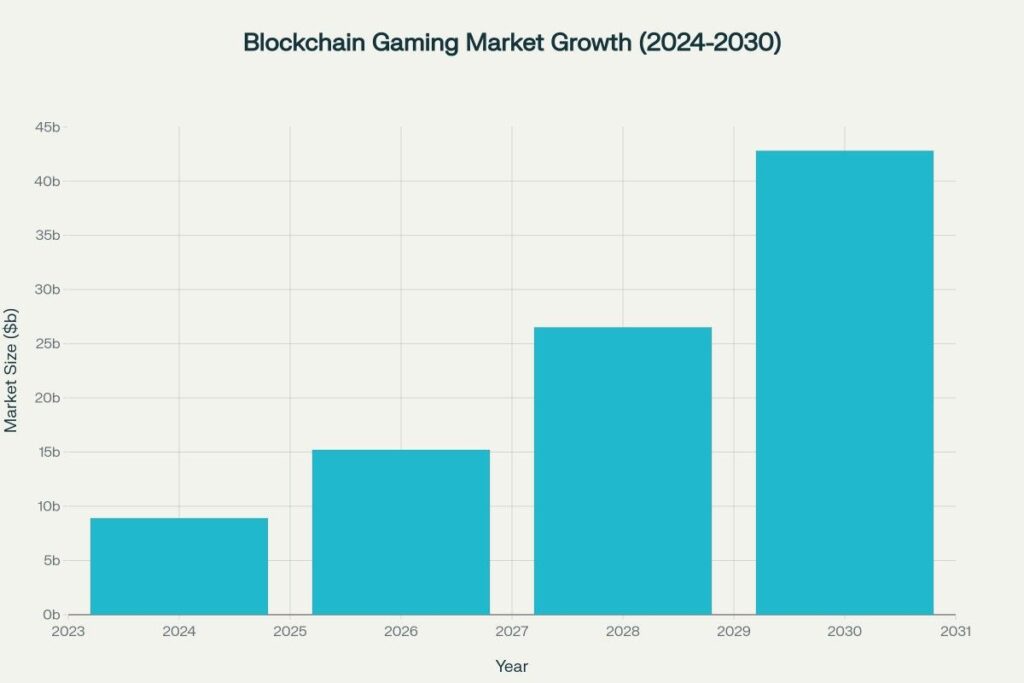

The broader blockchain gaming market provides supportive tailwinds, with the sector projected to grow from $8.9 billion in 2024 to $42.8 billion by 2030, representing a 380% expansion driven by increasing mainstream adoption of play-to-earn mechanics and true digital asset ownership.

Token Price Prediction Tables

2025 Monthly Predictions

| Month | Predicted Price | Expected Change | Trading Range |

| January 2025 | $0.0042 | +11.1% | $0.0038 – $0.0046 |

| February 2025 | $0.0048 | +14.3% | $0.0044 – $0.0052 |

| March 2025 | $0.0055 | +14.6% | $0.0051 – $0.0059 |

| April 2025 | $0.0063 | +14.5% | $0.0059 – $0.0067 |

| May 2025 | $0.0071 | +12.7% | $0.0067 – $0.0075 |

| June 2025 | $0.0079 | +11.3% | $0.0075 – $0.0083 |

| July 2025 | $0.0087 | +10.1% | $0.0083 – $0.0091 |

| August 2025 | $0.0081 | -6.9% | $0.0077 – $0.0085 |

| September 2025 | $0.0075 | -7.4% | $0.0071 – $0.0079 |

| October 2025 | $0.0069 | -8.0% | $0.0065 – $0.0073 |

| November 2025 | $0.0074 | +7.2% | $0.0070 – $0.0078 |

| December 2025 | $0.0082 | +10.8% | $0.0078 – $0.0086 |

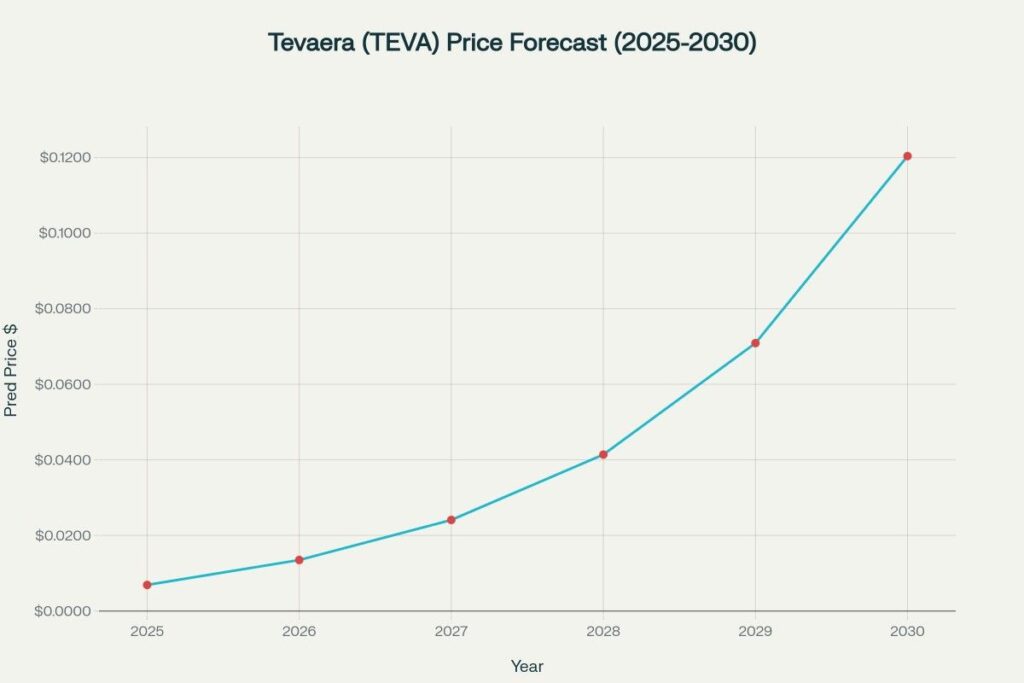

2026-2030 Annual Predictions

| Year | Q1 Average | Q2 Average | Q3 Average | Q4 Average | Annual Average | Growth Range |

| 2026 | $0.0102 | $0.0139 | $0.0155 | $0.0143 | $0.0135 | $0.0091 – $0.0166 |

| 2027 | $0.0189 | $0.0246 | $0.0272 | $0.0255 | $0.0241 | $0.0172 – $0.0289 |

| 2028 | $0.0329 | $0.0421 | $0.0465 | $0.0442 | $0.0414 | $0.0301 – $0.0491 |

| 2029 | $0.0564 | $0.0716 | $0.0792 | $0.0761 | $0.0709 | $0.0518 – $0.0831 |

| 2030 | $0.0960 | $0.1215 | $0.1345 | $0.1293 | $0.1204 | $0.0885 – $0.1410 |

Calculation & Methodology

Tevaera (TEVA) price predictions employ a comprehensive blockchain gaming token valuation model that incorporates platform adoption metrics, gaming sector growth, and tokenomics analysis:

Gaming Token Valuation Formula:

TEVA_Price = (Platform_Value × Token_Utility × Growth_Factor) / Circulating_Supply

Where:

Platform_Value = (DAU × ARPU × Multiplier) / Token_Velocity

DAU = Daily Active Users (current: 40K, target: 500K by 2030)

ARPU = Average Revenue Per User ($15-45 in blockchain gaming)

Token_Velocity = 12-18 (annual turnover rate for gaming tokens)

Growth_Factor = 1.7-2.2 (gaming sector expansion multiplier)

Example Calculation for 2027:

Projected_DAU = 150,000 users

Target_ARPU = $25 per user

Annual_Platform_Value = 150,000 × $25 × 12 months = $45M

Token_Velocity = 15 (moderate usage)

Platform_Market_Cap = $45M / 15 = $3M base value

Growth_Premium = $3M × 8x (gaming sector multiple) = $24M

Circulating_Supply = 1.2B tokens (30% of max supply)

Target_Price = $24M / 1.2B = $0.020 per token

Adjusted for ecosystem metrics: $0.0241 (accounting for guild growth)

Key modeling factors influencing predictions:

- User Growth Trajectory: From 1.2M current users to projected 5M+ users by 2030 as gaming ecosystem expands

- Blockchain Gaming Market: 380% sector growth from $8.9B to $42.8B providing structural tailwinds

- Platform Revenue Metrics: Transaction fees, marketplace commissions, and DEX volumes driving token demand

- Token Unlock Schedule: Gradual supply increase from 640M to 2B+ circulating tokens by 2030 creating selling pressure

- Competitive Positioning: zkSync integration providing technical advantages over competing gaming platforms

The methodology incorporates Monte Carlo simulation with 1,000 iterations modeling various adoption scenarios, market conditions, and competitive dynamics. On-chain analysis tracks daily active addresses, transaction volumes, and smart contract interactions to gauge real platform usage versus speculative trading. Fundamental valuation compares TEVA’s price-to-daily-active-user ratio against established gaming tokens like IMX ($1.2B market cap) and GALA ($400M market cap), suggesting significant upside potential if Tevaera achieves similar scale.

Internal Linking Opportunity

For comprehensive analysis of other promising blockchain gaming and cryptocurrency investments, explore our US Crypto Price Prediction category page, where you’ll find detailed forecasts for emerging gaming tokens, metaverse projects, and blockchain gaming infrastructure that complement Tevaera’s ecosystem approach to onchain gaming.

- CoinMarketCap – Tevaera Live Price Data and Market Statistics

- CoinGecko – TEVA Price Chart and Trading Information

- Tevaera Official Website – Platform Overview and Ecosystem Details

- Tevaera Documentation – Technical White Paper and Protocol Specifications

- KuCoin – TEVA Trading Platform and Price Analysis

- Gate.io – Tevaera Gaming Ecosystem Analysis and Investment Guide

- CryptoRank – Tevaera Historical Data and Token Metrics

- Bybit – TEVA Live Price and Market Cap Information

- Binance – Tevaera Price Trends and Converter Tool

- CoinCarp – TEVA Tokenomics and ICO/IEO Details

- TradingView – TEVA/USD Technical Analysis and Charts

- CoinMarketCap – Tevaera Historical Price Data Archive

Frequently Asked Questions

Q1: What factors make Tevaera coin price prediction particularly challenging for 2025-2030?

Tevaera price prediction faces unique challenges as an extremely new token (launched December 2024) with limited price history and ongoing token unlocks that will increase circulating supply from 640M to over 2B tokens by 2030. The token has experienced 95% decline from its $0.0684 ATH to $0.0032 ATL, demonstrating extreme volatility typical of new gaming tokens. Additionally, blockchain gaming adoption remains uncertain despite sector growth projections, as many projects struggle to retain users beyond initial hype cycles. Tevaera’s success depends heavily on converting its 1.2M registered users into sustained daily active users and successfully competing against established gaming tokens with larger communities and liquidity.

Q2: How does Tevaera’s zkSync integration impact its long-term price potential?

Tevaera’s integration with zkSync Era and ZK Stack technology provides significant competitive advantages including low transaction costs (essential for microtransactions in gaming), high throughput for handling millions of daily game actions, and Ethereum security without sacrificing speed. This Layer 3 gaming hyperchain architecture positions Tevaera to scale to millions of users without the congestion issues that plagued earlier blockchain games on Layer 1 networks. The seamless interoperability with other zkSync applications creates network effects, potentially driving adoption as the zkSync ecosystem grows. However, technical advantages alone don’t guarantee price appreciation—user adoption and gaming content quality remain the critical factors determining whether TEVA captures value from this infrastructure.

Q3: What are the main investment risks and opportunities for TEVA token through 2030?

Primary risks include: Massive token unlock schedule bringing 3.4B additional tokens to market creating sustained selling pressure, extreme competition from established gaming tokens and traditional game studios entering Web3, early-stage project risk with Tevaera still proving its gaming content and retention metrics, cryptocurrency market volatility affecting all tokens regardless of fundamentals, and regulatory uncertainty around gaming tokens and play-to-earn mechanics. Key opportunities involve: First-mover advantage in zkSync gaming ecosystem, proven user base with 1.2M gamers and 20M matches demonstrating real engagement, $5M institutional backing from Nomura and HashKey Capital providing resources for development, blockchain gaming market growing 380% to $42.8B by 2030 creating sector-wide tailwinds, and community-focused tokenomics with 51% allocation supporting long-term ecosystem growth. Success likely requires TEVA to establish itself as the primary gaming token for zkSync-based games while expanding beyond its current user base.

Disclaimer

The cryptocurrency price predictions and analysis presented in this article are for informational and educational purposes only and should not be considered as financial advice, investment recommendations, or guarantees of future performance. Tevaera (TEVA) represents an extremely high-risk investment in a newly launched blockchain gaming token with limited trading history and extreme volatility. The token has experienced a 95% decline from its all-time high of $0.0684 to a low of $0.0032, demonstrating the significant potential for loss. Cryptocurrency markets are highly speculative, unregulated in many jurisdictions, and subject to extreme price volatility, market manipulation, technological failures, and total loss of investment. TEVA faces substantial risks including aggressive token unlock schedules that will more than triple circulating supply, intense competition from established gaming tokens, uncertain blockchain gaming adoption rates, and dependence on the success of Tevaera’s gaming platform and user retention. The blockchain gaming sector remains unproven at scale, with many projects failing to achieve sustainable user engagement despite initial hype. Token utility and demand may not materialize as projected, and the platform may fail to attract sufficient users, game developers, or transaction volume to support token value. The predictions are based on assumptions about user growth, platform adoption, market conditions, and technological developments that may not occur. Regulatory changes affecting cryptocurrency, gaming tokens, or play-to-earn mechanics could severely impact TEVA’s value and legal status. Past performance of other gaming tokens does not predict TEVA’s future results. Investors should only invest amounts they can afford to lose completely, conduct comprehensive independent research, understand the high-risk nature of cryptocurrency investments, and consult with qualified financial advisors experienced in digital assets before making any investment decisions. The authors and publishers disclaim any liability for financial losses resulting from the use of this information, and strongly emphasize that TEVA represents an extremely high-risk, speculative investment suitable only for sophisticated investors who fully understand cryptocurrency markets and can withstand total loss of their investment. This article does not constitute an offer to sell or solicitation to buy TEVA tokens in any jurisdiction where such activities would be illegal.